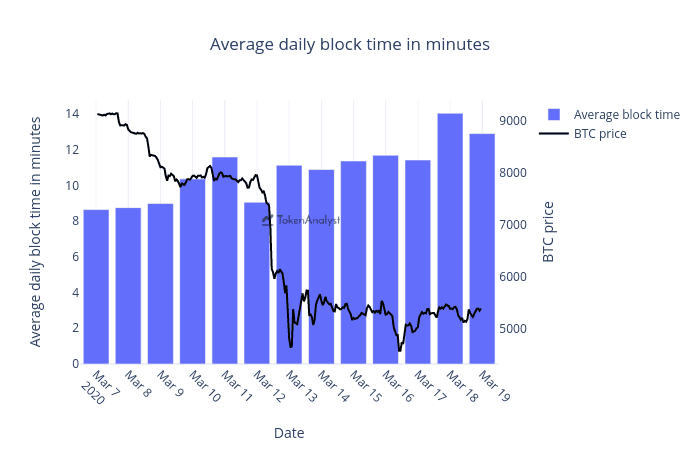

The latest steep declines in Bitcoin’s price have pushed miners to switch off some of their equipment to reduce costs. Consequently, this slowed down the average daily block time by as much as 70%.

Miners’ Response To The Price Drop

Miners are the backbone of Bitcoin and any other Proof-of-Work-based cryptocurrency. They create new bitcoins by using hardware to solve complicated computer equations. The miner who solves them the fastest receives the reward (fee) for the transaction, which he adds to the block. On average, a new block is added on the blockchain network every 10 minutes.

The rewards come in bitcoins and miners’ revenues are directly impacted by how Bitcoin’s price is performing. And lately, as the largest digital asset dropped from a high of $10,000 in February to a yearly low of $3,600 a few weeks later, their revenues decreased as well.

As a result, miners had to switch off equipment to reduce costs, according to the popular monitoring resource – Tokenanalyst.

Ultimately, this led to a serious increase in the average block time. Back when Bitcoin was hovering over $9,000, the average block time needed was about 8 minutes. After shutting down miners’ equipment, though, the required time has now jumped to 14 minutes on some occasions – an increase of over 70%.

As the average block time slows down, it also impacts the upcoming Bitcoin halving. Scheduled to take place on block number 630,000, the event may be delayed. At one point, some suggestments indicated that it could take place in April but, the estimated day now is May 13th.

It’s also worth noting that the Halving will decrease the block rewards to 6.25 BTC per block. This could also affect miners and their profits, especially if Bitcoin’s price doesn’t recover. Once again, it raises the question if Bitcoin mining is still profitable.

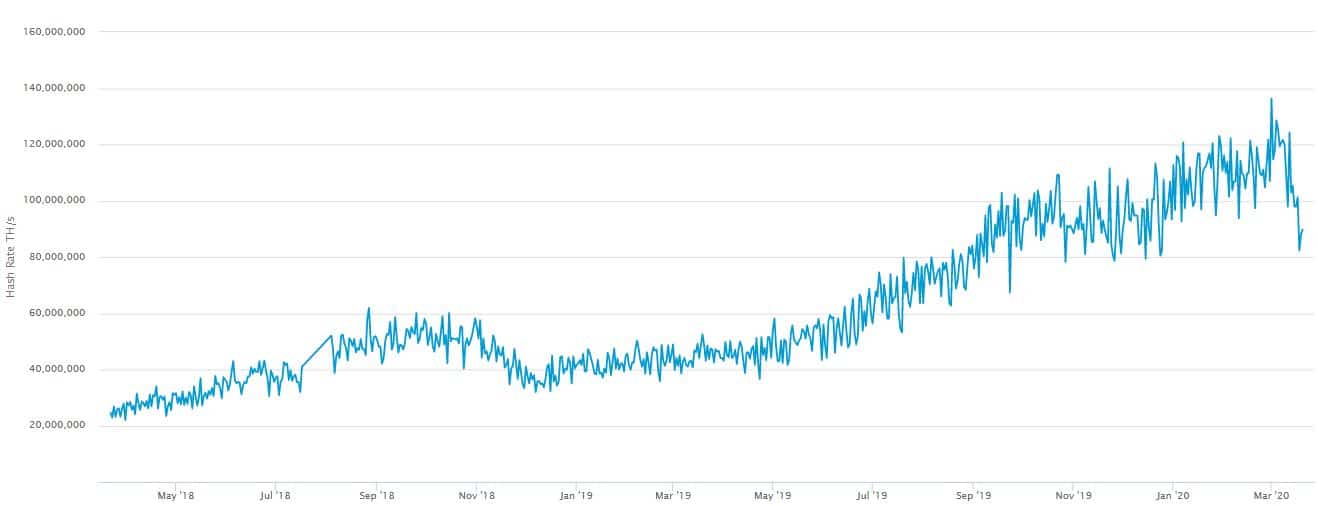

Bitcoin’s Hashrate

Shutting down equipment impacted Bitcoin’s hash rate, as well. Just at the start of March, it recorded a new all-time high of over 136 quintillion hashes per second. Moreover, it outlined a steady and continuous increase in the past few years, despite any previous price actions.

With the latest developments, though, the hash rate noted a serious plunge to approximately 82 quintillions. That’s the lowest point it has recorded since the end of December last year.

The post Bitcoin Halving Delayed? Following Recent Bitcoin Sell-Off, Average Block Time Increased To 14 Minutes appeared first on CryptoPotato.

The post appeared first on CryptoPotato