Disclaimer: The findings of the following article are the sole opinion of the writer and should not be taken as investment advice

Binance Coin, like many altcoins, has suffered first-hand, yet again, at the hands of Bitcoin’s volatility. Due to a drop of ~$2,200 on Bitcoin’s price charts starting 12:00 UTC, 25 November, altcoins have been shedding blood.

In fact, Binance Coin dropped by 17%, shedding almost $6 in a span of just 12 hours. While this is bad, let’s take a look at BNB’s long/medium-term chart to see if there are more drops incoming. Further, a short-term analysis will determine if one should touch BNB or not.

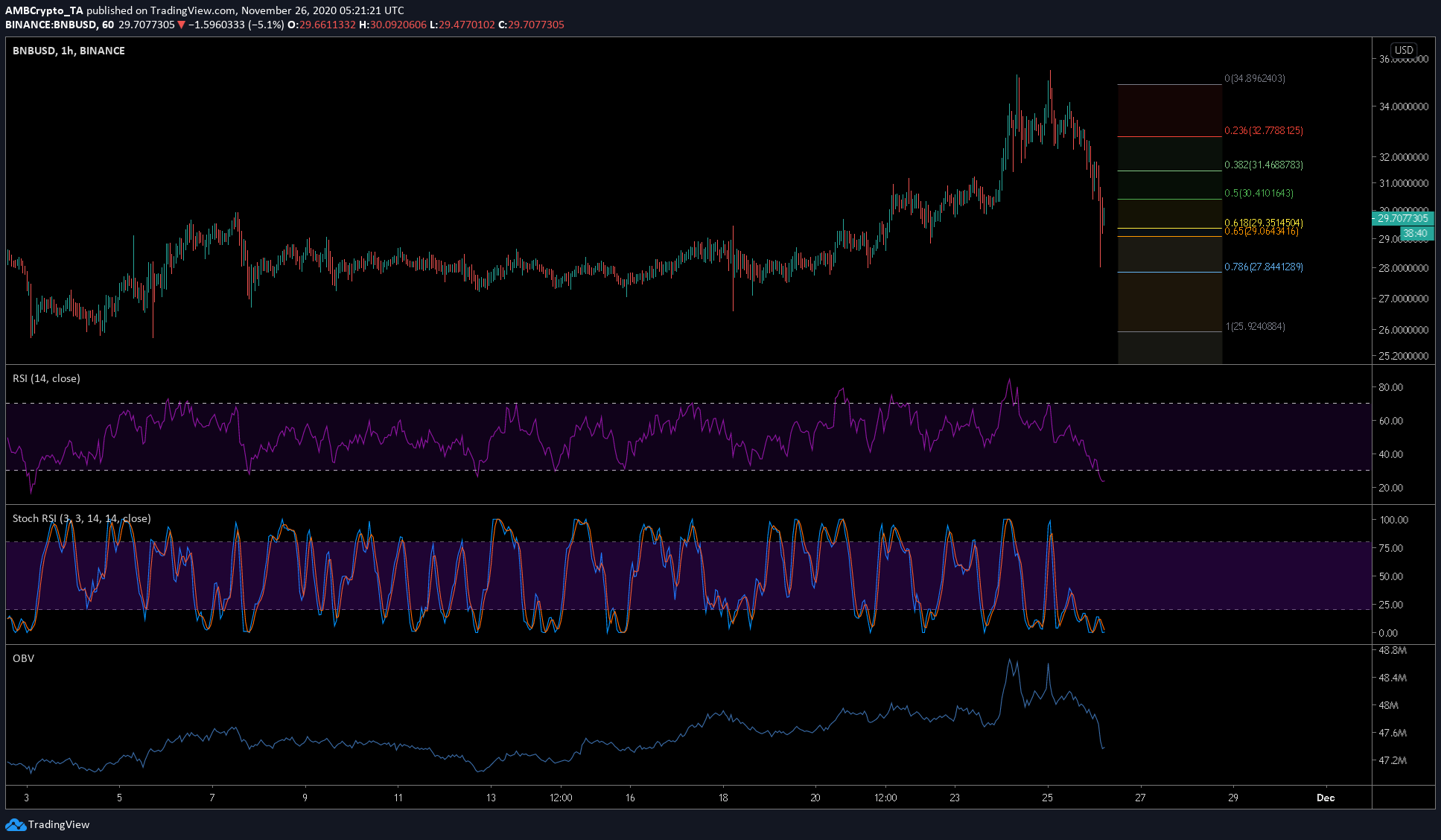

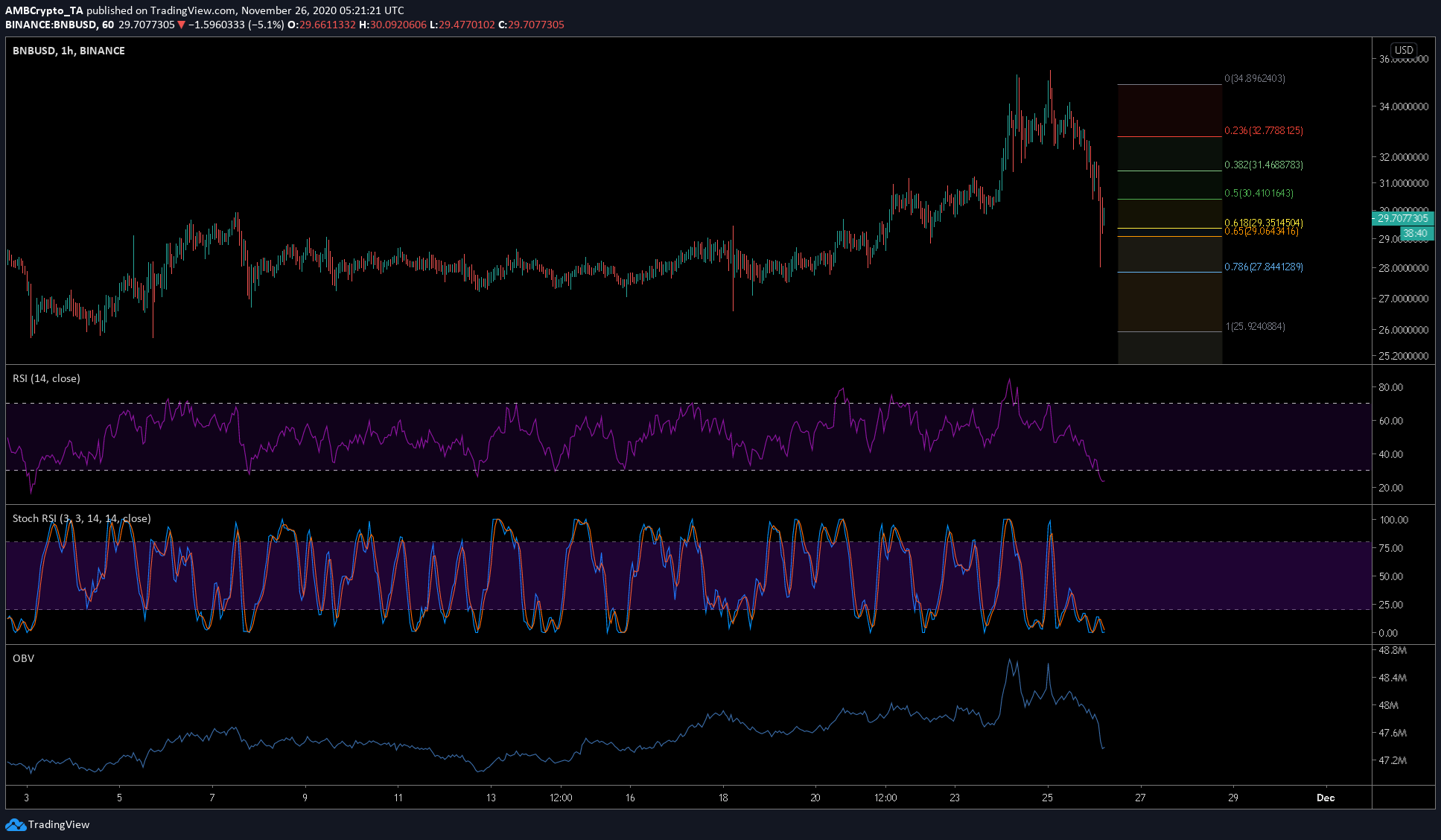

Binance Coin 4-hour chart

Source: BNBUSD on TradingView

The latest drop is interesting since while it wicked out to the 0.786-Fibonacci level, it was stabilizing above the Golden Pocket, at the time of writing. Hence, one thing we can infer from this is that we can expect the price to surge higher from the said pocket.

Albeit low, it seemed possible that the price might retrace below the golden pocket due to BNB’s strong correlation with Bitcoin. In fact, the 30-day correlation between BTC and BNB has risen from 0.29 to 0.35. While the correlation had dropped rapidly in the last quarter, we can expect altcoins to feel a strong tug from BTC, should it come crumbling down.

The indicators for BNB on the 4-hour timeframe look bottomed out, hence, we can expect the altcoin’s price to stabilize for now.

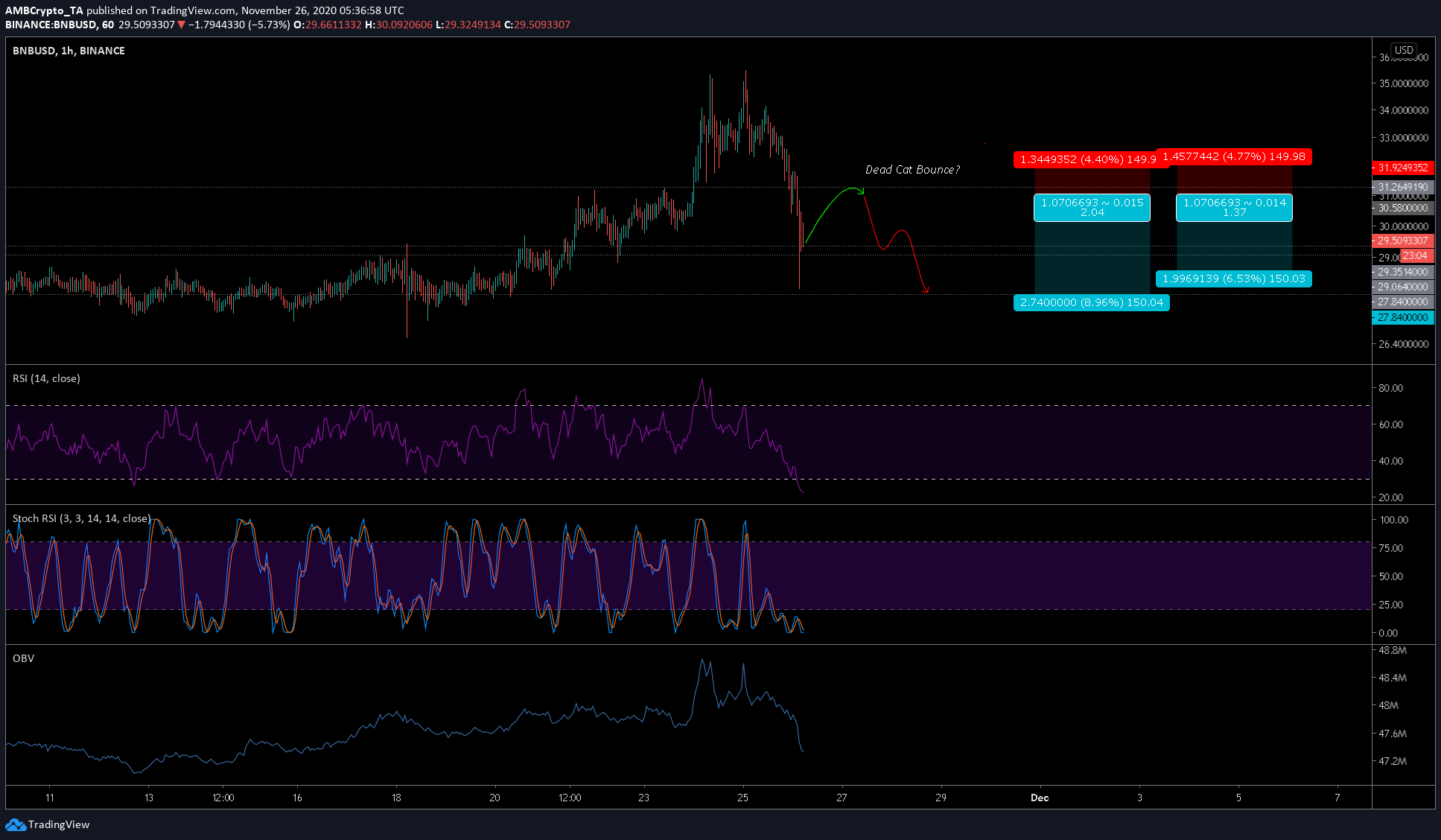

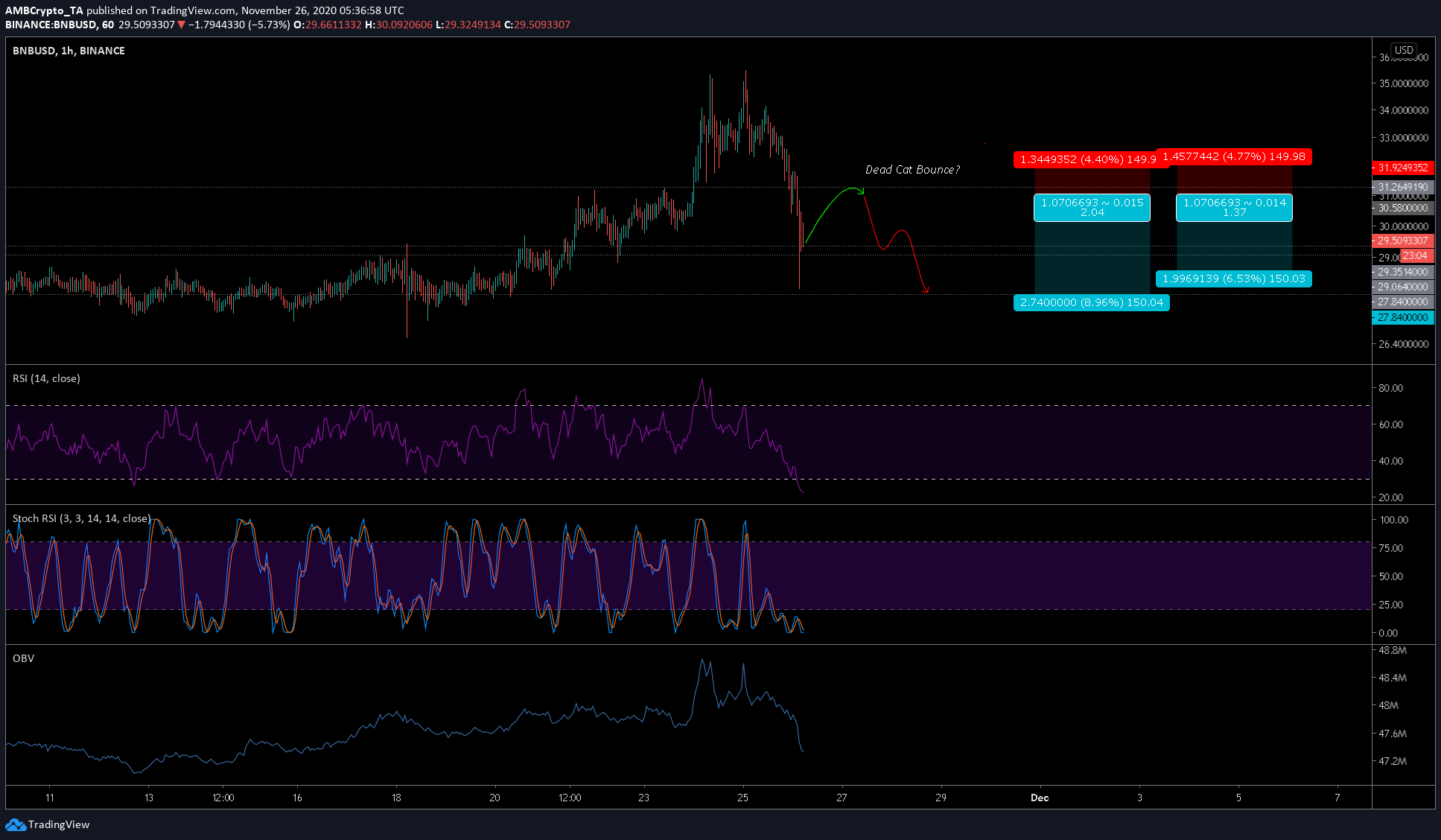

Binance Coin 1-hour chart

Source: BNBUSD on TradingView

From a short-term perspective too, we can expect the price of BNB to stabilize, or even surge by a few ticks. However, there seemed to be a looming pullback over altcoins due to Bitcoin. Since Bitcoin’s position didn’t look so good at press time either, an overall downtrend for BNB can be expected.

Rationale

Apart from the correlation of Bitcoin affecting altcoins, BNB has a chance to surge higher – up to $31.26 – a zone of resistance where it can revert and drop back down again. This would open up the likelihood of a dead cat bounce, hence, the overall bearish aka short position on BNB.

Both the RSI and Stochastic RSI were in the oversold zone, indicating a recovery soon.

Levels to look out for

Entry: $30.58

Stop-Loss: $31.92

Take-Profit: $27.84, $28.58

Risk-to-Reward: 2.04, 1.37

The post appeared first on AMBCrypto