A recent report compiled by Santiment revealed that the number of Bitcoin whale addresses had been gradually increasing in the past few years. The growing accumulation levels and HODLing mentality could reduce the impact of short-term bearish developments and pump BTC in the long-run.

Bitcoin Whales At ATH

BTC whales are considered individuals or organizations holding at least 1,000 bitcoins in one address. According to Santiment’s report shared with CryptoPotato, the number of such addresses has recently marked a new all-time high.

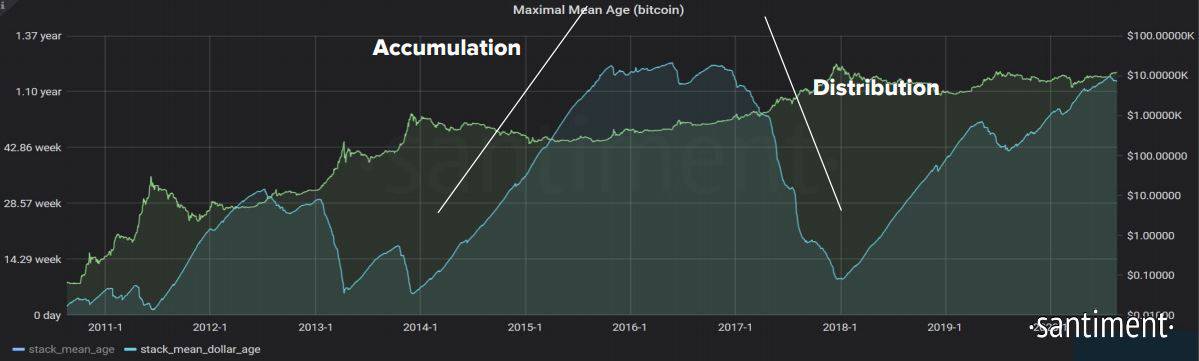

As illustrated in the above chart, BTC whales were accumulating and HODLing prior to the 2017 parabolic price increase. However, as the prices started tumbling, whales began disposing of their coins.

The trend reversed when Bitcoin’s price bottomed at below $4,000 in late 2018. Since then, the number of addresses containing 1,000 BTC or more has been continuously increasing to its current level of 2191. The report noted that most recently, whales began purchasing even more at the end of May 2020, shortly after the third halving.

“The recent uptrend implies that – despite uncertain market conditions – large HODLers seem to be confident about Bitcoin’s near and mid-term price potential.”

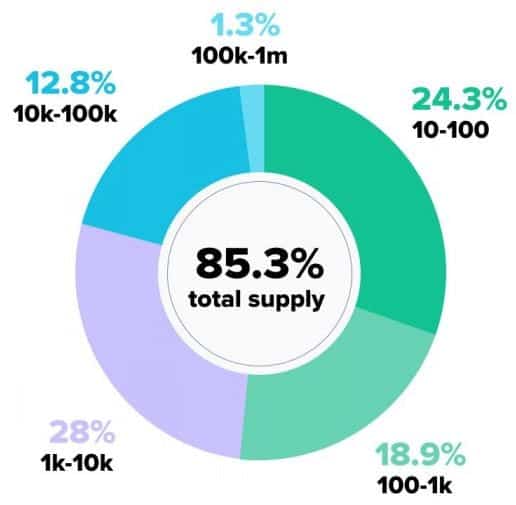

Although Santiment indicated that retail Bitcoin investors have dramatically increased since 2015, they are still responsible for less than 15% of the entire BTC supply. The remaining 85.3% is distributed among addresses with at least 10 BTC to even 1 million coins.

Similar whale-dominated behavior is also evident among altcoins, Santiment noted. “Out of 855 assets that we track on-chain data for, 727 have >50% of their total supply located in the top 100 addresses.”

HODLing Cycles And Possible Price Effects

Sentiment brought out a metric dubbed Mean Dollar Invested Age (MDIA), which suggests an ongoing HODLing cycle that started in the summer of 2019. MDIA “shows the average amount of days that all coins stayed in their current addresses, normalized for the amount of ‘dollars’ spent to acquire each coin.”

The company noted that so far, the MDIA metric has “caught every major BTC cycle.” If the MDIA is rising, as it is now, it signals a “network-wide accumulation trend,” and vice-versa.

However, Santiment warned that the metric had reached somewhat of a plateau in the past 30 days, indicating gradual profit-taking among some long-term HODLers. Such sell-offs could lead to a sharp price decline, as it happened recently when Bitcoin slumped from above $12,000 to $10,000 in 48 hours.

Apart from similar short-term price effects, whales could impact BTC’s price for the better on a macro scale. The more they accumulate bitcoins, the less available supply is left for trading and newly-coming investors. By assuming that the demand remains the same, “whale accumulation can prop up BTC price and weaken the impact of otherwise bearish trends.”

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato