During the past 24 hours, Bitcoin tanked to $15,100, but it has recovered since then and trades around $15,400. Most high and mid-cap altcoins have outlined substantial gains and have reduced BTC’s dominance to below 64%.

Bitcoin Price Slides But Recovers

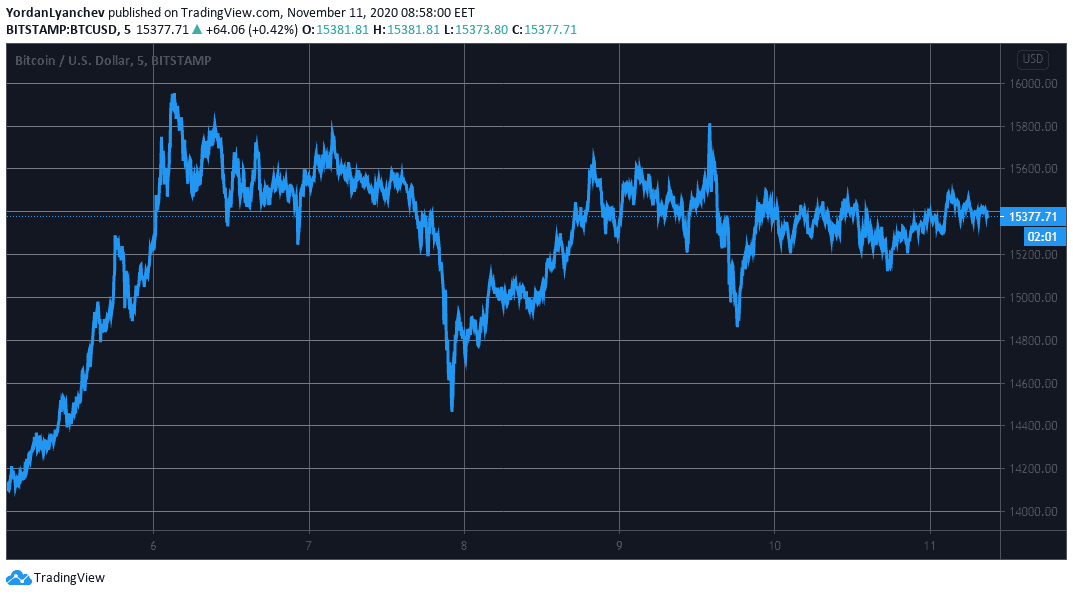

After peaking at nearly $16,000 last week, Bitcoin has struggled with maintaining such a high price tag. It dropped below $14,300 a few days after, but managed to initiate a false breakout towards $15,800 when news broke that Pfizer’s COVID-19 vaccine has worked successfully in 90% of trial cases.

Nevertheless, the primary cryptocurrency slumped once more to below $15,000 just hours after. It reclaimed the $15,000 mark on November 9th and hasn’t looked back since.

In the past 24 hours, the asset slipped briefly to $15,100. However, the bulls quickly took charge and sent it to its current level of about $15,400.

The technical indicators suggest that BTC would have to conquer the resistance lines at $15,600 and $15,800 before potentially challenging the year-to-day high at $16,000.

Alternatively, BTC could rely on $15,200, $15,000, and $14,900 in case another price dip arrives.

Altcoins In Green: DeFi Tokens Explode

Most alternative coins have been soaring in the past 24 hours. Ethereum has increased by 3% and trades slightly above $460. Thus, ETH’s impressive performance since the US Presidential election day continues. The second-largest cryptocurrency traded at $370 on November 3rd and has gained nearly 25% in a week.

Ripple has jumped by 2%, but XRP still sits beneath $0.26. Chainlink (3%), Polkadot (3%), and Litecoin (2%) have also increased in value. As a result, LINK sits above $13, Polkadot is at $4.5, while LTC has neared $60.

Even more impressive performances come from lower-cap altcoins and especially DeFi tokens. Loopring is the most notable gainer in the past 24 hours, with a 26% surge. UMA (19%), SushiSwap (16.5%), Compound (14%), Celo (13%), Reserve Rights (13%), Ampleforth (12%), Kyber Network (10.5%), Yearn.Finance (10%), and Uniswap (10%) complete the double-digit price gainers.

With the increases among the altcoins and BTC’s static performance on a 24-hour scale, Bitcoin’s dominance has suffered. The metric comparing BTC’s market capitalization against all alternative coins has fallen to 63.8%. Only a few days ago, it hovered above 66%.

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato