BitFinex Bitcoin’s open long positions keep increasing rapidly and had recently set a new all-time high record on the popular cryptocurrency exchange.

In the last two weeks, the total number has surged to over 43,000 BTC, bringing up the discussion within the community if this very odd behavior might end up in a cruel long squeeze, that will plunge Bitcoin way below $7000.

Bitcoin Long Positions Set a New All-Time High

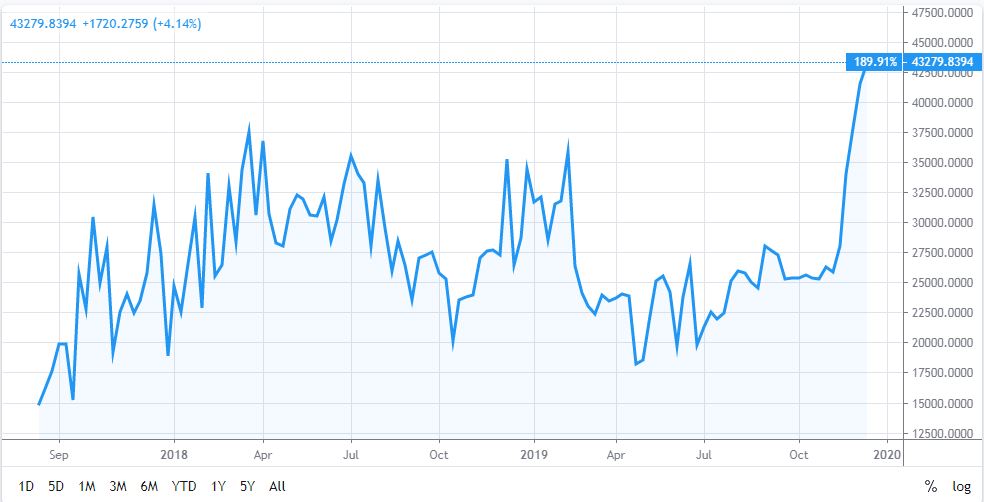

The number of Bitcoin long positions is constantly increasing, and it has broken the previous ATH record from March 2018 on Bitfinex. As of now, it has surged to over 43,000, and the trend doesn’t appear to reverse anytime soon. The parabolic surge is not the healthiest behavior of any asset.

BTC open longs, Bitfinex. Source: TradingView

Moreover, the most recent surge notes another 23% increase since two weeks ago. As Cryptopotato reported at the beginning of December, BTC longs had seen a 40% spike in a matter of days, and they were sitting at almost 35,000 back then. Since then, despite the price of Bitcoin had seen a minor decrease, the longs kept increasing.

As the number of long positions continues growing, it brings the question if this is another price manipulation to cause Bitcoin’s value down by delivering a long squeeze shortly.

Such squeezes generally appear when there is a massive amount of open longs. Despite what the Average Joe would think, that many long positions are positive for Bitcoin, as we have shown with other examples, the situation usually is reversed, and the price ultimately drops.

In case Bitcoin starts decreasing, the longs will encounter their stop-loss, and once those positions are forced closed, the domino effect will increase as the price will tumble more.

Bitcoin’s short term price prediction

Analysts have made numerous attempts trying to predict BTC’s future, but it usually likes to prove them wrong. Nevertheless, one prominent analyst seems to think that Bitcoin may retest $4,400 before it surges back up, and another analysis points out that it could go as low as $5,000 before the end of the year.

The technical aspects of the largest digital asset show that the Bollinger Bands are tightening, which could indicate a huge move coming up soon. It’s worth noting though that it’s currently unclear if the movement will be heading south or it could reverse upwards. For instance, last time the Bands were this close to each other, Bitcoin’s price skyrocketed with 42% in a day.

A possible drop to $5,000 would mean a 30% decrease from the current stand at $7,060, and it’s still unclear if BTC is heading that way. However, the number of long positions being at a new ATH is rather alarming, and it could be hinting for a significant long squeeze, which can result in negative price actions soon.

You might also like:

The post appeared first on CryptoPotato