Bitcoin is up by an impressive 22% this week as it currently battles with the $40K resistance area. As mentioned before, for the past two months, bitcoin’s price was trading between $30K and 42K. This week saw its highest point since June 15 ($41.3K according to BItstamp).

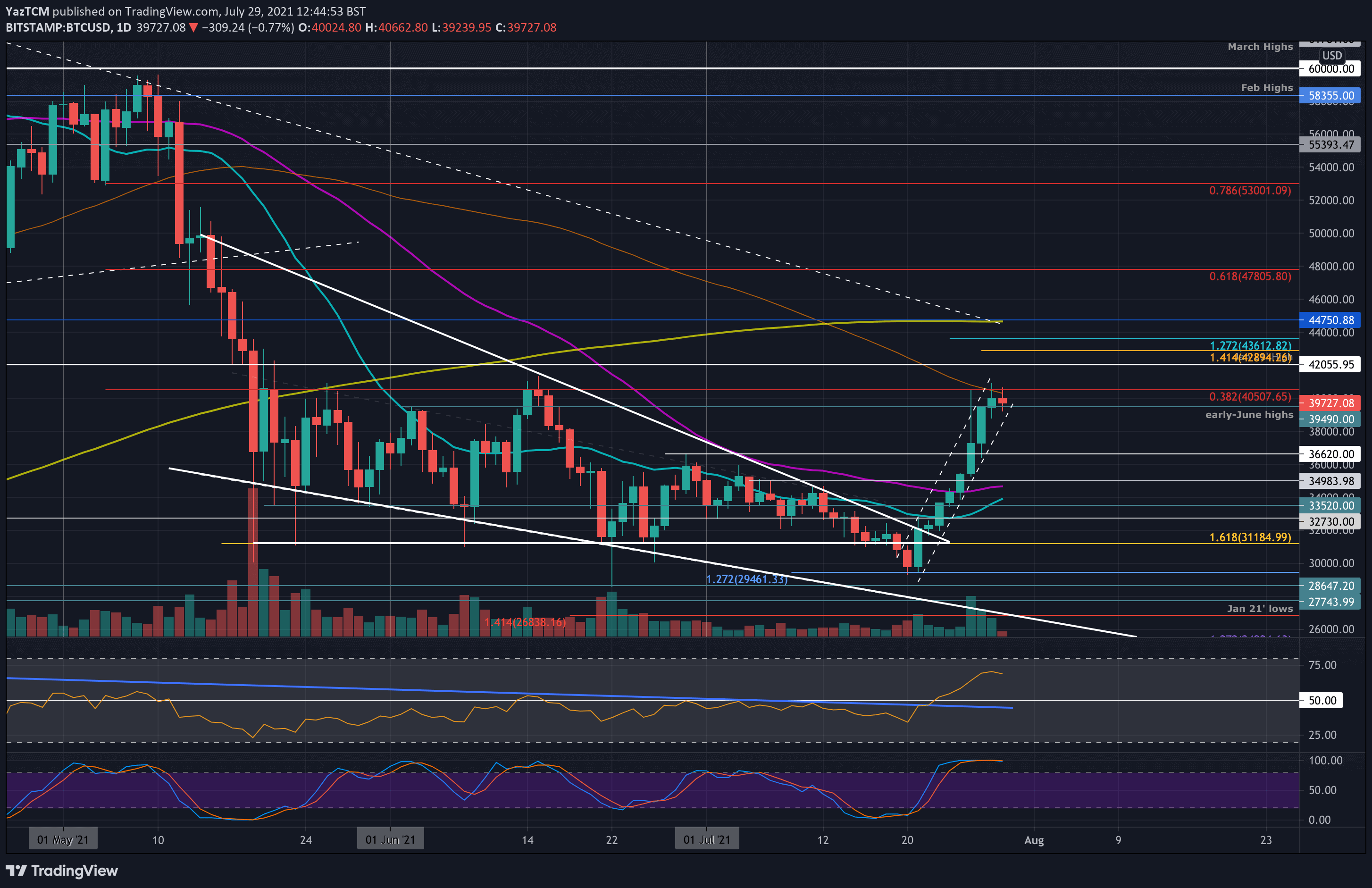

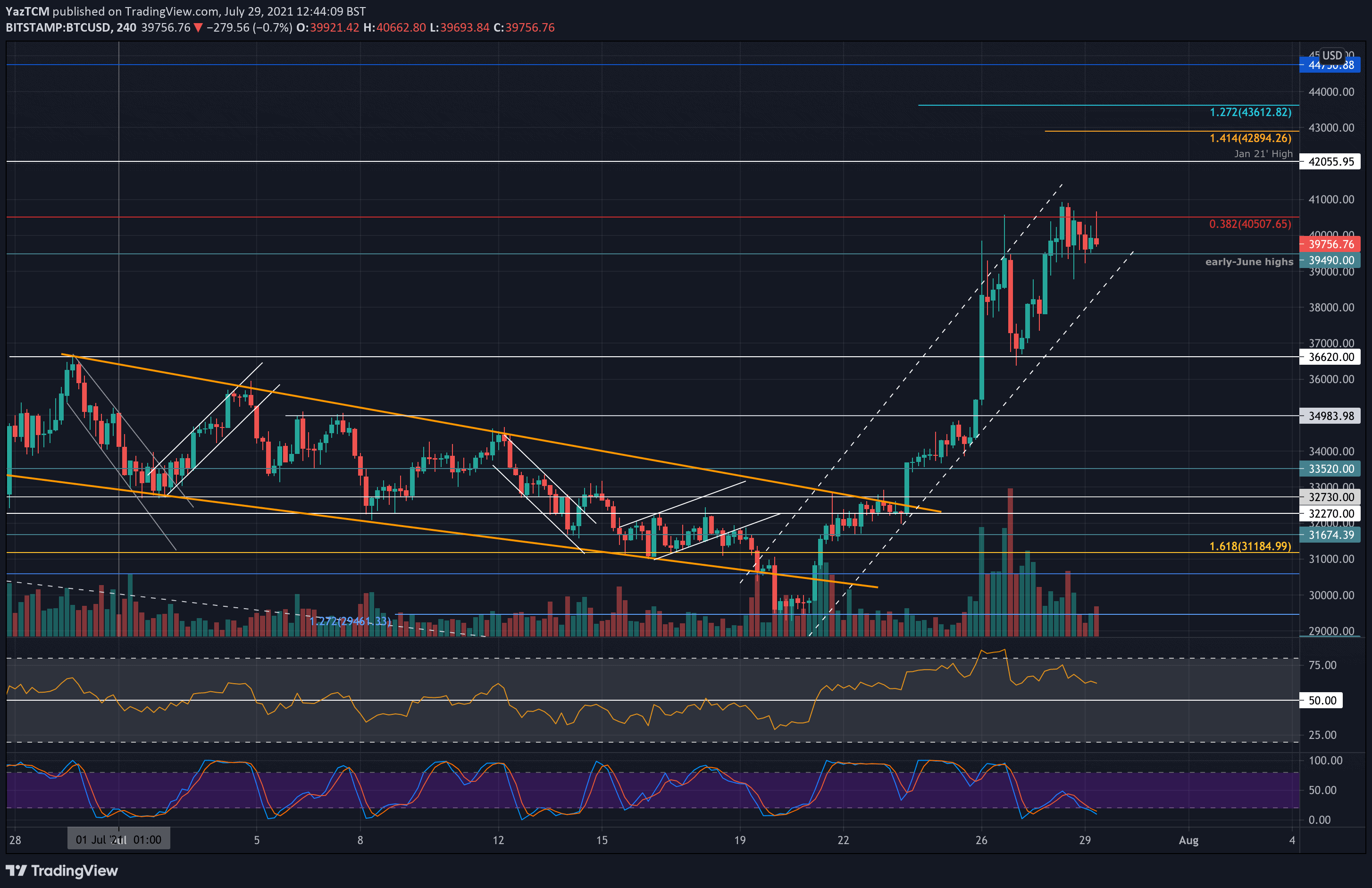

The past week has been promising for BTC, after breaking a descending wedge pattern and finally getting to overcome both the 20 and the 50 days moving average lines. This break of the 50-day MA was the first time the cryptocurrency has been trading above it since early May. As can be seen in the short-term chart below, the price surge is largely confined inside a nicely shaped ascending price channel.

Despite the promising momentum for the bulls, BTC is now testing major resistance of $40-42K, which is the top boundary of the above-mentioned range. Since the crash on May 19th, bitcoin was unable to close a weekly candle above $39K. The area also includes the 100-day moving average line at $40.3K as of writing these lines.

Besides, after consecutive eight green daily candles, it looks like Bitcoin might need to cool off a bit, as there’s bearish divergence appearing on the short-time frame, which is the 4-hour chart.

Nevertheless, if BTC manages to break through the $40-42K resistance area with a daily and/or weekly close above – the way to BTC $50K might be very quick.

BTC Price Support and Resistance Levels to Watch

Key Support Levels: $39,500, $37,000, $36,620, $36,000, $35,000, $34,460.

Key Resistance Levels: $40,000 – $40,500, $41.3K, $42,000, $43,610, $44,750, $47,800.

Moving forward, the first resistance lies between $40-40.5K, which contains the 100-day MA and a bearish .382 Fib. Above this, resistance lies at $41,300 (June’s high), $42,000 (Jan 2021 highs), $43,610 (1.272 Fib Extension), $44,750 (200-day MA & descending trend line), and $47,800 (bearish .618 Fib).

On the other side, the first support lies at $39,500 (early-June highs). This is followed by support at $37,000, $36,620, $35,000 and $34,460 (50-day MA).

As mentioned, there is a bearish divergence developing on the 4-hour chart. However, on the daily, the momentum is clearly in favor of the bulls.

Bitstamp BTC/USD Daily Chart

Bitstamp BTC/USD 4-Hour Chart

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited offer).

PrimeXBT Special Offer: Use this link to register & enter POTATO50 code to get 50% free bonus on any deposit up to 1 BTC.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato