Bitcoin has recouped from yesterday’s dip to below $11,200, but most altcoins are significantly outperforming the primary cryptocurrency. Several impressive price increases, including new all-time highs for Chainlink and Tezos, have reduced Bitcoin’s dominance to below 60%.

Altcoin Wild-Ride Continues With LINK and XTZ At ATH

As CryptoPotato reported yesterday, 24 hours ago, the entire market lost about $20 billion of its capitalization after a violent retrace from most coins. Today, however, the situation appears much greener with some notable increases.

First and foremost, Chainlink has registered yet another ATH. LINK has been dominating the market lately and frequently charts a price higher than the previous top. During yesterday’s price dip, LINK dropped to $12.5, but it pumped by almost 40% to its fresh ATH of nearly $17 (Binance).

Tezos is another impressive gainer, which has followed LINK’s footsteps. XTZ reached $4.4 a few days ago, but it dropped rather quickly to $3.6. Yet, bulls didn’t allow it to stay long beneath $4 and pumped the price to its new high of $4.5 (on Binance).

The most notable gainer in the past 24 hours, however, is Numeraire (NMR). The native cryptocurrency coming from the hedge fund company Numerai has skyrocketed by over 150%, mainly because the largest US-based exchange Coinbase announced listing the asset.

Aragon has also exploded by nearly 90% since yesterday, after the leading cryptocurrency exchange Binance said it would add it on its platform.

BitShares (42%), XinFin Network (40%), IRISnet (34%), Swipe (32%), Algorand (27%), Waves (25%), Band Protocol (21%), Bancor (20%), are also part of the double-digit increase club.

Very few coins are retracing against the dollar today – JUST is down by 2.5%, while Aave loses 1% of its value.

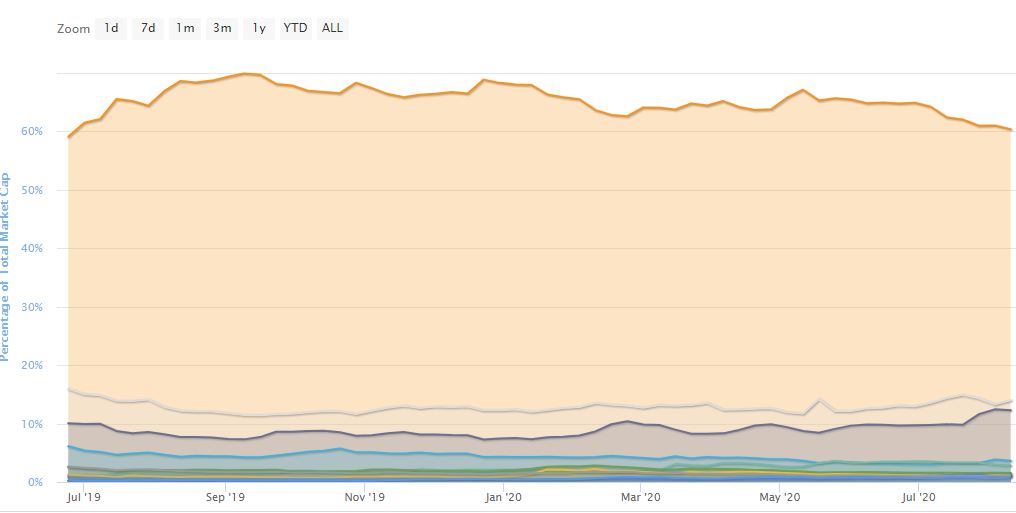

Bitcoin’s Dominance Below 60%

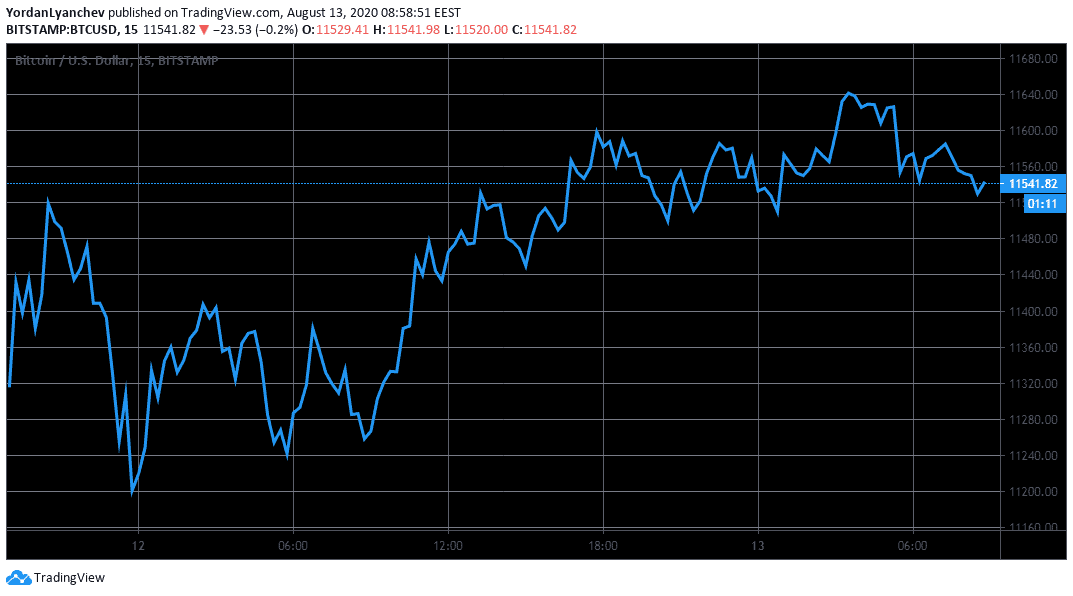

The primary cryptocurrency is also in the green today since it bottomed below $11,200 yesterday and has recovered to the $11,500 area at the time of this writing.

Interestingly, Bitcoin’s performance continues to resemble that of the two most popular precious metals and safe-haven assets – gold and silver. The increased correlation between the two asset classes was evident again during the last 24 hours as gold and silver have also recovered to some extent, following a few consecutive days of price losses.

However, Bitcoin’s 2% increase since yesterday can’t compete with the massive price pumps among most altcoins. Consequently, the metric comparing BTC’s total market cap against all other coins has decreased. According to data from CoinMarketCap, for the first time since July 2019, Bitcoin’s dominance has dropped below 60% to 59.5% as of writing these lines.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato