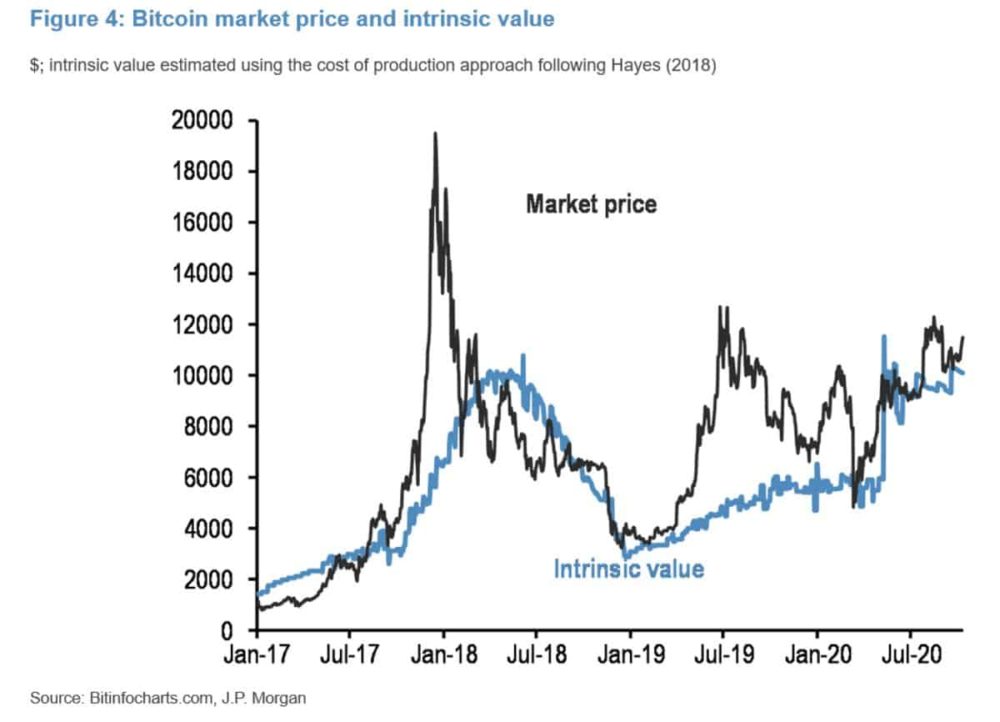

Financial strategists at JP Morgan have projected a bleak outlook for bitcoin prices in the short term. According to them, the cryptocurrency has a higher price and is trending at 13 percent over its ‘intrinsic value.’

They based their analysis on ‘positioning indicators’ derived from bets made by traders in the futures markets. But does the argument hold true?

The Weather in Bitcoin Land Will Consist Of ‘Modest Headwinds’

According to the latest reports from mainstream media outlet Bloomberg, JP Morgan strategists have presented a near-term bearish case for bitcoin price. Looking at a futures market-based positioning indicator, Nikolaos Panigirtzoglou and his fellow colleagues stated ‘that there still appears to be an overhang of net long positions.’

Bitcoin lost much of its excessive ‘froth’ in the September crash, Nikolas and the other analysts said. But the cryptocurrency is still priced about 13 percent higher than its ‘estimated intrinsic value.’ Which, according to the JP Morgan folks, works out to be a little below $10,000 (read $9918 to be precise).

The big bank strategists arrived at the intrinsic value figure for bitcoin by considering it as a commodity and after going through the bare minimum cost to produce/mine the cryptocurrency.

Also, according to the JP Morgan strategists, bitcoin is experiencing strong demand from corporate entities. This is especially due to reputed public companies like Square and technology company MicroStrategy infused significant reserve funds in BTC.

Will BTC Undergo A Short-Term Drop?

Econometrics, a Twitter-based daily bitcoin data and insights provider, shared some information gleaned from trader behavior in the CME Bitcoin futures market. Folks are taking it slow, according to the handle, and are skeptical of the possibility for a ‘breakout.’

CME #Bitcoin Futures

Oct. 13, 2020Another slow day. Apparently traders aren’t convinced that the time is ripe for a breakout.

Keep an eye on it 👇 pic.twitter.com/zh54zyNYEy

— ecoinometrics (@ecoinometrics) October 14, 2020

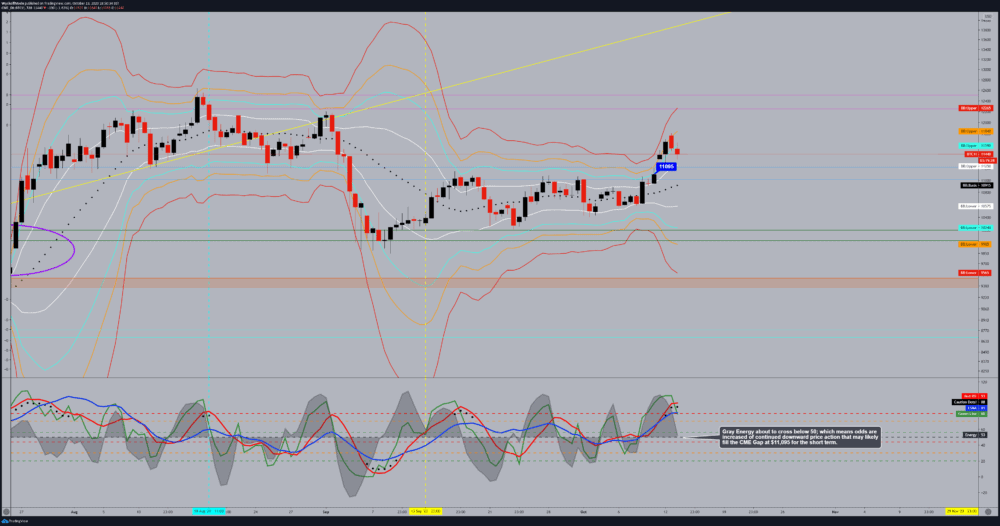

After an in-depth look into the CME Bitcoin futures technical setup, it becomes clear that BTC could indeed move to fill the gap left at $11,095 (in the short-term) as pointed out by the TradingView based chartist WyckoffMode.

The Relative Strength Indicator (RSI) for bitcoin price is on its way to dip below 50, the trader/chartist said. This confirms the increased odds of downward price action. This means BTC is strongly prone to drop to fill the CME futures gap at $11,095.

The observations are from a 12-hour time frame chart of bitcoin CME futures.

Featured image courtesy of ABC News.

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited offer).

The post appeared first on CryptoPotato