According to a recent report, the largest U.S.-based cryptocurrency exchange Coinbase has become the largest validator for Tezos (XTZ). It brings the question of whether or not validation from exchanges is set to become the next trend in the cryptocurrency world.

Coinbase Leads In Tezos Validating

The attention Tezos (XTZ) is getting lately doesn’t come only from the community, but from major cryptocurrency exchanges, as well.

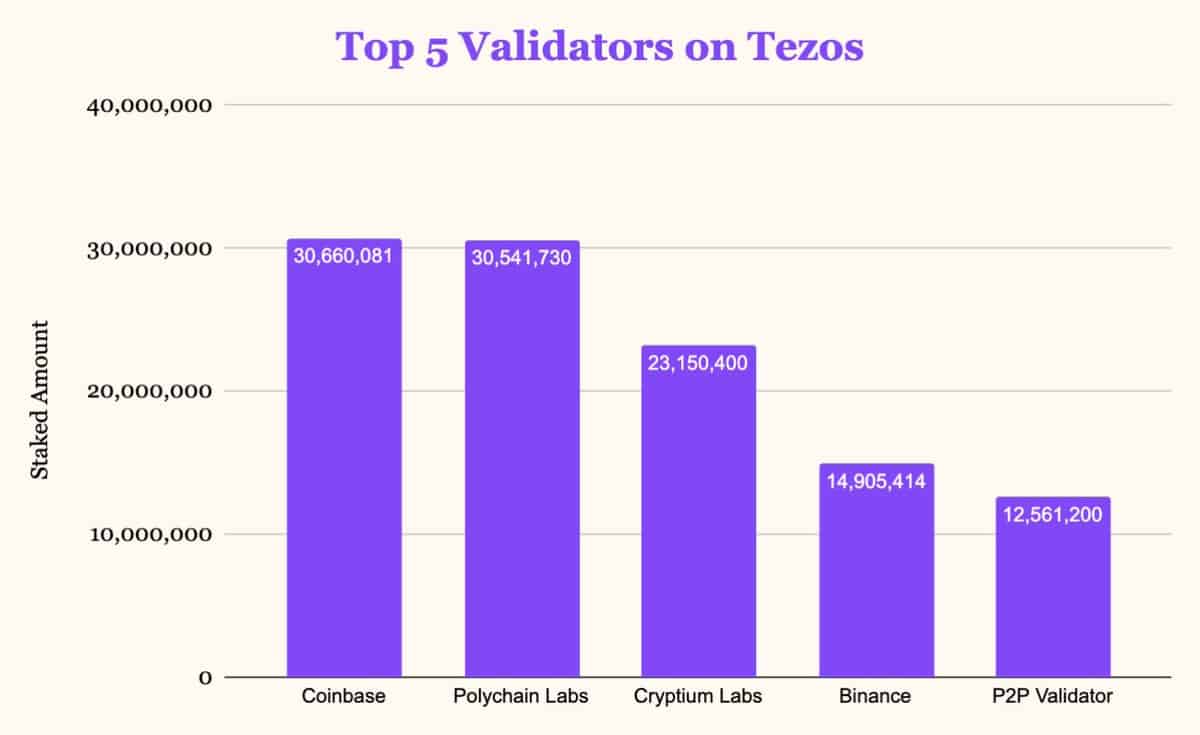

A recent report shows that exchanges are becoming more involved with the validation of the digital asset. According to it, Coinbase has become the largest validator of Tezos by overcoming Polychain Labs.

TezosValidators.

It’s also clear that Binance is making strides in the field as well, currently occupying the 4th place. However, the chart does not include foundation bakers, and if it did, it would place Foundation Baker 2 in the 3rd position.

Validation is the process when miners (in Proof-of-Work) or coin holders (in Proof-of-Stake) validate a specific transaction. In the case of Tezos, since it’s PoS-based, the more coins a person or an entity has, the more staking power he controls.

Is Validation The New Trend?

The increased interest from cryptocurrency exchanges towards validating of major digital assets raises the question if this will be the next trend. This idea was brought up by Bobby Ong, the Co-founder of Coingecko, saying that we are to see exchanges dominating most validators lists. He seems to think that merely staking as a service could struggle.

We will soon see exchanges dominating most top validators list. Staking as a Service companies will struggle. Exchanges will compete to offer zero fee staking. Easier for users and exchanges can cross-subsidise from their trading biz. Users gets further entrenched into exchanges. https://t.co/RPGJFwEgBE

— Bobby Ong (@bobbyong) December 14, 2019

He also brings another exciting point if the exchange would allow users to choose a specific baker but doesn’t seem too optimistic about it.

In any case, the positive developments around Tezos have obviously had their impact on its price, as the cryptocurrency is amongst the strongest performers as of late. This is even more impressive when considering the fact that most of the digital assets have been tumbling in price recently.

You might also like:

The post appeared first on CryptoPotato