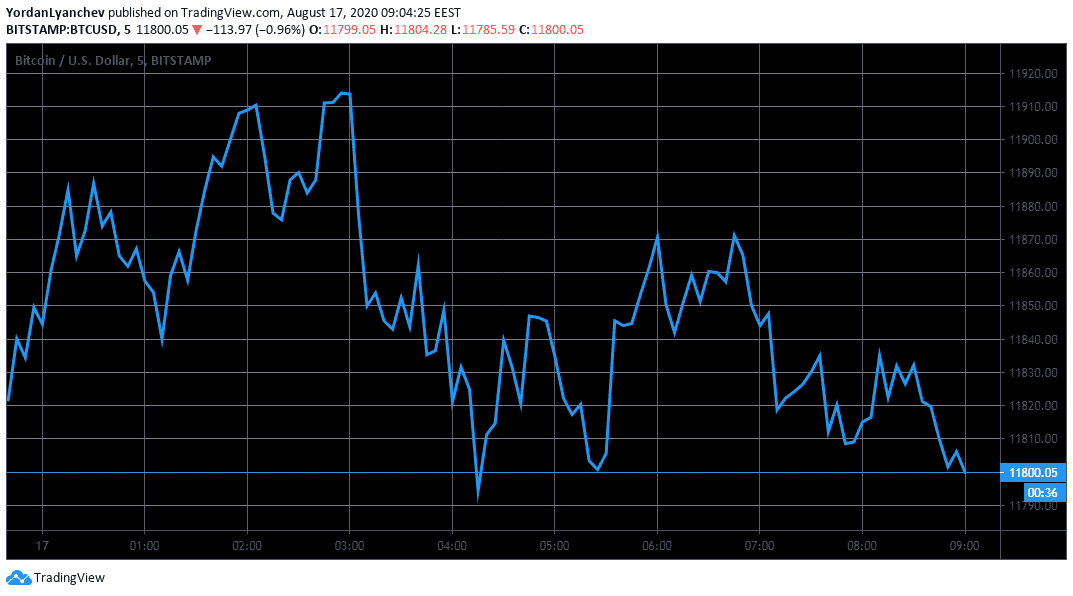

Bitcoin stays stagnant at around $11,800, as of now, while most large-cap altcoins have calmed down in the past 24 hours. The situation among low-cap alts is radically different.

Low-cap Altcoins On The Move

Most large-cap alternative coins haven’t shown any significant fluctuations since yesterday. Ethereum is less than 1% down to $425, Ripple (-0.25%) to $0.3, and minor gains are visible for Chainlink, Binance Coin, Cardano, and EOS.

The two most volatile assets from the top ten are Litecoin with a 3% price increase to $63 and Bitcoin SV’s 2.4% drop to $218.

The outlook among the top 25 coins is somewhat different, with 5% increases from Stellar, Cosmos, and NEO. Tron is the most substantial gainer here, with 8%. TRX continues its recent bull run following the strategic partnership with Waves to enhance mass adoption in the DeFi space.

However, the most significant gainers from the past 24 hours are representatives of the lower-cap alts – OMG Network (50%) and Ocean Protocol (42%) after the latter’s Binance listing. OMG exceeded $3 earlier today – a level the asset hasn’t seen since June 2019.

WAVES is also feeling the effects of the Tron partnership after another 30% price increase to $4.50. Thus, WAVES has marked a 150% jump in less than a week as it traded at $1.8 on August 12th.

The double-digit increase club is also attended by Ren (23%), Basic Attention Token (19%), 0x (15%), Yearn.Finance (15%), Fetch.ai (14%), Aave (13%), Siacoin (11%), BitTorrent (10.5%), and Ontology (10%).

Divi (-8%), Quant (-6%), and Ampleforth (-5%) are the most substantial losers of the day.

Bitcoin Stays Still And Loses Dominance

Bitcoin’s intraday price developments appeared promising at first glance when the asset headed upwards to about $11,900. However, the bulls couldn’t sustain the run, and BTC rapidly reversed to about $11,800.

After a few minor and unsuccessful attempts to head higher again, Bitcoin returned to the same $11,800 level, where it’s situated at the time of this writing.

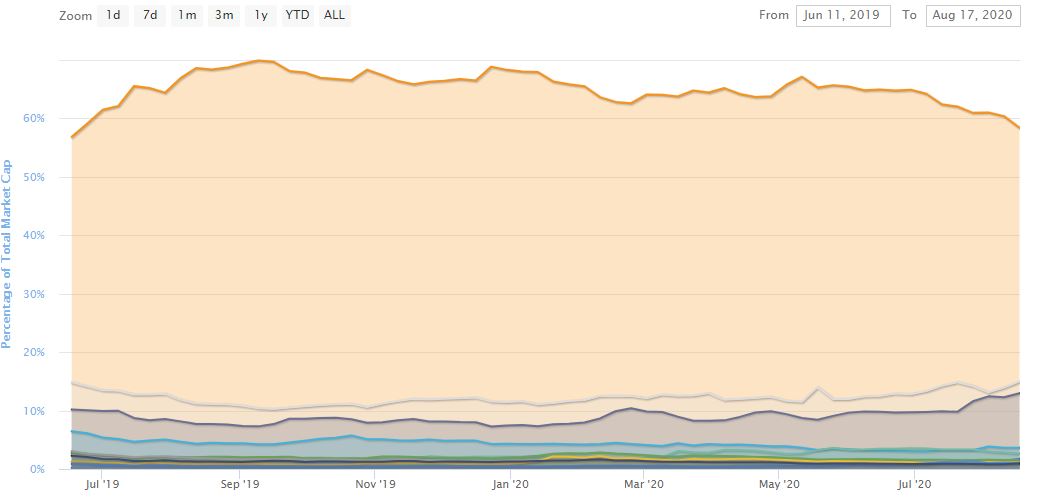

Consequently, as altcoins continue charting impressive gains, and Bitcoin refuses to overcome its $12,000 nemesis, its dominance suffers. The metric comparing BTC’s market cap against all other coins has dived to 58.4%. This is the lowest number displayed since mid-June 2019.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato