Bitcoin’s market reflected signs of recovery in the past week, after being worn down most of December. Although the BTC market cap was still down week-over-week, its estimated hash rate grew by over 10%. However, the hash rate of altcoins like Ethereum [ETH], Litecoin [LTC], and Bitcoin Cash [BCH] dropped by almost 2.9%, with ETH taking the cake for the largest recorded drop of 8.3%, according to data collated by Coin Metrics. Even though it lost 10% of market cap week-over-week, ETH’s active addresses, transaction, and fees reportedly increased week-over-week, indicating its usage remained independent of its market cap.

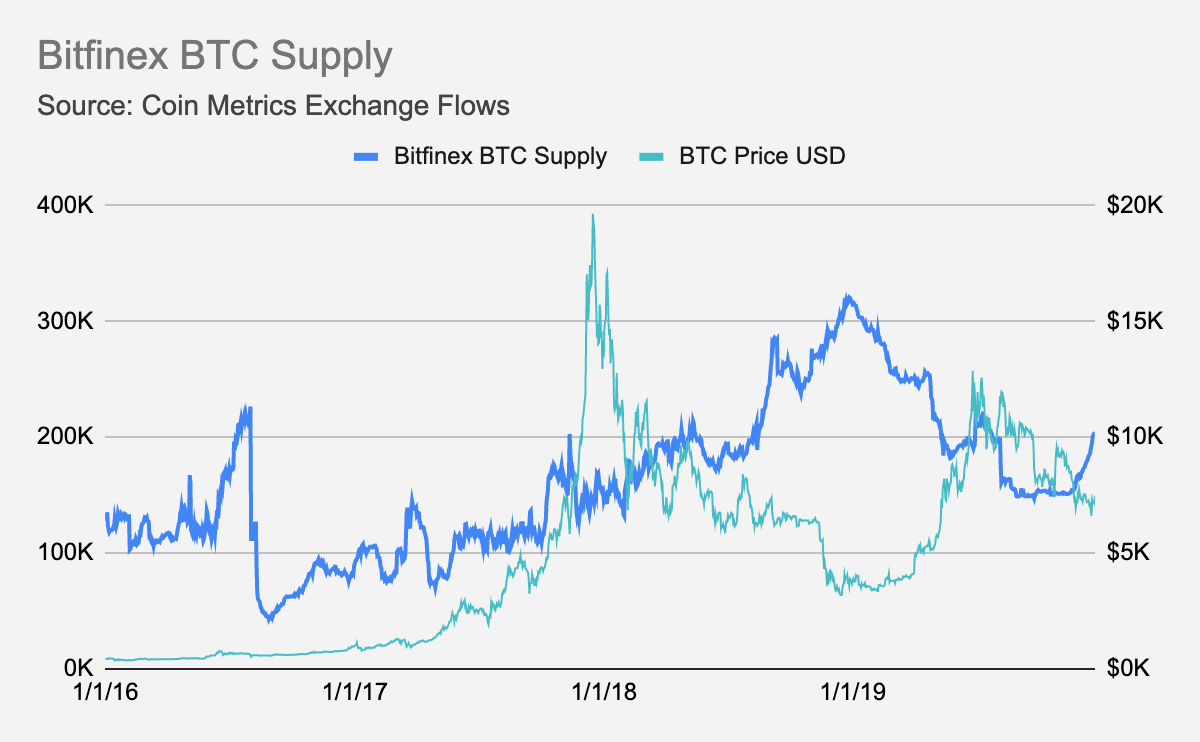

Bitfinex marked a sharp rise in BTC supply over the last month, despite its ailing price. The exchange held 204,150 BTC on 22 December, a spike of almost 30% from its previously recorded data.

Source: Coin Metrics

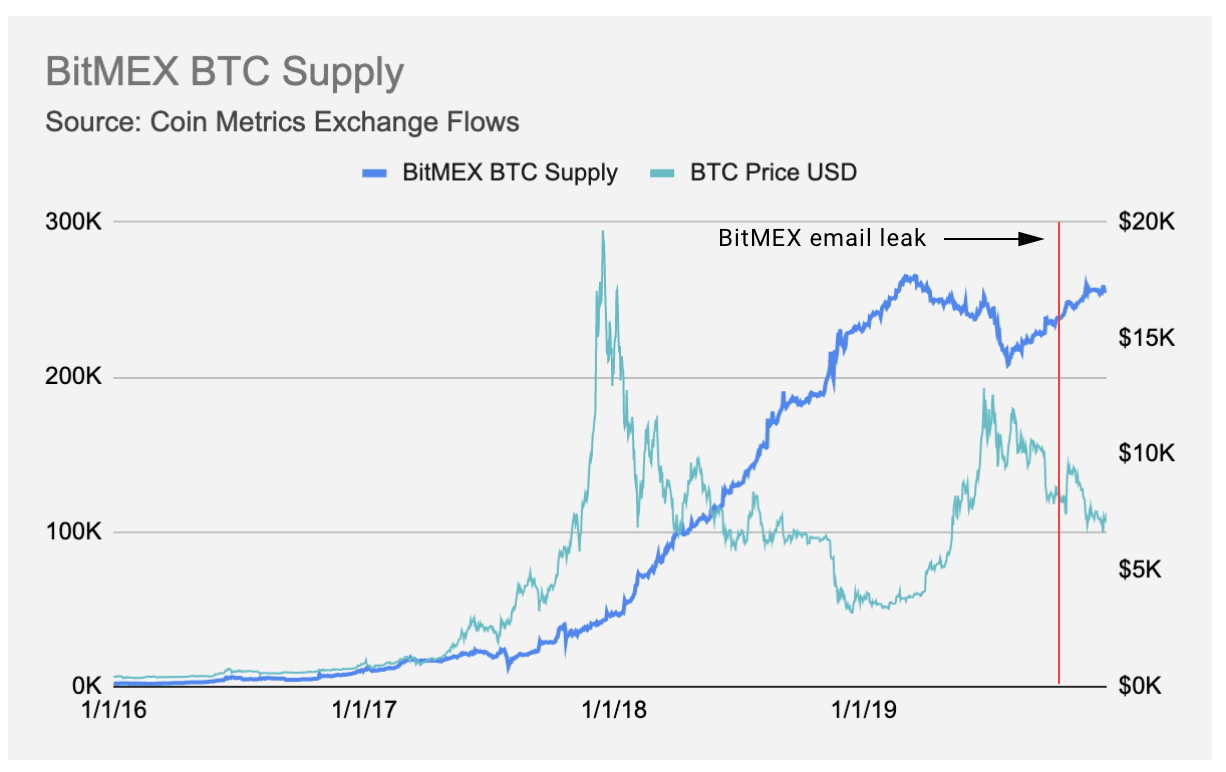

Likewise, BitMEX’s BTC supply also noted a gradual rise over the last month, despite the email leak that exposed 23,000 email addresses of its clients. However, the supply of BTC has increased from 246,937 to 255,741, close to its all-time highs.

Source: Coin Metrics

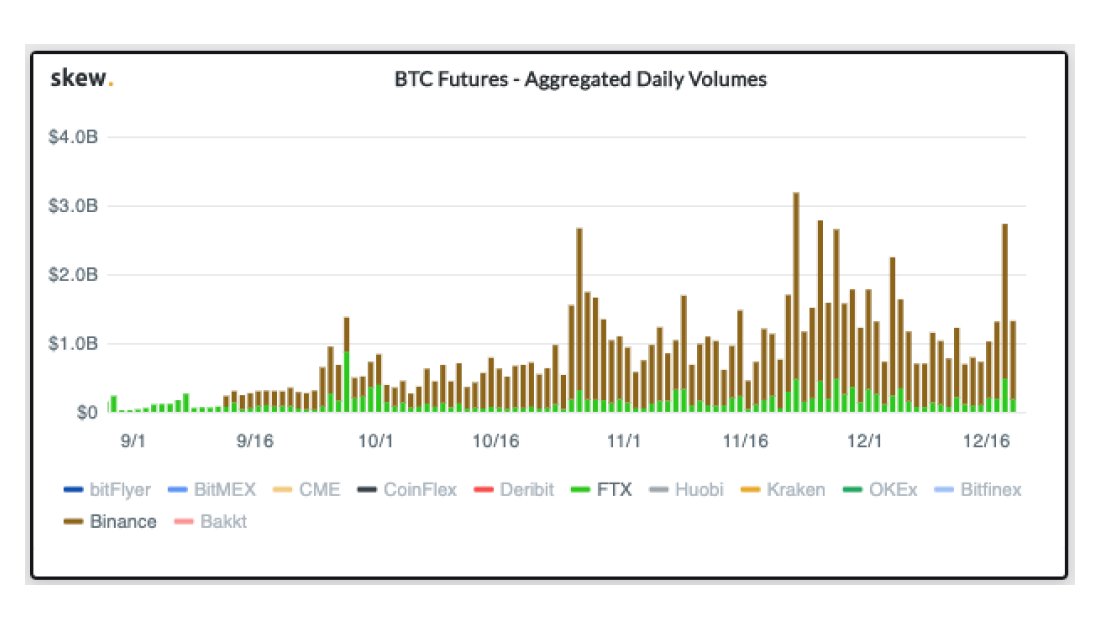

However, the derivatives market is where BitMEX could face major competition from Binance’s recent investment in FTX, a cryptocurrency derivatives platform and one of the largest Bitcoin futures exchanges. According to data provider Skew, FTX reported a daily volume of $500 million on its platform and Binance and FTX together has registered $1 billion in daily volume on a regular basis, in the past quarter.

Source: Skew

FTX and Binance made their entry into the futures market only in 2019, but their strategic partnership has been looked at as a game-changer.

The post appeared first on AMBCrypto