Three days after Celsius imploded on the 13th of July 2022, the CFTC, swiftly followed by the SEC, launched separate investigations into the crypto platform’s business practices.

The company was also investigated – and in some cases sued – separately by local authorities in Vermont, New York, and elsewhere.

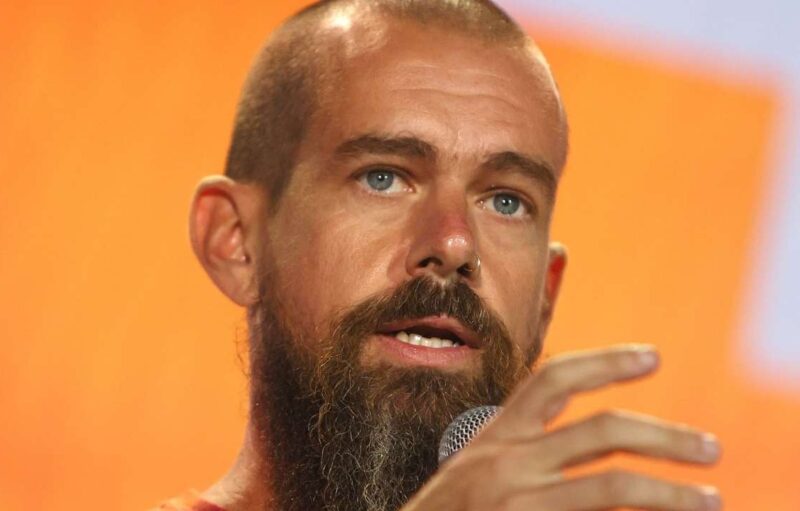

I’m suing the former CEO of cryptocurrency platform @CelsiusNetwork for defrauding investors out of billions of dollars.

Alex Mashinsky lied to people about the risks of investing in Celsius, hid its deteriorating financial condition, and failed to register in New York.

— NY AG James (@NewYorkStateAG) January 5, 2023

Charges brought against Celsius by the CFTC, however, would likely be federal.

Celsius Misled Investors, Says Confidential CFTC Source

The CFTC’s investigation has now concluded, and individuals within the organization have said that both Alex Mashinsky and his platform misled investors and ignored existing regulations, according to Bloomberg.

ADVERTISEMENT

These allegations are aligned with those posited by NYAG Letitia James, who accused Mashinsky of deliberately making false claims regarding his firm’s financial situation to woo investors.

“As the former CEO of Celsius, Alex Mashinsky promised to lead investors to financial freedom but led them down a path of financial ruin. The law is clear that making false and unsubstantiated promises and misleading investors is illegal. […] My office will stay vigilant and ensure that bad actors trying to take advantage of New York investors are held accountable.”

In turn, Mashinsky retorted that the New York Attorney General “fundamentally misunderstood” both Celsius’ business model and the role he played as CEO.

However, the organization itself has so far refused to officially comment on the matter. The sources from within the organization also refrained from specifying which regulations Celsius and Mashinsky broke specifically, outside of failing to register with the relevant authorities.

Lawsuit Possible by the End of July

Now that the investigation has concluded, the CFTC will reportedly host an internal vote on what to do with the information they’ve uncovered.

If a majority of CFTC commissioners agree with the interpretation of the research teams’ findings, a federal lawsuit may be filed against Celsius and, very likely, against Mashinsky himself. According to the confidential source, the gavel may drop no later than the end of July, assuming nobody decides to play devil’s advocate within the Commission.

Should the case be brought before a federal court, it would be the latest in a series of over 85 cases filed by the CFTC concerning digital assets. So far, the agency has been the reason for over $4 billion in penalties and restitutions sourced from fraudulent crypto markets, said CFTC director Rostin Benham.

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

PrimeXBT Special Offer: Use this link to register & enter CRYPTOPOTATO50 code to receive up to $7,000 on your deposits.

The post appeared first on CryptoPotato