On-chain analytics provider Santiment has reported that there has been a decline in unique addresses interacting on the Ethereum network, particularly since mid-September. Both August and September witnessed spikes in address activity, primarily driven by new DeFi yield farming opportunities from the likes of Uniswap.

🤔 $ETH‘s daily active address metric is still revealing that there is still plenty to be desired since its peak in late July. There has been a decline in unique addresses interacting on the #Ethereum network, particularly since September 17th. https://t.co/MA6YkdGYlz pic.twitter.com/6FfOaVjMBY

— Santiment (@santimentfeed) October 11, 2020

As DeFi markets have started to cool off, the impact on Ethereum usage can clearly be seen. Total value locked across all DeFi platforms remains high at almost $11 billion but the food farming frenzy and gas-guzzling yield hopping appears to have abated.

With lower activity on ETH addresses, demand for network usage has declined and that is good news for gas prices.

Gas Prices Tanking

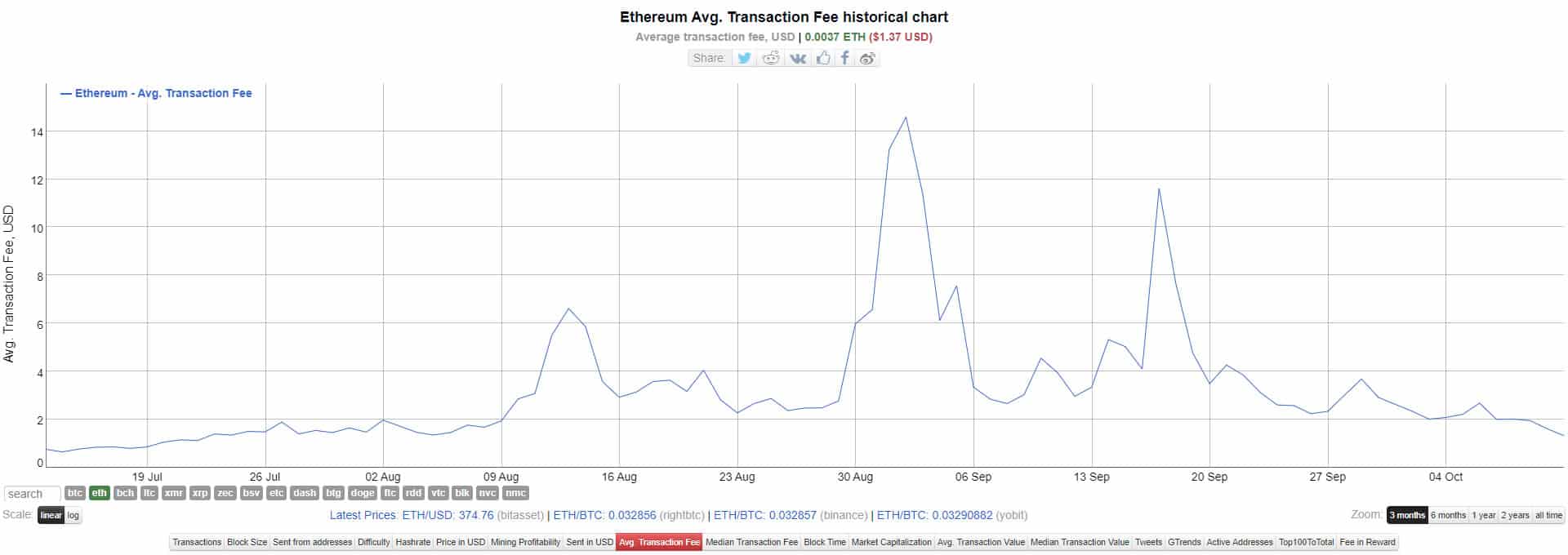

According to bitinfocharts.com, ETH gas prices have plummeted 91% since their all-time high on September 2. The date and resultant gas spike can be correlated to the SushiSwap frenzy which resulted in over a billion dollars in collateral being moved from Uniswap to the DeFi fork.

The second spike came on Sept. 17 when Uniswap launched its four ETH liquidity pools and UNI mining incentives, along with that huge airdrop. Both times, average transaction fees spiked to double digits and those wanting to rush transactions through were forking out as much as $50 for the privilege.

Today, average transaction prices have fallen back to almost normality at $1.33, roughly where they were in late July before the DeFi food frenzy took off.

ETH Gas Station reports the standard gas price being at an acceptable 40 gwei with high-speed transactions for 50 gwei. Uniswap is still the largest consumer of gas with $12.7 million processed over the past 30 days.

ETH Price Outlook

Prices for the asset itself have been bullish over the weekend with ETH topping out at $377 according to Tradingview.com. Ethereum gained 12% since its low last week of $335 and has returned to prices last seen over three weeks ago.

Logan Han, a leading trader on Binance, predicted that Ethereum prices will continue to climb in the short term and surpass its all-time high in 2021.

same feeling $eth pic.twitter.com/W65AAohVG2

— loganhan (@loganhan_) October 11, 2020

If current levels turn to support, ETH could quite easily reach $400 again very quickly. The primary catalyst for any major moves this year will be the mainnet launch of Beacon Chain which, according to developers, is not that far away now.

The post appeared first on CryptoPotato