2019 created many regulatory hurdles for crypto-businesses, mainly exchanges. Binance had to temporarily shut shops in the United States to comply with the regulatory norms, and soon launched its Binane U.S. platform to serve the customers in the country. However, Binance became a trendsetter, as many exchanges followed its lead and launched its own exchange tokens, IEO platform, and blockchain.

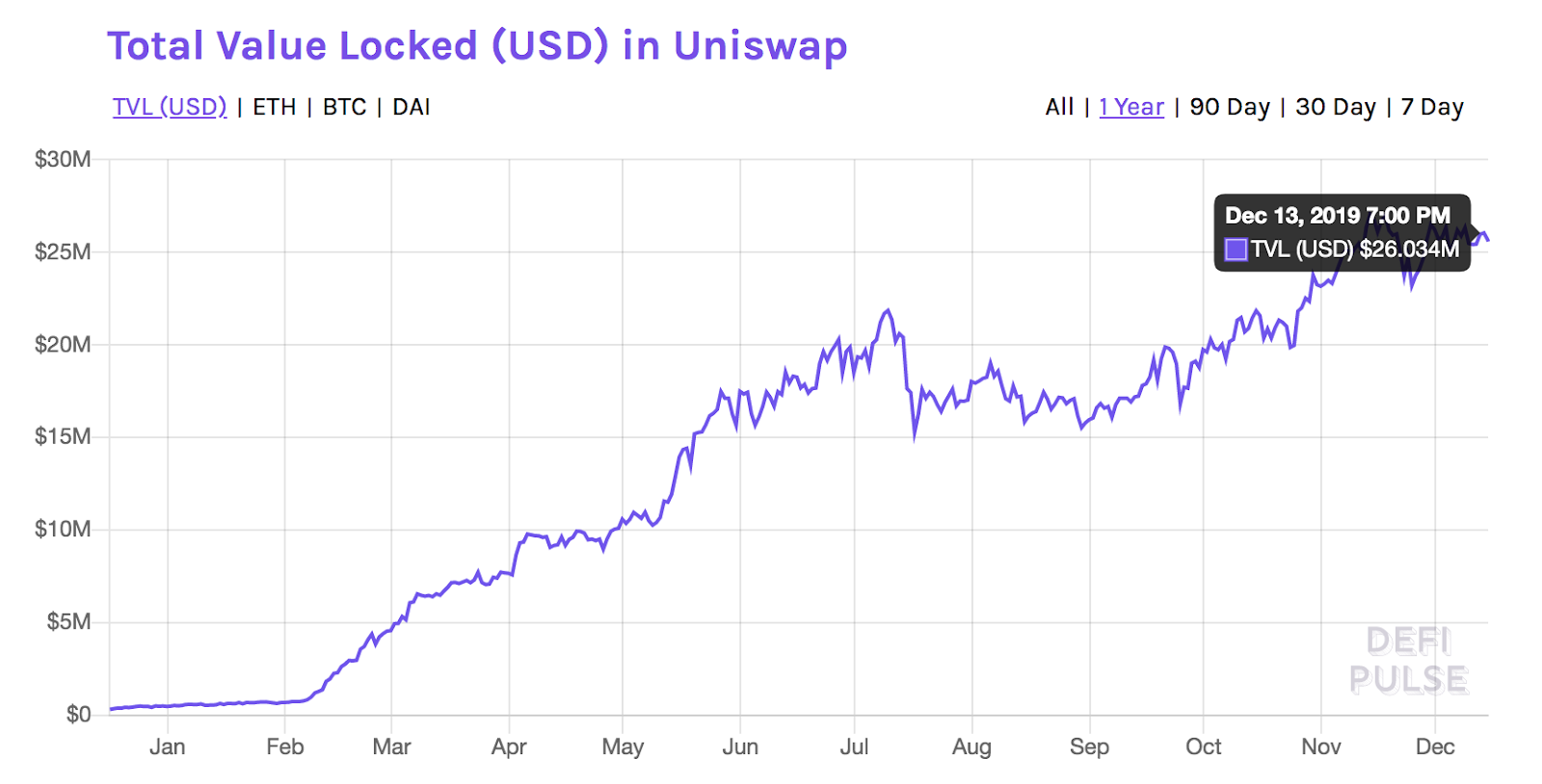

However, exchanges are governed by the liquidity it provides and the same is true for decentralized or centralized exchange. This logic was re-enforced by P2C [Peer-to-contract] models like Unisawp. Being an automated market maker, Uniswap enabled anyone to get paid in exchange for depositing capital into a shared liquidity pool.

The recent report from Messari explained:

“The P2C model is particularly effective because it removes the need for a counterparty along with the associated complexity of providing liquidity to a decentralized order book. That’s why Uniswap is thrived at a time when P2P models were sucking wind.”

Source: DeFi Pulse

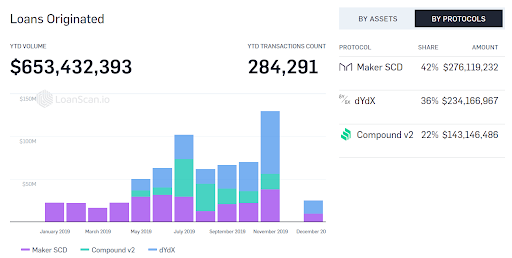

Apart from solving the liquidity troubles, 2019 marked a growth market in lending, especially in DeFi. According to the data provided by Messari, “DeFi protocols originated $650 million in loans, with $450 million currently locked up as collateral and ~$75 million in loans outstanding.”

Source: Messari

Even though collateralized lending acted as a start, it is not the feature that a new financial system can be built upon. The DeFi lending equation has a void that needs to be filled with better-decentralized identity and credit scoring apps, noted the report. Looking hopefully to the coming year, the report by Messari CEO, Ryan Selkis remained positive about the “Continous Organizations” and opined that it could be similar to 2019’s Unisawp of ICOs.

The post appeared first on AMBCrypto