After celebrating its first birthday earlier this month, Binance Futures has announced a new milestone. The derivatives trading platform of the leading cryptocurrency exchange Binance has exceeded $1 trillion in trading volume since the start of the year.

Binance Futures Reaches $1T Trading Volume YTD

Launched a year ago, Binance Futures rapidly started expanding its market share. Apart from registering frequent all-time high trading volumes, the open interest on the derivatives platform followed suit and recently crossed $1 billion for the first time.

Earlier today, the company announced the most recent milestone in a press release shared with CryptoPotato. It reads that the “derivatives platform has transacted $1 trillion in year-to-date volume.”

Binance Founder and CEO Changpeng Zhao (CZ) commented that the company implemented “what worked for us in spot trading” when establishing the futures platform. He specified that Binance aims to ensure “platform stability, product innovation, excellent user-friendly interface, and user support.”

“We invested in an unparalleled matching engine that has proven itself time and again, and we focused our initial development in our first product to ensure we get it right. We now have 90 products across four product lines to meet user demand for greater diversification.

Binance Futures offers a wide selection of altcoin products, including coin-margined and USDT-margined futures, options, and our innovative Binance Leveraged Tokens.” – said VP of Binance Futures Aaron Gong.

The statement also informed that Bitcoin is responsible for nearly 60% of the entire volume, while altcoins account for the remaining 40%.

Binance Futures’ Role In BTC Trading Volumes

The first-ever and largest cryptocurrency by market cap remains the most frequently traded digital asset on futures platforms. As such, it’s worth exploring the performance and market shares of different exchanges.

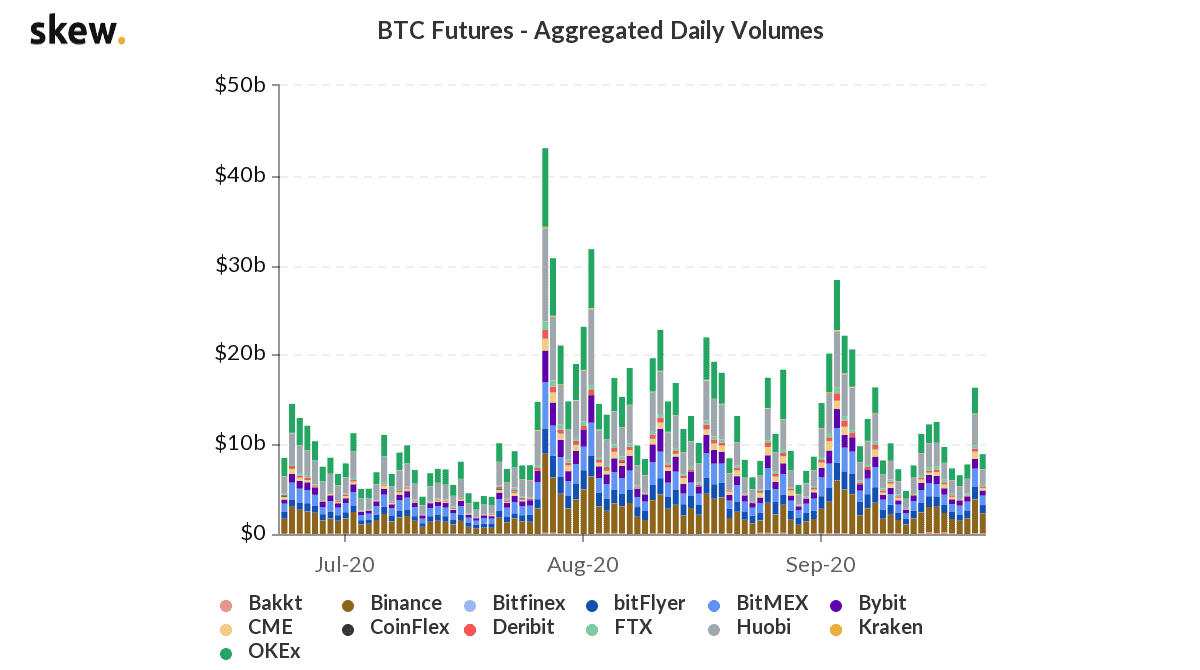

Data from the analytics company Skew indicates that three platforms have been leading in Bitcoin trading volume in the past several months – OKEx, Huobi, and Binance Futures.

As reported in July, the Bitcoin futures trading volume marked a fresh all-time high of over $40 billion in a day. The three platforms mentioned above took the lion’s share as they were responsible for more than 50%.

Additional data from Skew showcases that Binance Futures has taken the lead on a micro-scale, but OKEx and Huobi follow closely.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato