Following the deployment of the Dencun upgrade at 1:55 PM UTC today, the Ethereum market encountered resistance in sustaining its position around the $4,100 mark, triggering a selling wave. Consequently, the price of Ethereum dipped beneath Fibonacci retracement levels, losing the key milestone of $4,000. Presently, market sentiment for Ethereum is shifting towards a bearish outlook, triggered by various on-chain indicators that suggest a potential further downturn in its price.

Ethereum Triggers Selling Pressure

The Dencun upgrade was successfully implemented on the Ethereum mainnet at 1:55 pm UTC on March 13. As the most eagerly awaited hard fork since the Merge, Dencun is anticipated to notably decrease transaction fees on layer-2 networks while also improving Ethereum’s scalability as a whole.

The introduction of Dencun arrives almost a year following the Shanghai upgrade in April 2023. This previous update allowed network participants to unstake their Ether for the first time since the network’s transition to a proof-of-stake model after the Merge.

However, the introduction of the Dencun upgrade has triggered a sell-off in the market, as investors have started to liquidate their positions. Moreover, the current mood among Ethereum traders is increasingly bearish, hinting at a potential downtrend.

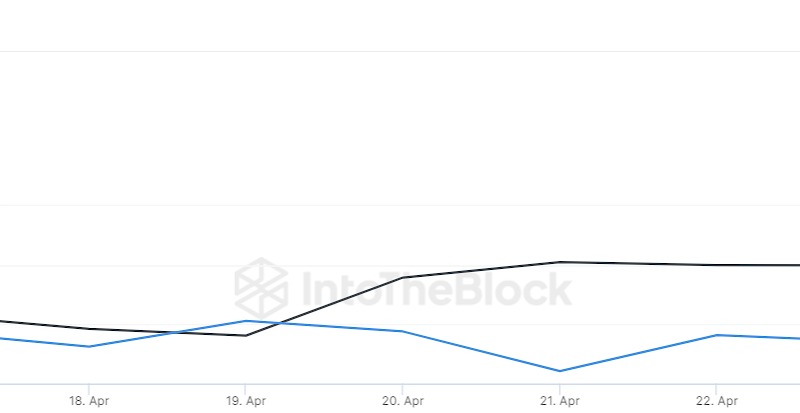

Data from IntoTheBlock shows a significant rise in the Netflow metric for Ethereum, with trading volumes hitting 85.29K ETH. This development suggests that the inflow of Ethereum to exchanges is surpassing the outflow, resulting in a buildup of reserves on these platforms. This pattern highlights the growing possibility of an upcoming downward adjustment in prices.

Additionally, the one-month call-put skew for Ether, indicating market mood in options trading, has moved to negative, showing a preference for put options that protect against price drops. This trend is also seen for the 60-day period, but the 90-day and 180-day outlooks remain positive, according to Deribit data tracked by Amberdata. Additionally, QCP Capital noted a slight reduction in ETH spot-forward spreads, unlike the wider spreads in Bitcoin markets, hinting that a significant fall in ETH prices could lead to tighter forward spreads due to the liquidation of leveraged long positions.

What’s Next For ETH Price?

Buyers failed to hold the ETH price in a buying demand as sellers strongly defended the $4,100 level. As a result, ETH price declined below immediate Fib channels and lost its key milestone of $4,000. However, buyers continue to accumulate during pullbacks, defending the support lines.

If the price again surges above the significant $4,000 threshold, it might pave the way for a potential rise to $4,500, which may pose a minor challenge. Nevertheless, breaking through this barrier could send the ETH/USDT trading pair toward the $4,900 mark.

The recent sharp decline has pushed the Relative Strength Index (RSI) toward the midline, indicating that traders should proceed with caution. For sellers to intensify the ongoing bearish momentum, they need to drive the price below the 20-day Exponential Moving Average (EMA). Achieving this could lead to a corrective phase for the altcoin.

The post appeared first on Coinpedia