As ‘Uptober’ concludes its chapter, November is set to carry the trend, continuing Bitcoin’s impressive upward trajectory. Over the past month, Bitcoin has recorded gains exceeding 30% due to notable developments such as Grayscale’s triumph and the listing of BlackRock’s ETF on the DTCC site. Analysts are now looking forward to the potential launch of ETFs as the year draws to a close, with growing confidence that Bitcoin will maintain its bullish rally, possibly sending its price beyond $35,000 next week.

Bitcoin’s Record $16 Billion Open Interest Sets The Price

Traders are actively opening positions on Bitcoin price, driven by its increased volatility. As a result, the Open Interest metric touched this year’s record high of $16.35 billion. The majority of these traders entered the market during Bitcoin’s strong rally from October 16 to October 24. However, the price of BTC appears to be slowing down now, possibly influenced by declining ETF hype. Nevertheless, the on-chain metrics for Bitcoin remain robust for November.

In the past, the fourth quarter has typically shown a bullish rally in the market. November has often maintained a neutral position, carrying forward the momentum from October, except for the FTX crash incident that occurred last year. On average, we can expect another 10% surge in November, pushing Bitcoin price toward $37,500.

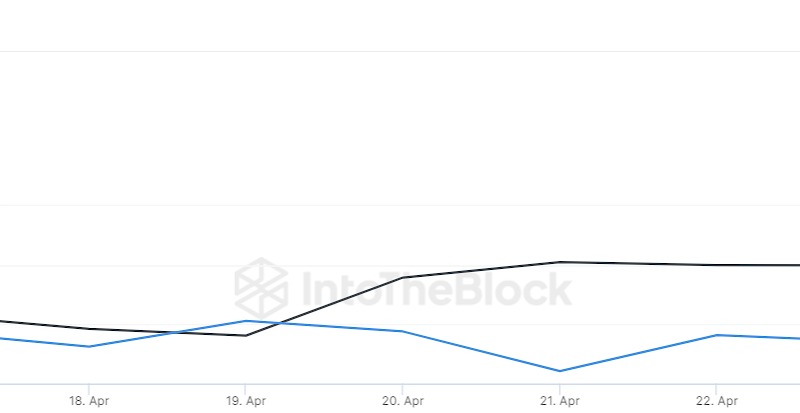

Data from IntoTheBlock shows that Bitcoin has experienced a continuous negative netflow for the last week. Interestingly, this trend suggests a positive outlook for the market, as a negative netflow points to declining reserves on exchanges due to an increase in outflows.

This signals ongoing accumulation by investors, predicting a potential uptick in prices, which could mean a bullish sentiment for Bitcoin in November. At the moment, the netflow is recorded at -820 BTC, strengthening investors’ interest.

What’s Next For BTC Price?

After facing a rejection recently, Bitcoin price has rebounded from $33,400, suggesting high buying demand near low prices. However, sellers continue to put pressure near the high of $34,500, suggesting an intense battle on the price.

Nonetheless, there’s a bullish hope as the relative strength index (RSI) continues to surge above the midline, suggesting that the market is favoring buyers. A breakout above $35,300 will trigger more purchases and massive short-liquidation. In this case, BTC’s price might surge exponentially and head toward its target of $36,600.

Any further surge will skyrocket the price toward $40K. However, surpassing the $35.3K level could be troublesome as sellers will attempt a trend reversal.

If sellers successfully shift the sentiment near the resistance, BTC price will likely trap buyers, making a sharp drop toward $32,400. If buyers fail to defend this support level, we might see a drop toward $29K.

The post appeared first on Coinpedia