Although the altcoin market remains highly volatile, most price movements in the past 24 hours have been sharp retraces with a few exceptions.

Bitcoin, on the other hand, remains stable and hasn’t left its familiar trading territory of about $9,150-$9,200. In the traditional financial markets, the three largest US indexes are in the green as Nasdaq even tops a new all-time high.

ATH For Nasdaq, Bitcoin Metric Suggests A Price Dive

More speculations and promises for a new coronavirus vaccine pumped stocks higher on Monday. Amazon’s (AMZN) 8% increase to 3,200 also helped Nasdaq to mark a 2.6% jump towards 10,767.09 points, making in the best performing index out of the big US trio.

The S&P was more modest in its gains, registering an increase of 0.8%, while the Dow Jones Industrial Average is insignificantly in the green by less than 9 points (0.033%).

Moreover, both gold and silver are also trading in the positive, charting increases in the past 24 hours. Gold continues to trade at an all-time high. Silver is also more than 2% up in the past 24 hours.

The primary cryptocurrency has indicated increased levels of correlation with the stock markets since the COVID-19 outbreak, but just recently showed first signs of decoupling. However, it seems now that its price is just stuck in the $9,000 – $9,300 trading zone, regardless of how the US-based stock market indexes perform.

During the past 24 hours, BTC went to a daily high of $9,240 to a low of $9,130 on Bitfinex and is trading now at $9,180.

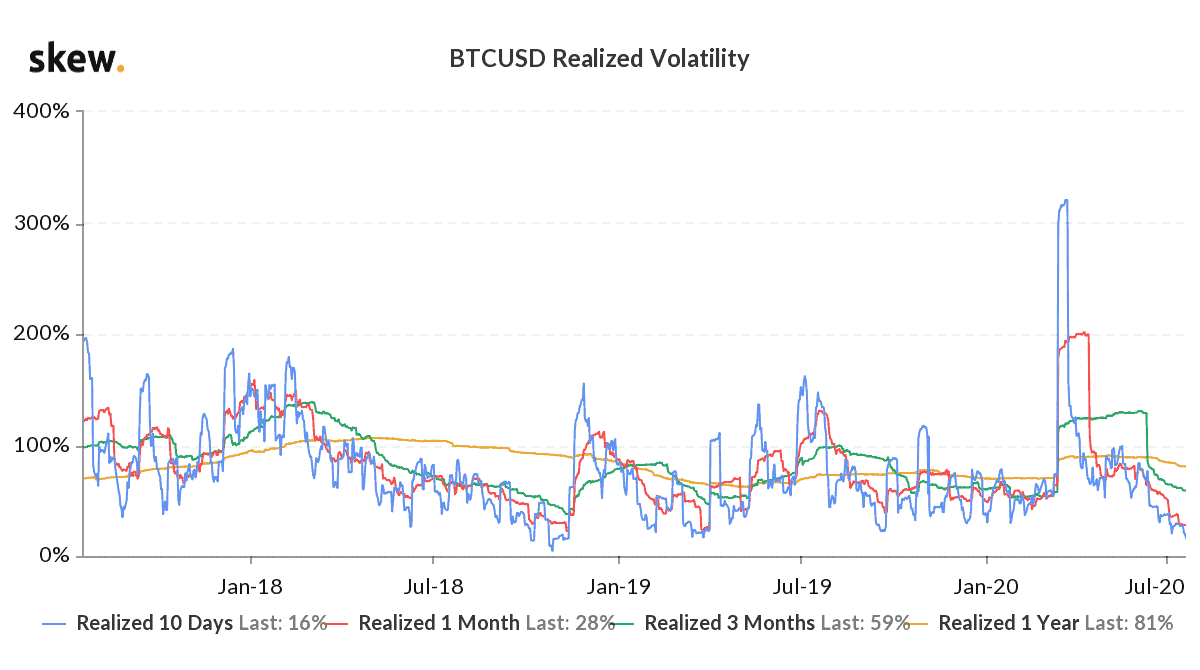

As such, Bitcoin’s 10-day realized volatility (measuring the volatility levels from a certain period in the past) has dropped to 16%. This means that BTC has moved less than 1% in either direction in the past ten days, data from Skew shows. The last time the number went so low came the infamous November 2018 plunge, where BTC “sold off nearly 50% thereafter.”

Adding the missing trading volume of late, it wouldn’t be entirely surprising if Bitcoin mirrors such a price drop soon.

Altcoins Retrace

The predominant color within the altcoin market today is red after several consecutive days of gains. Following a new all-time high marked recently, Chainlink is now down by 8%, and LINK is trading at $7.40.

iExec RLC is the most significant loser of the day from the top 100 with a 17% plunge. The move comes following a few days of increases. Terra also tanks today by 16.5%, and so does Aave (-16%). Kava and Aurora complete the double-digit retrace club by 14% and 11%, respectively.

While only two coins are increasing by double-digit percentages today (Flexacoin – 14%, and Synthetix Network – 13.5%), there’s a rare representative of the triple-digit club.

Syscoin’s impressive surge of 160% at the time of this writing means that SYS has entered the top 100 coins by market cap and is trading at $0.145. The company recently said that it will make an “exciting” announcement on July 23rd, which could be attracting investors and large inflows in its native cryptocurrency.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato