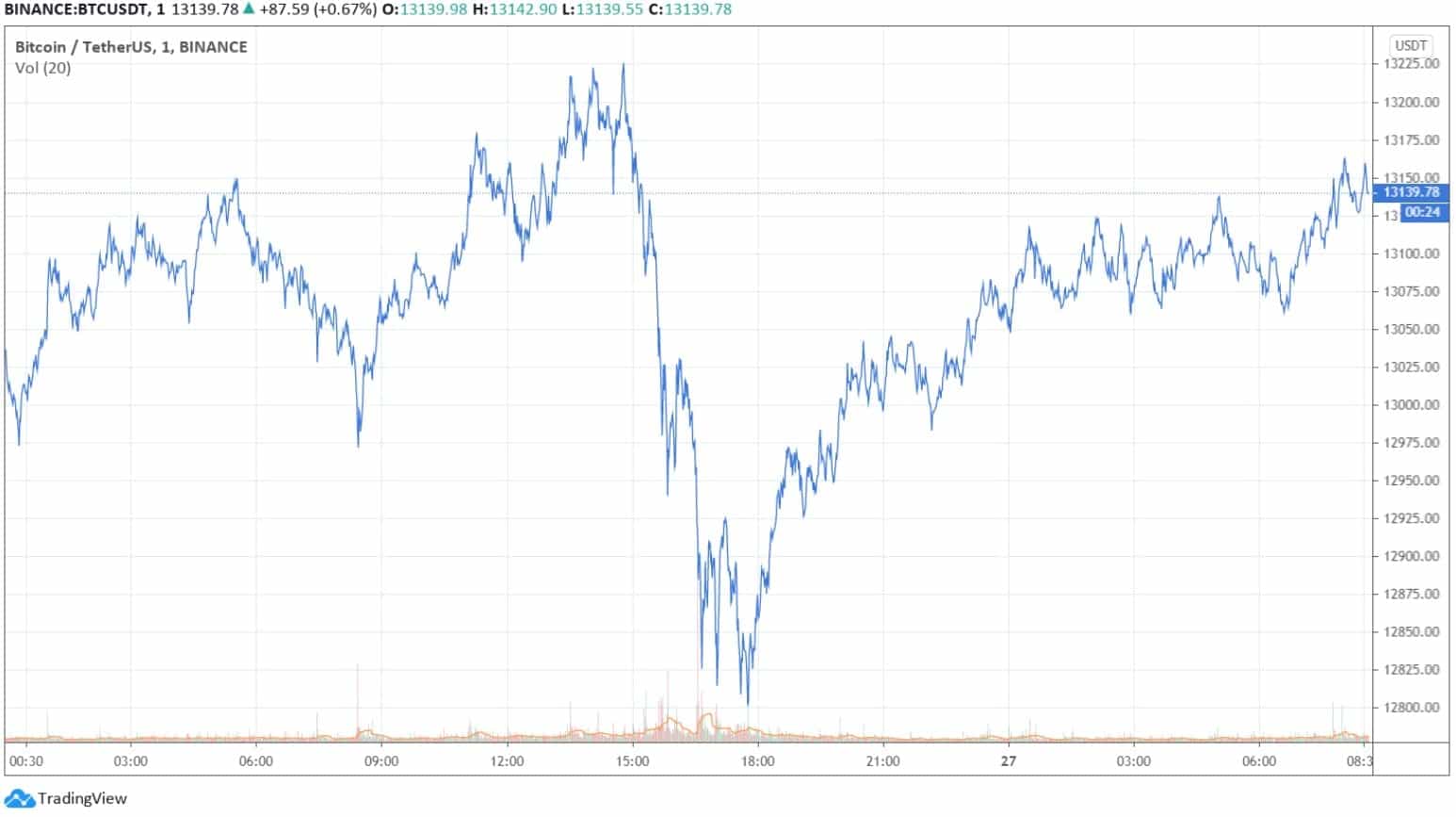

Despite a brief price slump to $12,800, Bitcoin has perhaps indicated signs of decoupling from the stock markets. Wall Street bled out rather viciously yesterday, while BTC has risen above $13,000 again.

Bitcoin Decouples From Stocks?

During the past several weeks, Bitcoin’s price performance has resembled that of the US stock markets. For example, when news broke out that US President Donald Trump tested positive for the COVID-19 virus, both asset groups tanked. Shortly after, when Trump left the hospital, BTC, and the stock market surged.

However, Bitcoin displayed a few yearly signs of decoupling last week. The three most prominent US-based stock indexes, namely the S&P 500, the Nasdaq Composite, and the Dow Jones Industrial Average, lost value, while BTC went on an impressive roll, resulting in a fresh yearly high of above $13,350.

Yesterday’s trading session was also quite negative for Wall Street. The growing COVID-19 confirmed cases and concerns regarding the new US stimulus brought massive drops. The S&P 500 and Nasdaq declined by nearly 2%, while the Dow closed with a 2.3% decrease.

Initially, Bitcoin also followed the adverse performance. BTC was trading high above $13,200, but it vigorously tanked to its daily low of about $12,800. However, the primary cryptocurrency has recovered most of its losses since then and trades closely to $13,100.

Red Dominates The Altcoin Market

On a 24-hour scale, most altcoins have lost significant chunks of value. Ethereum has dived by 3% and trades well below $400. Just a few days ago, ETH touched $420.

Ripple (-1.8%) has dipped beneath $0.25. Bitcoin Cash (-3.1%), Chainlink (-4.6%), Cardano (-1.5%), and Litecoin (-2%) are all in the red from the top 10.

There’re two obvious exceptions – Binance Coin and Polkadot. BNB has jumped by over 1% to $31.26, while DOT has surged by 9% to $4.7.

Further losses are evident from lower and mid-cap altcoins. Quant leads the way with a 13% decrease. Reserve Rights (-10.3%), HedgeTrade (-10%), CyberVein (-10%), Elrond (-9%), and Ampleforth (-8.5%) follow.

Nevertheless, a few coins are deep in green as well. Kusama is the most impressive gainer with a 26% surge, Ocean Protocol (14%), and Velas (9%) are next.

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato