Tesla stocks (TSLA) saw a tremendous price surge in the last few months, and the firm is looking to monetize the increase. Tesla plans a $2 billion common stock offering to strengthen its financial position.

While similar scenarios could play out in the traditional financial market, Bitcoin stands on the opposite shore. Its finite pre-programmed supply of 21 million means that no more coins can come in the market.

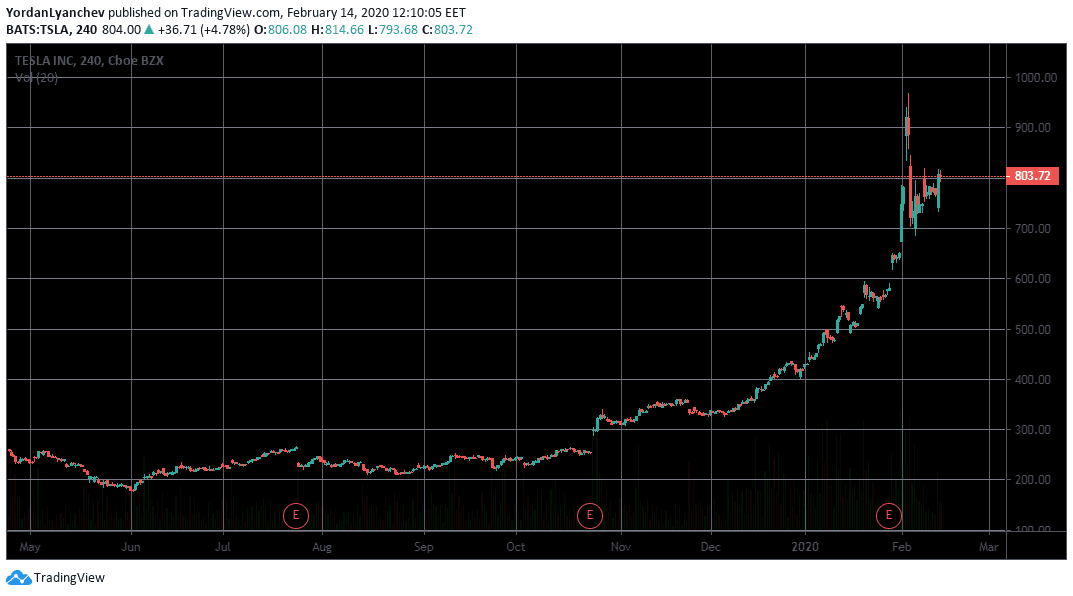

Tesla Stocks Performance And Offering

The last several months have been nothing short of impressive for Tesla and especially its stocks (TSLA). For reference, back in October 2019, the price of one share was $218, and a few weeks ago, it reached its all-time high of $965. Even with the current retrace to $805, this still represents an increase of over 270% in four months.

Tesla Stock Performance. Source: TradingView

Amid the impressive price performance, Tesla announced on February 13th that it plans to offer approximately $2 billion of common stock in an underwritten registered public offering. The company’s CEO, Elon Musk, will participate by purchasing up to $10 million. Larry Ellison, a member of the firm’s Board of Directors, will also purchase up to $1 million.

The official announcement informs that the raised money will be used “to further strengthen its balance sheet, as well as for general corporate purposes.”

According to Dan Ives, Wedbush Securities’ Managing Director, this is a “smart, strategic move. It takes any doomsday scenario around cash crunch… off the table.”

No More Bitcoins

Unlike Tesla, or for that matter, other publicly traded companies, Bitcoin is uniquely pre-programmed to exist with a finite supply. Its protocol is written in a way that doesn’t allow more than 21 million

One of the main benefits of a limited and predetermined supply is to control inflation. For instance, simple economic principles dictate that printing more money generally leads to increased inflation rates. Similarly, adding new stocks could have the same effect.

At the same time, an event called Bitcoin Halving happens every four years and reduces the number of coins mined every day. Currently, 1,800 new bitcoins come in existence daily, but after the next Halving in less than three months, the amount will drop to 900.

Ultimately, this causes a reduction in Bitcoin’s inflation rate. In this case, it will be slashed in half from the current 3.72% to approximately 1.8%

The post appeared first on CryptoPotato