The year 2019 has been kind of overwhelming for Cardona (ADA) with major highs and lows. The coin had reached its high in July 2019. Since then, the coin has been in a bearish trend, often being in the red zone. The past week had been better for ADA as it has seen growth in ADA/USD price. Crypto has increased by 6.2% since last week.

Cardona (ADA) coin is in the 10th position as per the CoinGecko data as of writing. The ADA coin has seen a steady surge of around 2% in the last 24 hrs. At present, the ADA/USD price $0.03367 USD with a 1.6% growth rate, while the ADA/BTC price is 0.00000464 BTC with a 2.49% surge. The 24hr volume is $40,386,874 USD while the circulating supply is 25,927,070,538 ADA.

ADA Price Analysis for Last 7 Days:

With a 6.2% surge in the last 7 days, Cardano is breaking through the current bearish trend. Where all the cryptos are going south, ADA is steadily increasing.

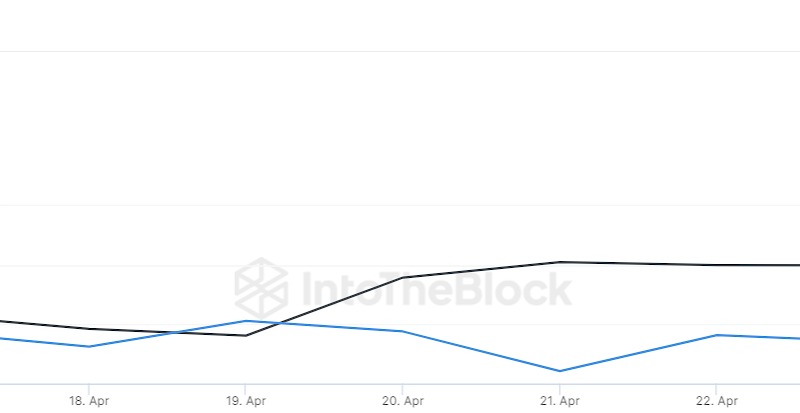

As seen in the chart, the ADA coin had been in a bearish zone, dipping to $0.031 USD on 18th December. But since then, the Cardona has seen a great surge. This trend continues as of writing. The current surge rate is around 2%.

ADA Technical Analysis:

The technical indicators show a bearish trend in the coming future.

- RSI Indicator – The 1hour chart of ADA / USD is increasing and nearing level 30.

- MACD Indicator – The 1-hour MACD indicator, however, is in the red zone and shows a bit leaning towards the bearish trend.

The ascent, which has occurred during the last week, proves that Cardano ADA is on the rise. Cardano could easily spend another few days in the current value area before breaking out. Further, it could initiate a rapid price increase.

Moreover, the project’s founder, Charles Hoskinson squashes all the negative remarks surrounding the crypto in his recent tweets.

What do you think of this ADA price analysis? Do you think ADA will continue its upsurge? Will the Bear trend gain momentum? Share your views on our Facebook and Twitter pages.

The post appeared first on Coinpedia