The cryptocurrency market has been around for more than 10 years. For this relatively short period of time, it has managed to establish a serious community of people who not only work with but trade with digital assets.

Naturally, there has been a lot of speculation about whether or not trading Bitcoin is the right choice, compared to just holding it. This is also where the popular HODL word comes from, as people who prefer to keep their Bitcoin rather than trade it, use it to describe their stance.

What Is HODL?

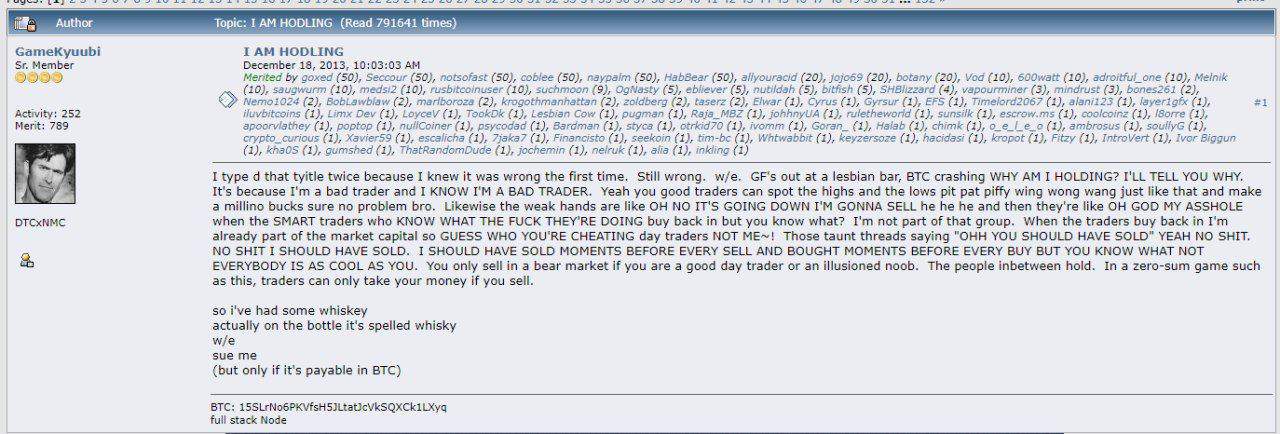

In a lengthy message to the much smaller cryptocurrency community back then, one person wrote an entire explanation on why he is holding in a post on the Bitcoin forum. Basically, he said that he doesn’t believe in his trading skills, nor he can get the right moment when to sell or buy, so the decision appeared clear – holding Bitcoin, even on bad days.

However, the person managed to mistake Holding with HODLing and thus inadvertently created a phrase that would stick for years to come. In fact, the post had a birthday recently, turning six years old.

OriginsOfHodl. Source: bitcointalk.org

When it started receiving popularity, the community came up with different possible meanings behind the HODL word, such as – Hold On for Dear Life. It’s most commonly used when the market is noting a price plunge, investors have negative sentiment, but the true believers continue to HODL their coins. The people who are applying the strategy are often referred to as “Hodlers.”

The prominent English-language international news organization, Quartz, added Hodl as an essential slang term in Bitcoin culture in 2017. The description it received reads – “to stay invested in Bitcoin and not to capitulate in the face of plunging prices.”

HODL As A Bitcoin Investment Strategy

The human species is known for many qualities, and for better or worse, emotions are among the most powerful. This comes as a contradiction with what experienced investors advise – we should leave emotions at the door. While most of us think that we can handle severe amounts of pressure when the asset we bought is losing value, that’s not usually the case, and we tend to break our composure in such cases. Oftentimes, we sell when it’s decreasing or buy when it ‘s surging, thus picking the wrong time for taking action.

While most traditional assets don’t lose vast chunks of their value rapidly unless there’s an outgoing recession of some sort, the cryptocurrency world plays a different ballgame. Being a relatively new form of investment, the crypto market could be violently volatile sometimes. For example, in the two years before the term was created (2011-2013), Bitcoin shot up by 52,000% and plunged by more than 80% over the next year. Moreover, the world’s largest crypto has recorded almost 20 new highs, followed by a notable drop.

So the answer to all of this volatility comes in the means of Hodling. Instead of risking unnecessary selling or buying that could potentially harm our investments, we can just Hodl our coins, and become “Hodlers.” It also applies to true believers of Bitcoin (or other cryptocurrencies), who think that digital assets will eventually replace fiat currencies as the most used form of financial transactions.

HODL’s Advantages

Experienced traders will urge that by Hodling, one might not make the most out of a volatile market move. While this may be true to proficient traders, it could be exceedingly hurtful to the general masses of cryptocurrency investors.

Let’s provide several examples of how Hodling can help you gain more in the long term. One statistic from a few months ago shows that the largest crypto existed for 3,869 days at the time, and 3,817 of those days, it has been profitable, which is a total of 98.66%. It also reaffirms the Hodling mentality by saying that “the only people that have actually lost money with Bitcoin have just been impatient.”

Hodling is a strong case for Bitcoin Maximalists – people who believe that it’s the only cryptocurrency with real value, which could be supported by the next example.

One cryptocurrency investor shared his 2017 strategy, where he put 1 BTC in 50 different altcoins. Two years later, most of those alternative cryptocurrencies were delisted from major exchanges, and he calculated his losses that ranged from almost 100% to 70% on different coins.

In conclusion, he noted that diversification might not be the best idea in the crypto market and that most altcoins appear to have one visible market cycle, and then they go down in value. However, it’s also worth pointing out that he hasn’t disclosed the exact alternative coins he bought.

A poll from October this year asked when the voters would sell their bitcoins – at $50,000, $250,000, $1,000,000, or never. While most people chose $1 million as their selling price, 23% said “never,” meaning that they are ready to Hodl Bitcoin for a long, long time.

Hodling’s Drawbacks

Yes, by Hodling, you might miss out on eventual trading profits, but as we said before, it’s not for everyone. However, some argue that Hodling might have another major drawback, and it’s actually harmful to all cryptocurrencies.

When someone is hodling his coins, it automatically means that he is not using them with their designated function as a payment form. And by not using something for its original purpose, you could be slowing down its evolution and, more importantly – mainstream adoption. It brings a valid question – how can people adopt an asset if it’s being held without implementation in the real world?

Bitcoin, for instance, is now accepted in numerous different sectors, such as online purchases, travel agencies and hotels, car shopping, and even real-estate deals. Yet, the community appears to believe that its long-term value will keep rising or that it serves best as a speculative asset that they can trade against for quick profits, and don’t utilize it for its true purpose.

Conclusion

Even though the term HODL originated as a fortuitous typo years ago, it has had quite an effect on the cryptocurrency community since then. People use it mostly when the prices are heading south, but it has also proven as a great strategy over the years. However, one should ask the question if it Hodling Bitcoin and other cryptocurrencies is beneficial for the industry.

You might also like:

The post appeared first on CryptoPotato