As we enter July, the crypto market eagerly awaits the upcoming move. Bitcoin, the flagship cryptocurrency, has been flirting with the $30.5K mark, a level that has both investors and analysts on their toes. SEC’s recent decline on spot BTC ETF applications has put intense selling pressure, bringing warning signs of an immediate move among investors. The question on everyone’s mind is, “What’s next for Bitcoin?”

$30.5K: Red Flag Or Buying Opportunity In July?

As we venture into the second half of the year, the market trends in July will play a decisive role in shaping Bitcoin’s trajectory. This month’s performance will provide crucial insights into whether Bitcoin can sustain its bullish momentum and achieve its ambitious targets. The next 30 days, therefore, are not just crucial but could potentially send BTC price to a high of $40K or a low of $20K.

The U.S. Securities and Exchange Commission (SEC) initially deemed the ETF applications submitted by various firms as insufficient. However, these firms promptly responded to the regulator’s concerns, sparking discussions within the community. This swift action has led to conjecture that the U.S. could be on the brink of green-lighting its inaugural spot ETF.

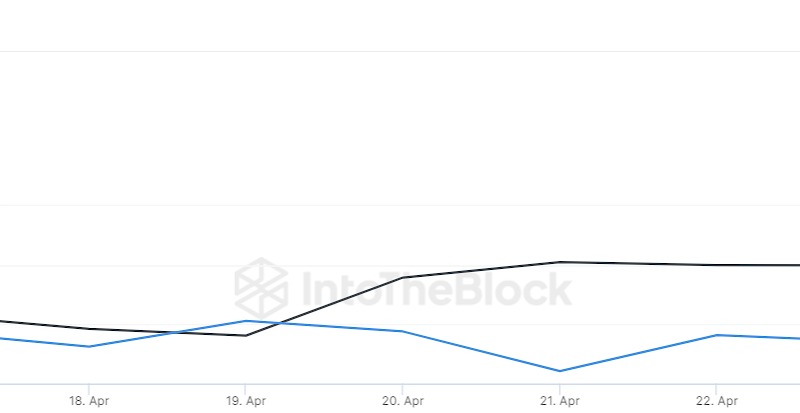

However, miners’ recent BTC movement could impact the price in the near term. As the price continues its upward trajectory, miners have started to transfer significant Bitcoins to exchanges. This transfer currently amounts to an impressive $105 million, marking the second-largest transaction ever made by Bitcoin miners.

This substantial offloading is expected to increase the availability of Bitcoin on exchanges, which could potentially create a downward push on the token’s price in the near future.

Yet, when viewed through the lens of historical trends, July appears even more promising. In its entire history, Bitcoin’s price has never experienced a decline of more than 10% within this month.

What’s Next For BTC Price?

Bitcoin maintains its close consolidation near $30.5K as it continues to face resistance near $30,800. This suggests that while the bears are making every effort to halt the upward trend, the bulls are continuously applying pressure. As of writing, BTC price trades at $30,541, declining over 0.2% in a day.

Typically, a close consolidation near a resistance level results in an upward breakout. The rising 20-day exponential moving average at $30,504 and the relative strength index (RSI) in the positive zone suggest that the upcoming path is toward the North.

If the buyers manage to keep the price above $31,000, Bitcoin’s price could gain momentum and initiate the next phase of its upward trend. A minor resistance exists at $32,500, but it’s likely to be overcome. The price could then make a run for $40,000.

The post appeared first on Coinpedia