BaseFEX is a cryptocurrency derivative exchange founded in 2018 by a veteran group of traders. Similarly to other exchanges in the industry, it offers futures trading in the form of perpetual contracts.

BaseFEX also allows margin trading – short and long – using high leverage and a promising variety of cryptocurrencies to choose from. BaseFEX sees a daily turnover upwards of $21 million on its Bitcoin perpetual contract, as of now, which is considerable for a newcomer.

BaseFEX

Pros

- A simple and easy-to-use trading interface

- The major cryptocurrencies are available for trading

- 24/7 Live Chat support

BaseFEX Video Review

BaseFEX Cryptocurrency Futures

BaseFEX allows users to gain exposure to the price of Bitcoin and some other popular cryptocurrencies through perpetual contracts.

A perpetual contract resembles a traditional futures contract, but it is different in that it doesn’t have a predetermined settlement date. In other words, traders can open and terminate it at their will, unlike traditional contracts that are only settled on a set date.

The cryptocurrency derivative exchange also has leveraged trading. For the Bitcoin perpetual contract, traders can place orders with a leverage of up to 100x, while for the other cryptocurrencies, it’s reduced down to 20x.

It’s important to know that while margin trading could increase your profits, but it can also put your capital in jeopardy. Margin trading should only be carried out by traders with sufficient experience in the field.

What Cryptocurrencies Does BaseFEX Support?

Currently, the exchange supports a total of six cryptocurrencies which could be traded using the mentioned above perpetual futures contracts. Namely, these are Bitcoin, Ethereum, Ripple, Bitcoin Cash, Litecoin, and Binance Coin (BNB).

While all the perpetual contracts can be settled in Bitcoin, only BTC and ETH can be settled in USDT.

For BTC-settled contracts, you would need to have bitcoin in your wallet to trade them, and the profits or losses would be denominated in BTC. For USDT-settled contracts, the margin, as well as the profit or loss of the contracts, is denominated in USDT.

Getting Started: How to Register an Account

Registering an account with BaseFEX is somewhat simplified because you would only need an email address to start trading.

One of the things that the exchange is promoting is “the absolute lack of KYC and AML check-ups” for its users. BaseFEX claims that it doesn’t disclose user data to any authorities or governments. Hence, the exchange is unregulated.

As soon as you hit the Register button on the homepage, that’s the screen that you’d have to fill up.

After initial registering, new users are required only to verify their email using a 6-digit code, and they can deposit funds and begin trading.

How to deposit funds on BaseFEX?

Once you have your account registered, it’s essential to deposit funds to trade. BaseFEX allows users to deposit both Bitcoin and Tether (USDT), which is quite convenient. Most other margin exchanges allow Bitcoin deposit only.

On the left side of the account profile, you will be able to find the Balance, Deposit, and Withdraw options.

From here, all you have to do is select the currency you’d want to deposit and send the appropriate amount to the address which is provided. The minimum deposit balance for Bitcoin is 0.002 BTC, while the minimum for Tether is 20 USDT.

BaseFEX won’t charge any fees on deposits or withdrawals. However, the standard network fees apply.

Trading on BaseFEX

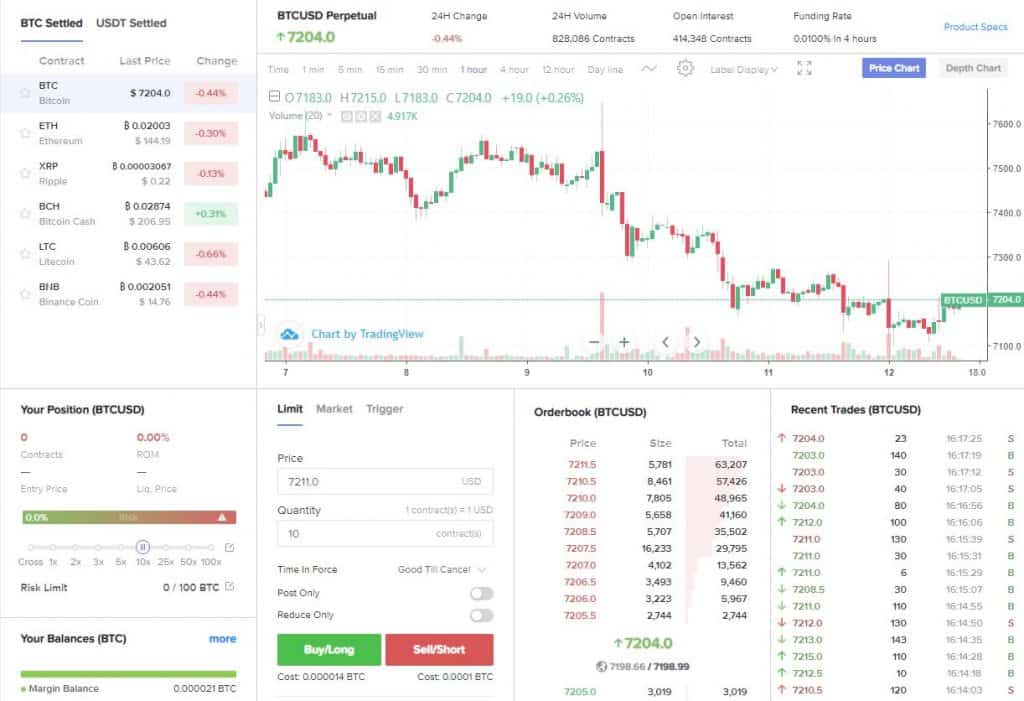

This is how the overall interface looks like:

On the top left corner, users will find the different cryptocurrencies available for trade and can select whether they want to settle the contracts in BTC or USDT. Right beside it, there is a chart provided by TradingView.

On the bottom left, users can set their leverage, and right next to that, there are the different trading orders and the order books, as well as the most recent trades.

The overall interface is intuitive, and it puts everything right in front of the eyes, which makes trading a lot easier.

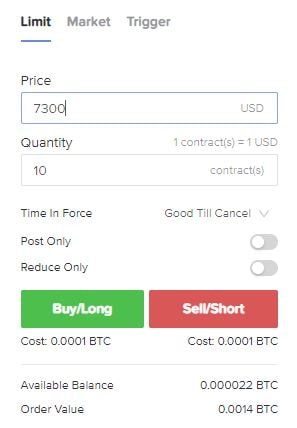

Limit Order

Limit orders are maybe the most common orders. They allow you to buy at a specific price, which can be different than the current market price. In case the limit order is higher than those on the order book, then the order would be immediately executed.

In the given example, Bitcoin was trading at around $7,210, but we want to buy at $7,300. Hence, setting an order to Buy/Long BTC when the price reaches $7,300. The above limit order uses ten perpetual BTC contracts, priced at $1 each and leverage of 10x. Hence, the total value of the order is $100, but the margin that you’d need to place it is only 0.0001 because you borrow the rest from the exchange on leverage.

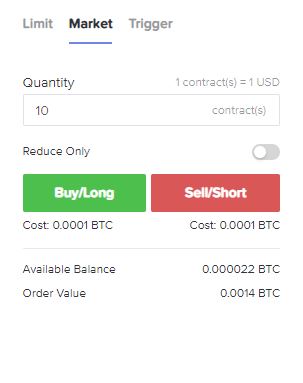

Market Order

Market orders are the simplest ones that you can use because they are filled immediately at spot prices.

In this example, the order is set for 10 BTC contracts. Again, the leverage is 10x, and that’s why the cost is just 0.0001BTC, despite the total value of the order being $100.

Trigger Orders

This is where things get a bit more interesting. This particular type allows you to place an order which will only enter the order book once a specific condition (trigger) is met.

In the above example, the set trigger condition is for the market price of Bitcoin to reach $7,400. As soon as it happens, a market order for ten contracts with leverage of 10x will be placed, and it will be filled immediately.

These types of orders can be used as stop-limits or take-profits. They can be used to manage your risks effectively or to optimize your profitability.

Closing a Position

Once you have your position opened, you will see it right under the “open position” tab. Here is where you can effectively measure the performance of your open positions in real-time and track metrics such as the entry price, size, order value, liquidation price, unrealized and realized profit and loss (PNL), and so forth.

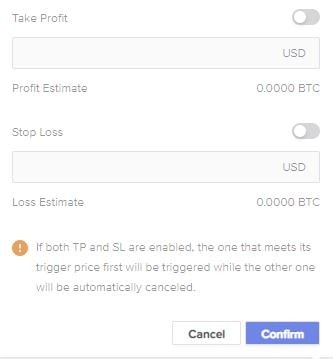

On the far right side, you will also find the option to close your position. You can do so immediately using the Close button, and this will see your position closed at the best available market price. The second option is to place an inverse limit or trigger order.

Additionally, BaseFEX allows you to place a take-profit and/or a stop-loss order simultaneously. What is more, it’s possible to enable both orders for the same position, and if one of the trigger prices is reached, the other one will be closed automatically.

BaseFEX’s Insurance Fund

Another exciting thing introduced by BaseFEX is its insurance fund. It comes from liquidations that are executed with a price that’s better than the bankruptcy price of that position.

The Insurance Fund takes over the trader’s unfilled positions before the exchange’s auto-deleveraging system takes them. The latter automatically deleverages the positions which are owned by opposing traders according to both profit and leverage priority.

Trading Fees on BaseFEX

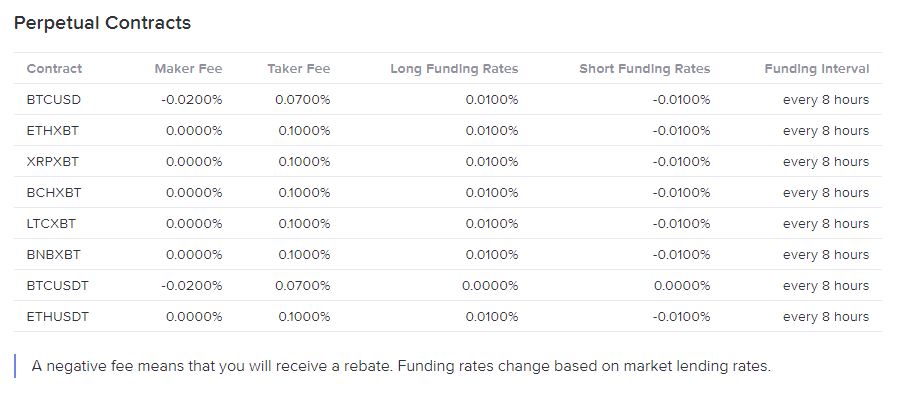

The fees on BaseFEX are standard compared to other derivatives exchanges. There are no fees for market makers – those who place orders fulfilled immediately. What is more, they also receive a rebate of 0.02% when using the BTC perpetual contracts. Market takers are charged a fee ranging between 0.07% and 0.1%, depending on the traded cryptocurrency.

Here is the current fees structure:

In terms of the funding rates, they vary from 0.01% on BTC, ETH, XRP, LTC, and BNB, to 0.3% on the BCH perpetual contracts. It’s worth noting that the BTC/USDT pair carries no funding rates. The funding interval is 8 hours for all the trading pairs.

Security: Is It Safe to trade on BaseFEX?

According to BaseFEX’s website, 100% of the cryptocurrencies are held in multi-signature cold wallets. Furthermore, all of the withdrawals are being verified manually.

What is perhaps more interesting is that the exchange claims to have the highest security rating among its competitors, according to Mozilla’s Observatory Test. Supposedly, only 4 out of 400 exchanges have scored an A+ on that test.

It’s also worth noting that the lack of KYC brings in some privacy benefits because users are not required to provide any personal information besides their email addresses. However, this assures that the exchange is unregulated and can’t be so without requesting KYC.

Customer Support

The platform has a few different support channels. You can get in touch through the live chat or an email.

The team is particularly responsive. We conducted a test, and they responded in less than 15 minutes via the Live chat, which is impressive. It means that you can expect to get an answer to your queries quickly and get the issues resolved promptly.

Conclusion

BaseFEX is a relatively new exchange, but it’s safe to say that it has accomplished a lot in its short time of existence. While the liquidity and the trading volume is comparatively low, the exchange is doing a lot to attract new customers by including essential features. Stimulating market makers through rebates is undoubtedly a move in the right direction. The trading interface is intuitive and straightforward, and the experience is seamless, in general.

You might also like:

The post appeared first on CryptoPotato