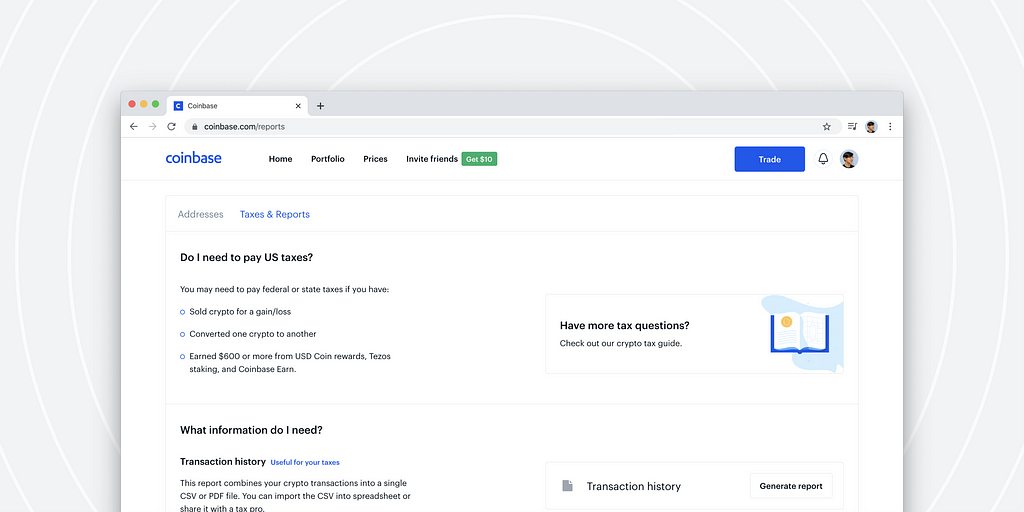

Each year, US taxpayers with taxable crypto events are required to report their gains or losses to the IRS. If you’re a US taxpayer who sold, used, or converted crypto in 2019, you may owe taxes on those transactions. We’ve outlined what to expect from Coinbase and the resources available to you. Our goal is to help all crypto traders better understand crypto taxes by providing tax resources for Coinbase customers as well as the broader crypto community.

What may need to be reported?

If you sold crypto, converted one crypto for another, or received crypto from XTZ Staking Rewards, USDC Rewards, Coinbase Earn, or referrals, these are all taxable events that may need to be reported. You can access your Transaction History report from your Coinbase account to see the transactions you made in 2019.

What forms will Coinbase provide?

For 2019 tax reporting, only some segments of Coinbase users receive paperwork from Coinbase during tax season:

- Coinbase.com customers will only receive an IRS Form 1099-MISC if they have received a total of $600 in earnings or more from Coinbase Earn, Staking Rewards, and USDC Rewards.

- Coinbase Pro and Prime customers who meet a threshold of more than $20,000 in gross proceeds and 200 transactions in 2019 will receive an IRS Form 1099-K; so will customers on those platforms who meet lower thresholds in AR, DC, MA, MS, NJ, and VT (more information here).

Learn more

To learn more about US taxes on cryptocurrencies, check out our 2020 Crypto Tax Guide. For more on Coinbase tax information reporting or our partnerships with TurboTax and CoinTracker, check out our Tax Help Center.

Coinbase customers can get a discount to TurboTax products using this link, and take advantage of CoinTracker for free if they have 200 or fewer transactions here.

Our goal is to be the easiest-to-use cryptocurrency platform by providing the tools and resources that help customers approach tax season with confidence.

Disclaimer: Coinbase does not provide tax advice and this blog should not be viewed as such. For questions relating to your specific situation we strongly recommend speaking with a tax professional.

Coinbase resources for 2019 tax returns was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

The post appeared first on The Coinbase Blog