Bitcoin finally made a move in the past 24 hours and surged to a new 7-week high of over $11,800. Interestingly, BTC’s price increase contrasted with the US stock markets as the three most prominent indexes closed yesterday’s trading session with serious losses.

Bitcoin Spikes To $11,820

CryptoPotato reported yesterday that Bitcoin had remained relatively calm in the past several days, despite recent negative news. The popular digital asset exchange OKEx suspended withdrawals after reports that its founder was taken away by the police, and the CME gap left open at $11,100 suggested a possible short-term price drop.

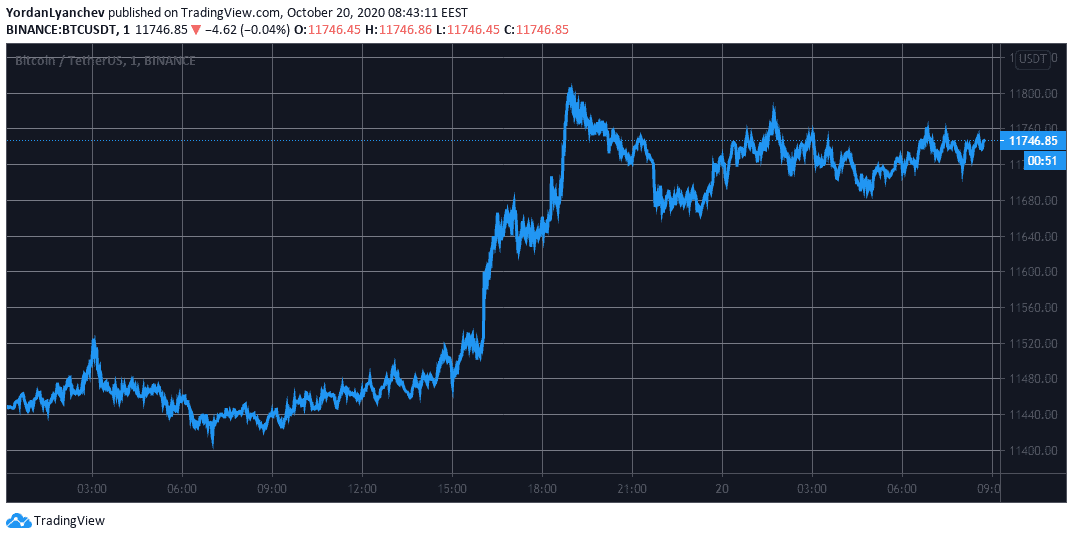

However, the primary cryptocurrency tends to prove people wrong, and that precisely what transpired yesterday. BTC traded around $11,400 but initiated an impressive leg up that resulted in a 3.7% increase to $11,820 (on Binance). This was the highest price level Bitcoin had seen since early September.

The asset has retraced slightly since then and currently hovers around $11,750. Nevertheless, this is still a 2.8% increase on a 24-hour scale.

The technical aspects indicate that the $12,000 – $12,100 area is the next major resistance in BTC’s way up.

With the price jump mentioned above, Bitcoin displayed early signs of decoupling from Wall Street. After weeks of resembling the US stock indexes, BTC surged in value, while the S&P 500, the Dow Jones Industrial Average, and the Nasdaq Composite all dropped by over 1.5% in a single day.

Bitcoin Extends Its Market Dominance

Although some alternative coins mimicked Bitcoin’s gains, most have remained relatively still. Consequently, the metric comparing BTC’s market cap with all altcoins, namely the Bitcoin dominance, has increased by nearly 1% to 59.7% in 24 hours. On a weekly scale, it has expanded by almost 2%.

Ethereum’s 1.4% price spike has taken ETH near $380. Ripple (3.1%) is the most impressive gainer in the top 10, and XRP trades close to $0.25.

Bitcoin Cash (0.8%), Chainlink (0.5%), Cardano (1%), and Litecoin (2%) are also in the green from the top ten. In contrast, Binance Coin (-0.2%) and Polkadot (-1%) have decreased slightly.

Dash has surged the most on a 24-hour scale (11.6%) to $74. Nano follows with a 10% pump to $0.9.

On the other hand, Aave (-12%) and ABBC Coin (-10.5%) have lost the most value. AAVE trades below $35, while ABBC hovers around $0.57.

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato