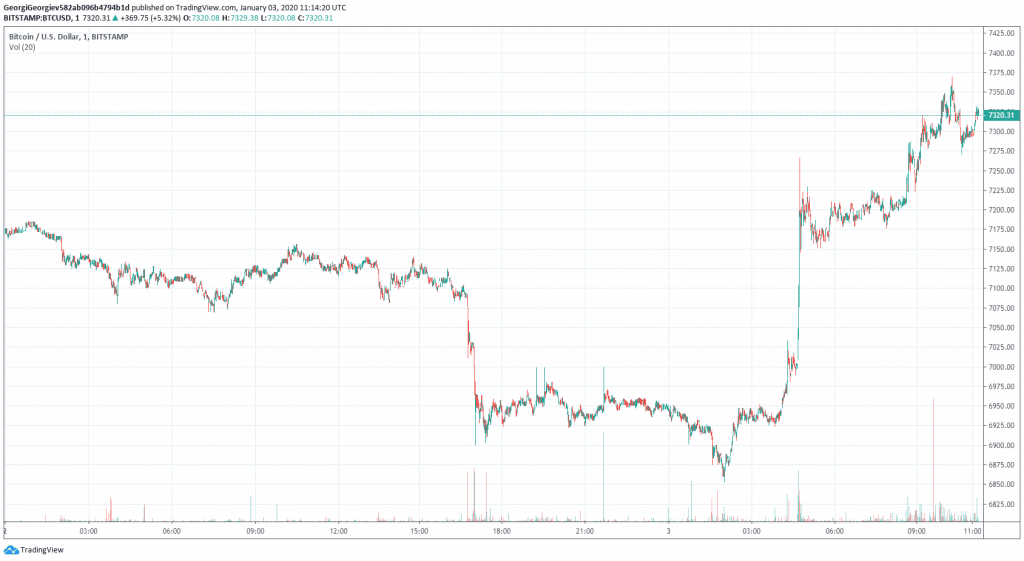

Bitcoin’s price went on yet another quick rollercoaster throughout the past 24 hours. It dropped down to about $6,850 yesterday, only to get back up above $7,300 today. Interestingly enough, the move comes following a US airstrike, which had the leader of Iran’s Quds Force’s leader killed.

Bitcoin Price Surges $500 In Hours

Yesterday, the price of Bitcoin dropped down to a low of around $6,850 in a violent red candle. Naturally, it had the overall sentiment in a mixed state because it dropped below $7,000, which is a significant psychological level.

However, it didn’t take long for it to recover and even to increase. Just a few hours later, the price popped with $500, reaching $7,350 on Bitstamp. At the time of this writing, Bitcoin trades at $7,280, which is an increase of a little less than 2.5% for the past 24 hours.

BTC/USD. Source: TradingView

As it’s almost always the case, the rise in Bitcoin’s price also pushed other cryptocurrencies in the green, as practically all of the top 20 projects are marking slight but positive increases. ETH is up 2.5%, Bitcoin Cash (BCH) is up 4.5%, while Binance Coin (BNB) charts an increase just shy of 1%.

Cryptocurrency Market Overview. Source: Coin360

Bitcoin’s dominance remains stable above 68%, showing that altcoins aren’t yet capable of reclaiming any serious grounds.

US Airstrike Has Iran’s Quds Force Leader Killed

Interestingly enough, the sudden move up in Bitcoin’s price coincides with a serious political event that took place at the same time.

The price started to increase almost immediately after it was reported that an airstrike at Baghdad’s airport, order by the president of the United States, Donald Trump, killed the head of the Iranian Revolutionary Guards’ Quds Force – General Qasem Soleimani.

As it has been brought up quite a few times before, Bitcoin has shown a negative correlation to traditional markets. Moreover, the Chair of the US Federal Reserve, Jerome Powell, said back in July 2019 that Bitcoin is a store of value like gold. This is perhaps why investors might use it as a hedge in times of political and economic turmoil.

The recent events are most certainly not a precedent. Last year, when President Trump said he would impose an additional 10% tariff on $300 billion worth of Chinese goods, Bitcoin surged $700, while traditional markets tumbled.

It’s also worth noting that Bitcoin is not the only commodity that increased its value following the airstrike. Global oil prices also rallied, charting gains by almost 3% in the wake of the event.

You might also like:

The post appeared first on CryptoPotato