After consistent consolidation under the $8000 mark since 22 November, Bitcoin briefly breached the mark on 7 January. While a significant portion of the community believed that the surge in question could be instrumental to the next bull surge, a major cryptocurrency market analyst observed a change in trends for a different digital asset.

Willy Woo, a reputed cryptocurrency commentator, highlighted that technical signs are turning bullish for Bitcoin’s silver counterpart Litecoin, adding that LTC may pave the way for Bitcoin’s next spike.

Source: Twitter

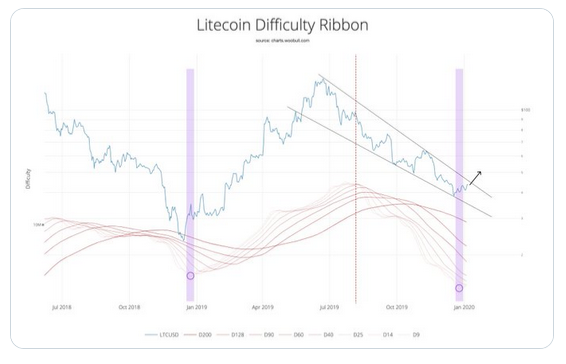

Woo observed that Litecoin‘s difficulty ribbon had undergone recovery mode at the time of analysis, a development that may unlock another bullish breakout for the altcoin. He added that the bullish spike for LTC may eventually lead to a bullish break for BTC.

That wasn’t all, however, as Woo also claimed that Litecoin had faced its largest miner capitulation over the past few months.

Source: BTC/USD on TradingView

However, if one were to compare Bitcoin and Litecoin’s charts side by side, it can be observed that a major resistance at 49.14 for LTC needs to be breached, before a case for a bullish breakout could be made. Similarly, Bitcoin had its resistance at $7984, a level which was breached for a short duration, in the last 24 hours.

Back in the first half of 2019, Litecoin was the best performing crypto-asset after it surged by over 350 percent, before it underwent its scheduled halving. The aforementioned, present-day recovery seemed to be mirroring a similar scenario from 2019, following which Litcoin’s price had escalated to significant levels.

At press time, however, in spite of Woo’s predictions, Litecoin needed to push its valuation further up in order to make a stronger case for a bull run.

The post appeared first on AMBCrypto