Bitcoin is the world’s largest cryptocurrency and its users have in the past decade seen the crypto’s use-cases diversify quite dramatically. As BTC’s price stood at $9,309.19, the financial bandwidth of the network, also known as the economic throughput has been rising. The metric measures the financial bandwidth of Bitcoin by utilizing its transaction count and average transactions in the US dollar. According to a recent report by Glassnode, the network was currently witnessing approximately $2.1 billion in economic throughput daily, which was a great recovery since the dip observed earlier this year.

Source: Glassnode

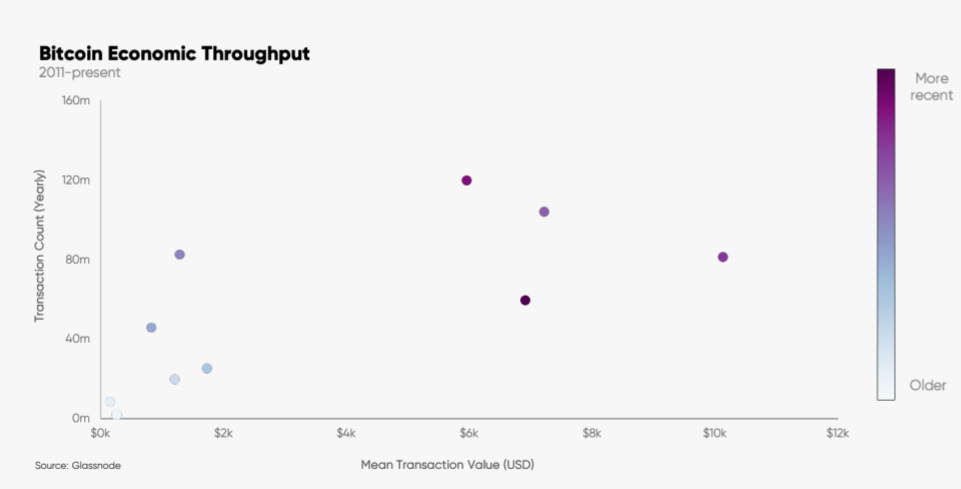

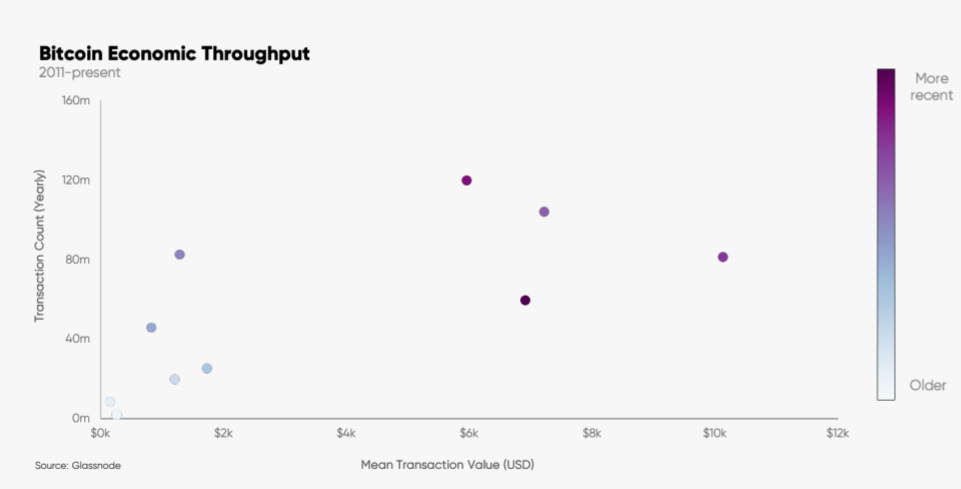

The mean transaction value of Bitcoin had peaked at the end of 2017 and the beginning of 2018 and noted an uptrend in 2020. However, a general increase in the mean transaction value indicated that the strong assurances provided by Bitcoin were arguably not optimal for low-value transactions.

Source: Glassnode

The above chart plotted against the mean transaction value for every year since 2011 indicated that the higher average transaction value was not associated with lower transaction count. The economic throughput strangled the growth of both its yearly transaction count and mean transaction value. This has collectively underpinned the significant growth in the economic throughput over the years.

This also meant that it was reasonable to expect a more negative association between transaction count and average transaction value, due to Bitcoin’s settlement assurance profile as a global network that details the nature of the system and how was fast transactions are settled. This would increase the usage of batched transactions, as well as fee dynamics.

While these were transactions taking place on-chain, there were other layers running on Bitcoin to aid its transactions, Lightning Network. The usage of off-chain transactions impact values but they do settle periodically at the base layer. Thus, as per data, the transaction count in YTD stood at 59.530 million, while the average transaction size was $6,915. This brought the Annual Economic Throughput to $411.643 billion, compared to last year’s $714.176 billion.

Source: Glassnode

With Bitcoin’s economic throughput continues to calculate the YTD, as the year is not yet over, there may be a rise in throughput visible as we have just begun the second-half in the market. The Bitcoin market did point at a volatile market making its way, however, the directed of the trend will be difficult to speculate.

The post appeared first on AMBCrypto