The market is experiencing a buying demand, reaching a total value of $1.45 trillion. The sentiment of greed is a dominant factor in this rise. Recently, Bitcoin attempted to break through the $38,000 mark but was unsuccessful. Despite this, there’s a noticeable trend of continuous growth efforts and a reduction in significant pullbacks from recent highs. Moreover, Ethereum has successfully sustained its value above $2,100, opening more long positions.

Fear And Greed Index Surges

According to data from alternative.me, the Crypto Fear & Greed Index has surged to 66, which shows a ‘greed’ sentiment. This index, which operates on a scale from 0 to 100, applies a variety of metrics such as market momentum, volatility, trading volume, and social media activity to analyze the market sentiment surrounding Bitcoin and altcoins.

As Ethereum (ETH) has long struggled to stay above $2,100, the recent price surge, following Bitcoin once again reaching the $38K level, has brought relief to long-position holders. Data from DappRadar notes that Ethereum-based decentralized applications (DApps) reached a total value locked (TVL) of $49.5, indicating a 7.1% rise from the prior week.

Although Ethereum’s market cap, at $253 billion, is less than Bitcoin’s $741 billion, both networks are generating comparable revenue from protocol fees. In the last week, the Bitcoin network collected $58 million in fees, closely followed by Ethereum, which collected $54 million.

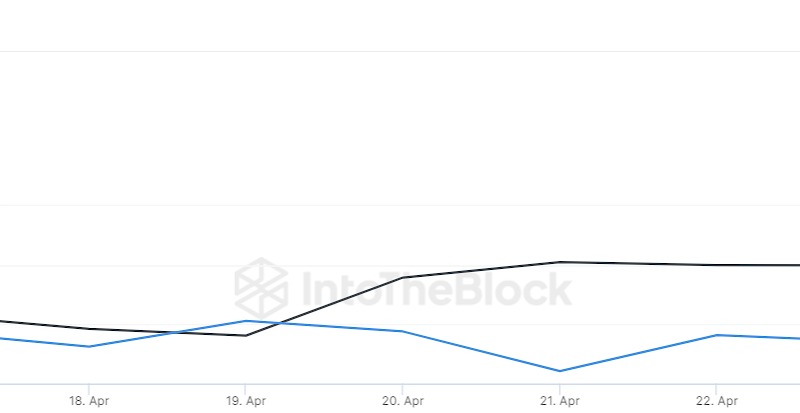

Ethereum is maintaining a strong transaction count, consistently surpassing 1 million transactions, indicating a steady confidence among its users. Additionally, there is a surge of 34% in whale activity, which is boosting confidence among futures position holders. The long/short ratio has climbed to 1.1459, with 53% of positions expecting an uptick in ETH’s price. However, there remains a possibility of a trend reversal, which could eliminate the current bullish sentiment.

What’s Next For ETH Price?

Ethereum is currently facing resistance around the $2,133 mark. Notably, the bulls have been successful in maintaining the price above the 20-day exponential moving average, a positive sign. As of the latest update, the price of Ethereum (ETH) is $2,096, reflecting a 1.79% increase from the previous day’s value.

The trend in moving averages and the relative strength index (RSI) being in positive territory suggest that the momentum is in favor of the bulls. If Ethereum can break through the resistance at $2,180-2,200, there’s a potential for the price to climb towards $2,500. However, this level might also attract heavy selling from bears. A bearish indicator would be if the price falls below the 20-day EMA, which could lead to a period of sideways movement, possibly keeping the price fluctuating around $1,860.

If the price drops again from $2,130, it may consolidate just under $2,100. This scenario could weaken the resistance level, possibly leading to a breakout in the coming hours.

The post appeared first on Coinpedia