After reclaiming some ground yesterday, Bitcoin has returned to its recent bearish trend by dropping below $10,300. Most altcoins follow with some notable price dips, resulting in a near $10 billion evaporated from the total market cap.

Bitcoin Dips Below $10,300

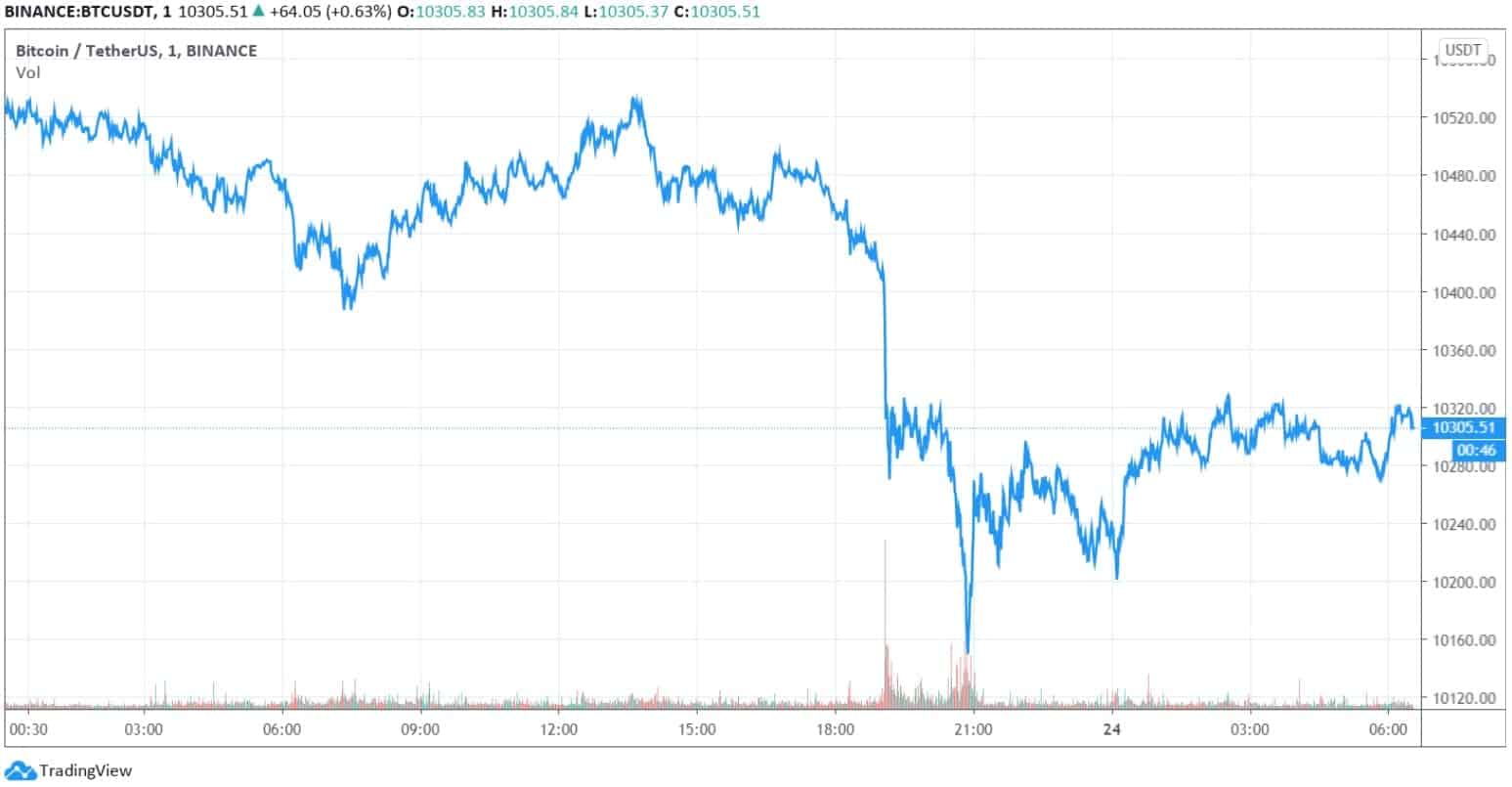

As reported yesterday, the primary cryptocurrency recovered some of the recent losses and traded around the previous 2020 high from February at $10,500. However, the asset couldn’t maintain its position and began free-falling once again.

In just a few hours, BTC went from its daily high of above $10,500 to its intraday bottom of $10,130 (on Binance). Since then, the digital asset has recovered some ground and is trading now just around $10,300.

Bitcoin’s current position places it close to the support level at $10,290. If BTC further breaks below, it could head towards $10,200 and the psychological $10,000.

Adverse price developments are evident among most financial markets. Gold, which typically performs similarly to Bitcoin, dipped from its high of $1,900 per ounce to about $1,850.

The most prominent Wall Street stock market indexes also closed in the red yesterday’s trading session. The S&P 500 went down by 2.4%, the Dow Jones Industrial Average by 2%, and Nasdaq lost the most value (-3%).

Red Dominates The Altcoin Market

Most alts bleed out today. Ethereum has declined by nearly 4% and it trades at $325. Ripple (-3%) fights to stay above $0.22. Bitcoin Cash, Binance Coin, Crypto.com Coin, and Litecoin have also dropped by about 3%.

Some lower-cap alts have decreased by double-digit percentages. DigiByte (-18%), Ren (-15%), Orchid (-13%), Reserve Rights (-12%), UMA (-12), OMG Network (-10.5), and Algorand (-10%) lead the way.

A few coins trade in the green as well. Helium has surged by 40% after being listed on the leading cryptocurrency exchange Binance. Uniswap (13%) and HedgeTrade (10%) follow.

Ultimately, though, the crypto market cap has dropped from yesterday’s peak at $332 billion to $325 billion.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

The post appeared first on CryptoPotato