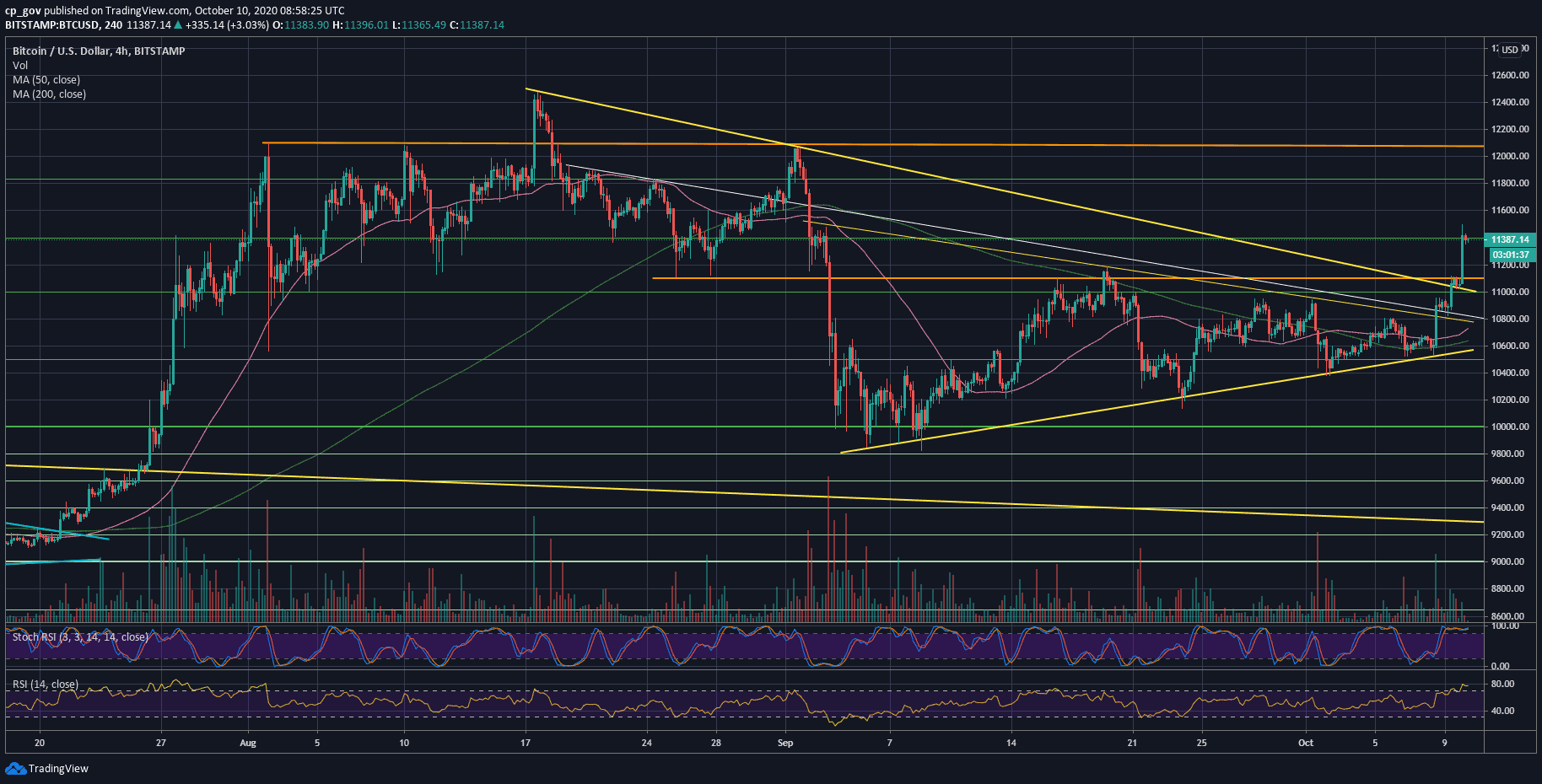

Bitcoin took a break from trading during the month of September, with relatively low volatility. As shown on the following 4-hour chart, the marked symmetrical triangle was basically the story of September: Started with a massive dump and a slow consolidation, since then, around $10,600.

As can be seen below, Thursday signaled a breakout – in favor of the Bulls. Since breaking the triangle at $10.8K, we saw a healthy consolidation and finally a breakout of the $11-11.2K area, which was the most recent high.

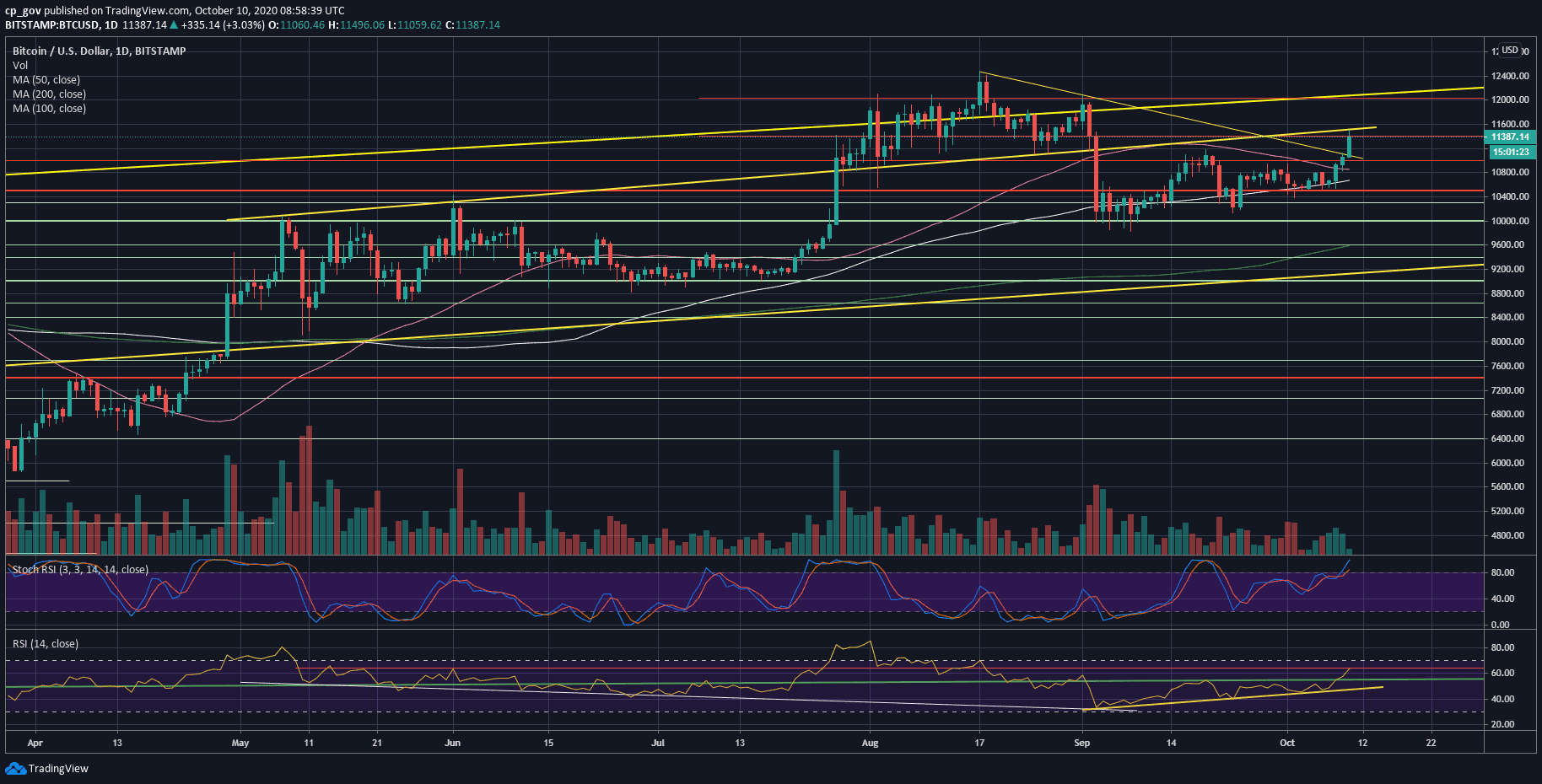

So far, as writing these lines, today’s daily candle marked $11,500 as the daily high. This is the first resistance to watch.

However, after three consecutive green days, Bitcoin might rest a bit. In case of a correction, the $11,000 – $11,2000 support would consider a very healthy retest. A daily close below $11K might change things in favor of the bears.

The Fundamentals and The Technicals

As we know, Bitcoin has been recently showing a positive correlation with Gold and the equity markets. The past days, especially Thursday and Friday, yielded 2-3% gains across major U.S. markets indexes. Shortly after Friday’s Wall Street close – it was Bitcoin’s turn to show its capabilities.

From a technical point of view, the daily RSI is now at 64-65, its highest point since August 17, 2020. Despite the excitement, the trading volume is still not significant.

BTC Levels to Watch in The Short-Term

As mentioned above, Bitcoin is now facing $11,400 – $11,500 as the first area of resistance. If BTC manages to break above, then $11,800 should be a weak resistance before the $12,000 – $12,100 resistance area.

From below, the first level of support now becomes $11,200, followed by $11,000 and $10,800.

Total Market Cap: $366 billion

Bitcoin Market Cap: $210 billion

BTC Dominance Index: 57.5%

*Data by CoinGecko

BTC/USD BitStamp 1-Day Chart

BTC/USD BitStamp 4-Hour Chart

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato