Disclaimer: The findings of the following article should not be taken as investment advice and the same should materialize within the next 24-hours

After clocking in a value of $307 on 5 September, Ethereum’s recovery over the past 36 hours has been strong. On 6 September at 21:00 UTC, a local top at $360 was registered, before ETH underwent another period of correction on the charts. Continuing to hold a higher range in valuation, Ethereum was valued at $343, at press time, with the cryptocurrency registering a market cap of $38 billion.

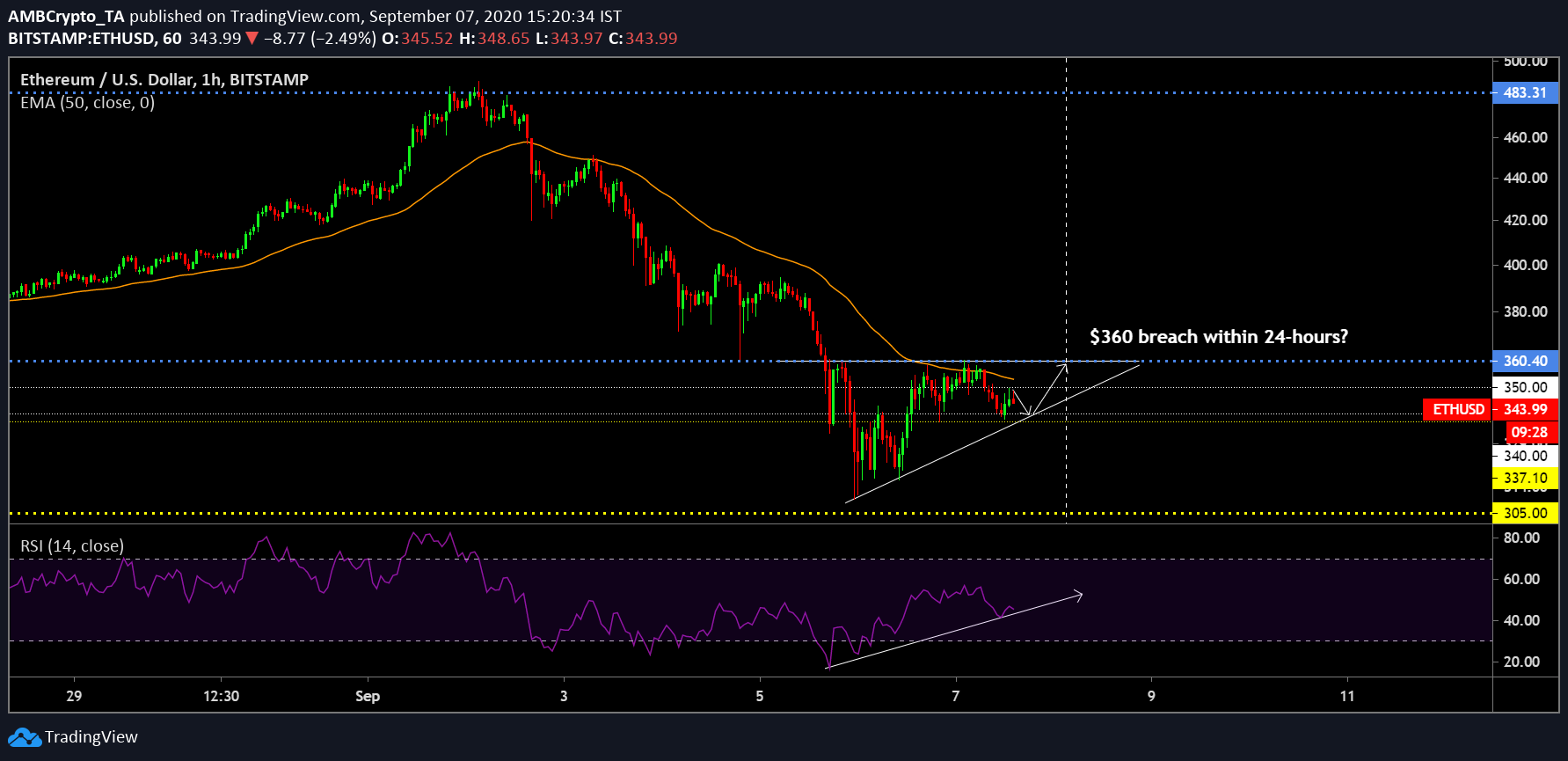

Ethereum 1-hour chart

Source: ETH/USD on TradingView

With bearish pressure slowly subsiding on Ethereum’s 1-hour chart, ETH’s immediate resistance was identified to be $360, at the time of writing. Acting as a strong re-test range since 5 September, its strength was yet to adjust, according to the market, but at the time of writing, its movement within an ascending triangle was indicative of a possible bullish breakout. However, a re-test did take place at the minor resistance of $350, and a possible retracement to $337 may be on the cards. If the price falls under $330, the pattern will be invalidated.

The bullish divergence between the Rising Relative Strength Index and ETH’s price movement is a plus for a bullish move, but the 50-Exponential Moving Average was marking out a strong overhead resistance at the $350-level.

Ethereum 30-min chart

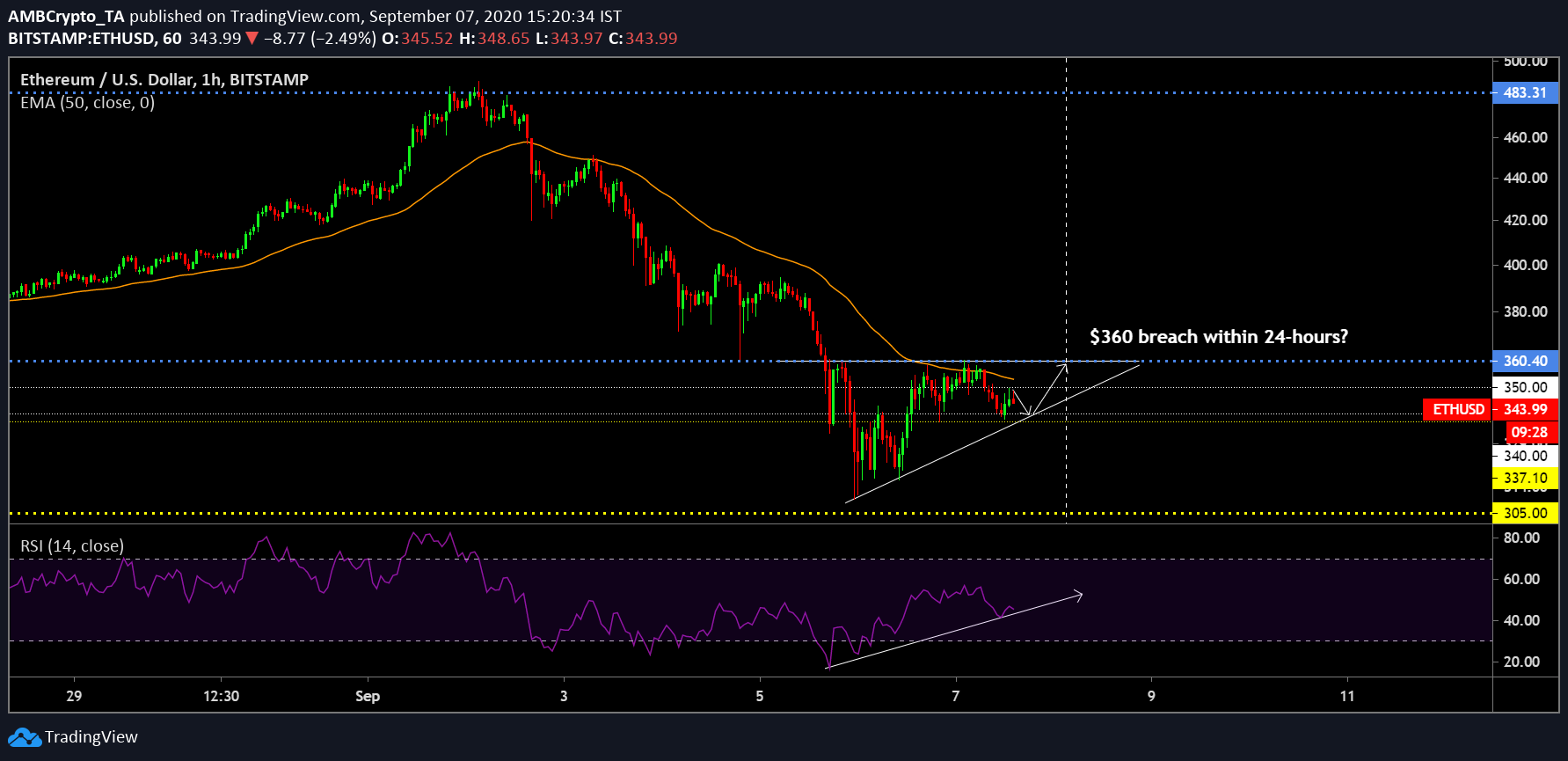

Now, if the breakout in question for the cryptocurrency were to be bullish, an entry for a long position can be estimated at the lower side of the nearest support. The trade can be opened at $336, while keeping a steep stop loss at $327, if the pattern is dismissed.

A take profit margin should be kept at $360, just in case, there is another re-test towards the south of the resistance. The $360-mark should be met by Ethereum over the next 24-hours.

Conclusion

Ethereum is likely to test its resistance at $360 over the next 24-hours.

The post appeared first on AMBCrypto