The BRC-20 tokens have gained significant momentum in recent times as major tokens have displayed massive price action during this month. Further, the ORDI price has added over 18% to its portfolio within the past day, indicating a trend reversal in the market.

The ORDI coin price traded in a closed range between $18.550 and $23.618 for a brief period, following which the market gained momentum and the price jumped over 186%.

However, the Ordi token faced rejection at that level and recorded a correction of approximately 35% in its value. The Ordi token then traded in a consolidated range between $44.575 and $55.536 for a while, after which the bulls gained momentum and broke out of the resistance level.

The rally was short-lived as the price faced rejection at $67.723, resulting in the price facing a pullback within the range. Since then, the price has been trading sideways, indicating weak buying and selling pressure for this token in the market.

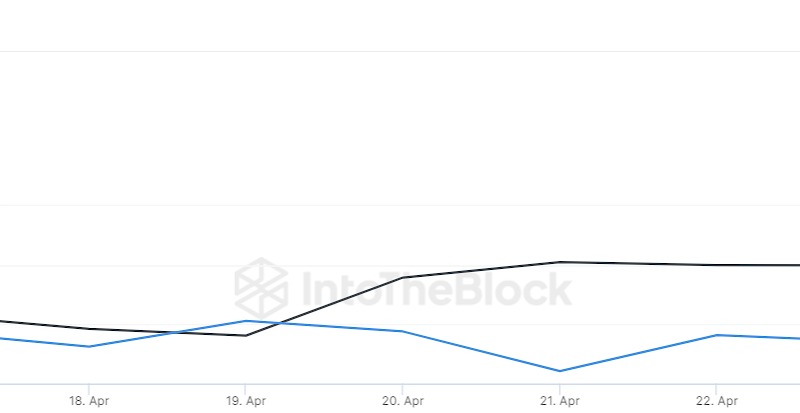

The Relative Strength Index (RSI) displays a sharp fall in the chart, highlighting a reduced price action in the market. Further, the averages show a high possibility of a bullish convergence, suggesting the coin will experience a trend reversal in the coming time.

Will The ORDI Price Go Up?

If the bulls hold the price above the support level of $55.536, the ORDI price will regain momentum and prepare to test its resistance level of $57.723 by the coming week. Further, if the market holds the price at that level, it will continue to rise and test its upper resistance level of $70 by the month-end.

Conversely, if the bears gain power over the market, the bulls will lose momentum and the price will fall to test its support level of $44.575. Moreover, if the bears continue to dominate to market, it will plunge further and prepare to test its lower support level of $33.689 in the coming week.

The post appeared first on Coinpedia