The first signs of decoupling became evident during yesterday’s trading session as the most prominent US indexes market 1-2% gains, while Bitcoin refused to follow and remained firmly in its $9,100 – $9,300 range.

On the other hand, the altcoin market sees lots of double-digit price increases and has reduced BTC’s dominance to 62.3%.

News Of Vaccine Pump The Stock Markets

Despite initial retreats in the stock market, the three large US-based indexes closed yesterday’s trading session in the green. The S&P is up by 1.34% and is touching 3,200, Nasdaq increased its value by 1% to 10,488, and the Dow was the most significant gainer with over 2% to 26,642.

The climb continued for the futures contracts after the closing bell. The reaction came after the US biotech company Moderna said it had developed a coronavirus vaccine, which produced antibodies in all patients during the early trials.

Consequently, the Dow Jones futures jumped by 265 points, and the futures of the S&P 500 and the Nasdaq 100 followed the upward movement. According to Michael Yee, a managing director at Jefferies, the optimism from the latest vaccine should prompt further price increases in the stock markets.

BTC Decouples?

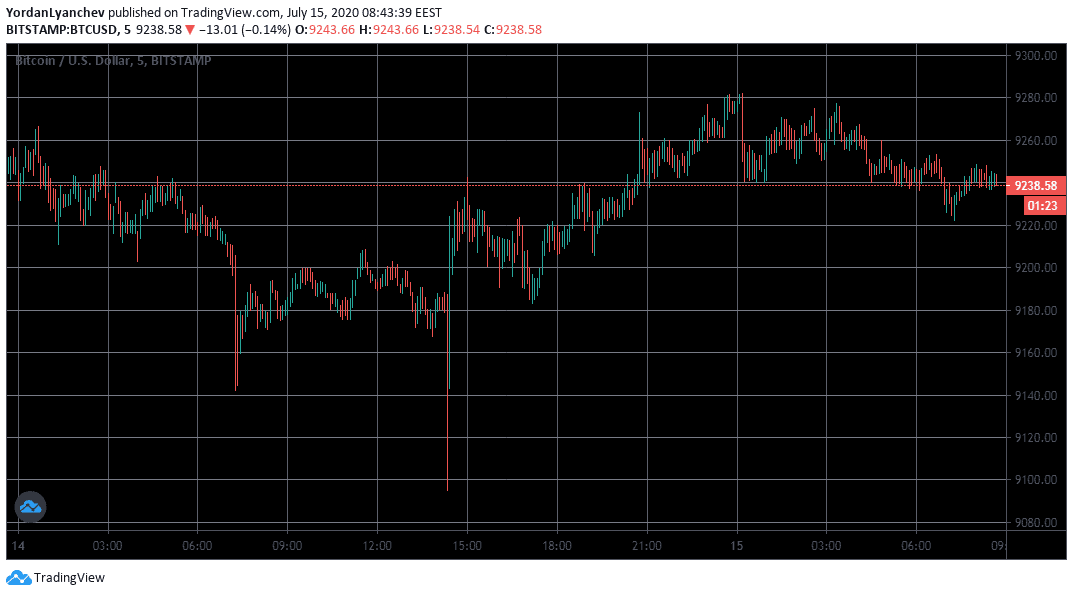

Bitcoin has charted similar price movements with the stock market indexes lately, hence increasing the correlation levels. Nevertheless, while the indexes mentioned above closed yesterday’s trading session in the green, Bitcoin’s 24-hour price development was somewhat different.

Not only BTC didn’t mark any notable gains, but it actually briefly dipped below $9,100 before going back up to $9,280 where it got rejected. At the time of this writing, Bitcoin finds itself at $9,240. This missing volatility lately and the fact that the Bollinger bandwidth has constricted to its lowest value since November 2018 scares the community that a BTC crash is right around the corner.

If a drop indeed comes, the primary cryptocurrency can rely on the psychological line at $9,000 to serve as support, followed by $8,600 and $8,400. Alternatively, should Bitcoin break out its nemesis resistance at $9,300, the next ones are at $9,600 and $9,800.

Altcoins Don’t Sleep

The altcoin market hasn’t disappointed in terms of price actions lately, with Chainlink being amongst the most notable representatives. Two days ago, LINK reached its ATH at $8,48, yesterday retraced heavily towards $7, but the bullish fluctuations continued today. The asset rises by 13% and is again trading at around $8.

Nevertheless, other alternative coins are registering more impressive gains today. Kava is at the top with a surge of 23% to $2.05 after news from Kraken that it will list it tomorrow.

Ontology announced becoming a partner of Google yesterday, and its native cryptocurrency ONT feels the effects today by an increase of 14%. Waves and Synthetix Network mark similar gains as well.

These massive price jumps amongst most altcoins have reduced Bitcoin’s dominance over the market. The metric has been declining steadily for weeks, and it now dipped to 62.3%, according to CoinMarketCap. This is the lowest point it has been in over a year.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato