As the second week for crypto trading began, the market slammed the bullish hopes of traders after bringing remarkable surges for over the past few weeks. Major cryptocurrencies including Bitcoin (BTC), Ethereum (ETH), and Solana’s SOL, along with other significant altcoins, were hit by bearish volatility and opened in a downtrend. Despite massive long liquidations, Injective experienced a notable surge instead of declining like others, suggesting potential for further upward movements.

No Address Is Facing A Loss

Over the last 24 hours, the crypto market witnessed a total liquidation of nearly $400 million as Bitcoin lost 10% of its value, touching the low near $40K. Despite this, altcoins including Avax, Injective made a surprising surge. Injective price recorded a surge of nearly 22% so far.

Data from Coinglass reveals that the price of INJ underwent a significant sell-off totaling $2.3 million. This sell-off included the liquidation of bearish positions amounting to nearly $1.3 million. Consequently, resistance levels have weakened, and presently, no addresses are facing losses.

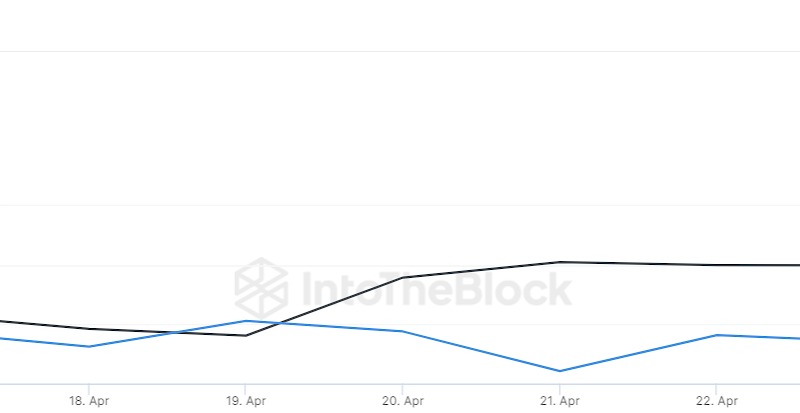

According to IntoTheBlock, there’s a significant increase in the number of profitable addresses following INJ’s surge to a 2.5-year peak. At present, 97% of all addresses, totaling 20.3 thousand, are experiencing profits. Remarkably, there are no holders incurring losses, with the remaining 3% of addresses neither gaining nor losing.

The current trend suggests a bullish outlook for INJ’s price, as holders may accumulate more to maximize their investment returns. Yet, the liquidation of $1 million by early holders today poses a bearish risk to INJ’s upward trajectory.

It’s often observed that a decline in Bitcoin’s value can push the altcoin market cap, as investors shift their focus to major altcoins to continue profit-making. Conversely, a rise in Bitcoin’s price could draw short-term investors back, leading to a slight correction in the altcoin market.

What’s Next For INJ Price?

Injective price has been encountering resistance around $24, yet the bulls have maintained their position against the bears. This indicates that the bulls are still dominant in the market. Currently, INJ price is trading at $22.8, surging over 21% from yesterday’s rate.

The bulls are anticipated to continue their efforts to send the price towards the upper resistance at $25. At this price point, it’s expected that the bears will engage in aggressive selling. Additionally, the RSI being overbought signals a potential short-term risk of either a correction or a period of consolidation. If INJ breaks its ATH, we might see more gains in the coming weeks.

On the downside, the first level of support is at the 20-day EMA. Should this support level be breached, the INJ price could test the crucial support at $17. It is expected that buyers will aggressively defend this level, as the next support level is significantly lower at $14.

The post appeared first on Coinpedia