Becoming wealthy takes years of hard work, determination, achievement, planning, saving, and a lot of luck unless you invest wisely and take calculated risks that yield a high reward. Even the most successful investor ever, Warren Buffett, says that “if you don’t find a way to make money while you sleep, you will work until you die.”

Investing isn’t the only answer. Actively managing an investment portfolio through trading will speed up the process to profit exponentially. Also, choosing the right assets means the difference between becoming wealthy fast, or focusing on modest long term results.

Earning through trading and investing quickly is often associated with high risk, but with proper risk management practices, risk can be minimized and mostly eliminated. And with the right strategy, gains will far outweigh the occasional loss, making risk almost non-existent.

The techniques are clear, but which assets to choose is always changing, and can be somewhat difficult to find if you aren’t familiar in-depth with a number of financial markets. To help guide you in the process, we have created this guide to the top 5 assets to become rich in 2019 fast.

Bitcoin and Cryptocurrency

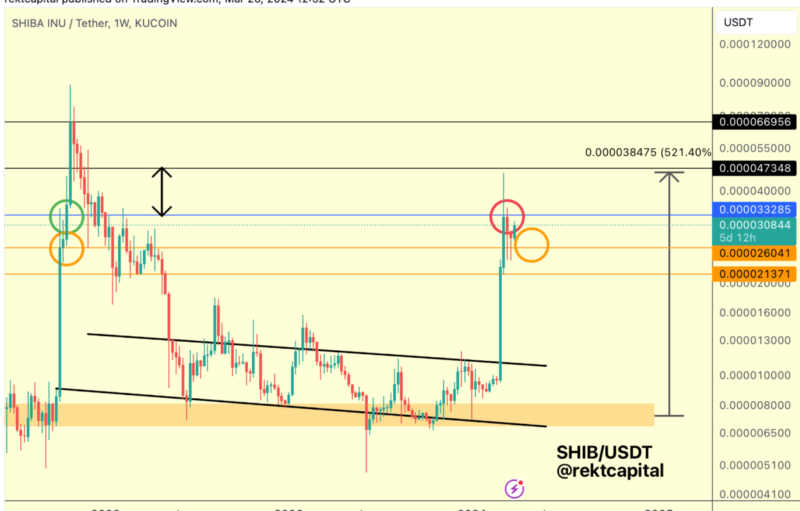

Bitcoin and cryptocurrency top the list. These digital assets are a trader’s dream, as they often produce wildly volatile price swings making for the largest possible opportunity for profit. Bitcoin thus far in 2019 has brought investors who bought the $3,100 bottom over 300% returns. This trade on 100x leverage could have multiplied the gains further by one-hundred times.

For example, PrimeXBT research shows that a trader who had shorted Bitcoin at its peak at $20,000 with just 1 BTC at 100x leverage and closed at the $3,100 bottom, it would have yielded the investor $1,690,000 in just one, single trade. No other asset class offers this kind of potential.

Other crypto assets perform similarly, but also can be used as a hedge against Bitcoin positions for further capitalizing on the crypto market. For example, if altcoins such as Litecoin, Ripple, EOS, and Ethereum are showing an opposite correlation to Bitcoin, a 100x short position in altcoins while taking a 100x long position in Bitcoin could produce dramatic results.

Bitcoin has additional attributes as an economic hedge that are causing its price to surge while other assets classes are plummeting – such as the Dow Jones or the S&P500 – in the face of growing concerns over a trade war between the United States and China escalating further and causing a global economic collapse.

Pot Stocks

2017 was the year of cryptocurrencies like Bitcoin, 2018 was the year of the pot stock, with most startups in the space performing strongly for early investors. In early 2019, these investments had a slight pullback that made for a strong buy signal.

The marijuana industry is budding, no pun intended, and the entire industry will be transformed in the coming years as its recreational, and medicinal use expands and grows. The United States and Canada have recently made strides in marijuana acceptance, decriminalizing and even legalizing its use across both countries.

These assets pose a high risk due to the overall uncertainty surrounding a growing industry that is only just starting, but this means that the upside potential is enormous.

Penny Stocks

While the name “penny stocks” may confuse investors into thinking that these stocks cost merely a cent per share, penny stocks are defined by the United States Securities and Exchange Commission as any stock that shares trade below $5.

These high-risk stocks are typically more volatile than other stocks, and many fail entirely. However, these young, growing companies often have extremely high earning potential, especially if they eventually go from penny stock to a real contender in the stock market.

Finding the right penny stock to invest in is the real challenge at hand, as there are so many undiscovered gems hidden among a metaphorical pile of dirt. Much research is needed, and a high tolerance for risk.

IPOs

IPOs are initial public offerings, that allow investors to get in on the ground floor of startups and companies before they are publicly traded. Oftentimes, the moment these assets begin being publicly traded, the price skyrockets, rewarding early IPO investors handsomely.

IPOs can be risky, but typically if the company has made it this far, it has longevity in the market.

The perfect example of a recent IPO taking off and bringing substantial gains to early investors is Beyond Meat – a Los Angeles-based manufacturer of plant-based imitation meat products. At its IPO, shares were sold for just $25 each. At the end of July, it had reached a high of $234 per share.

IPOs often perform well like this, which makes investors eager to get in whenever possible.

Precious Metals

Precious metals aren’t massive gainers, so their inclusion on this list may be confusing. However, if a true economic collapse occurs, more similar to the 1929 “Great Depression” than the 2018 “Great Recession” then the devaluation of stock markets and fiat currencies could cause the value of gold to rise significantly.

Gold and other precious metals are often used as a flight to safety during economic turmoil, and both its longevity and scarcity make gold the choice of many as a safe-haven asset.

As capital flows out of the currently falling stock market, it often gets moved into gold and other safe-haven assets.

Gold has been used throughout history as a store of value, and transactional currency. Essentially, no other asset has been around as long as gold that is still valuable today. This makes it a unique asset, which its value and potential will greatly depend on the overall economic environment in the near future.

In the meantime, in 2019, gold is still performing extremely well for investors as global tensions and fears increase. Most believe that gold is just starting its next bull market, which if true would make gold among the top-performing assets of 2019 – even with most other markets in danger of collapse.

Many platforms, including PrimeXBT offer spot gold contracts on leverage, turning even smaller moves in the gold market – which has recently seen large price spikes upward as economic concerns grow – into strong opportunities to trade and profit.

How to Invest Safely and Effectively?

Now that you know which assets to invest in or trade, choosing the right platform is the next most important step between you and becoming rich. Safety and security should be of the utmost concern, as well as ease of use and the tools and assets that are available.

PrimeXBT features bank-grade security and offers many layers of protection for investors trading on the platform such as two-factor authentication and address whitelisting. The trading platform also features many advanced tools that can help minimize risk in these high-yield assets, in addition to tools that can help traders generate even more profit from their positions than their capital normally allows for.

PrimeXBT features industry-best 100x leverage across many of the assets included on their platform – many of which are outlined in this guide. 100x leverage turns even the smallest initial capital into a profit-generating portfolio. For example, $100 in initial capital becomes $10,000 on 100x leverage, and a 0.3% gain turns into a 30% gain.

While there is risk involved, PrimeXBT offers traders the tools they need to mitigate risk with stop-loss orders and take profit orders. Both long and short positions can be taken simultaneously, allowing for hedge positions and profiting from the trend whichever way it turns.

PrimeXBT recently lowered trading fees on assets and overnight financing fees on cryptocurrencies like Bitcoin. The new, lower fees allow investors to take longer-term leveraged positions on the assets listed, for the largest possible gains.

PrimeXBT is easy to use, takes minutes to get started, and can help you in your journey to becoming rich in 2019. Sign up today and get started making profitable trades right away.

Disclsoure: This is a sponsored post

Image(s): Shutterstock.com

The post appeared first on The Merkle