Following the latest developments and price movements from Ethereum, the second-largest cryptocurrency by market cap has seen its weighted social sentiment turn significantly more positive to reach a fresh all-time high.

Twitter Loves Ethereum

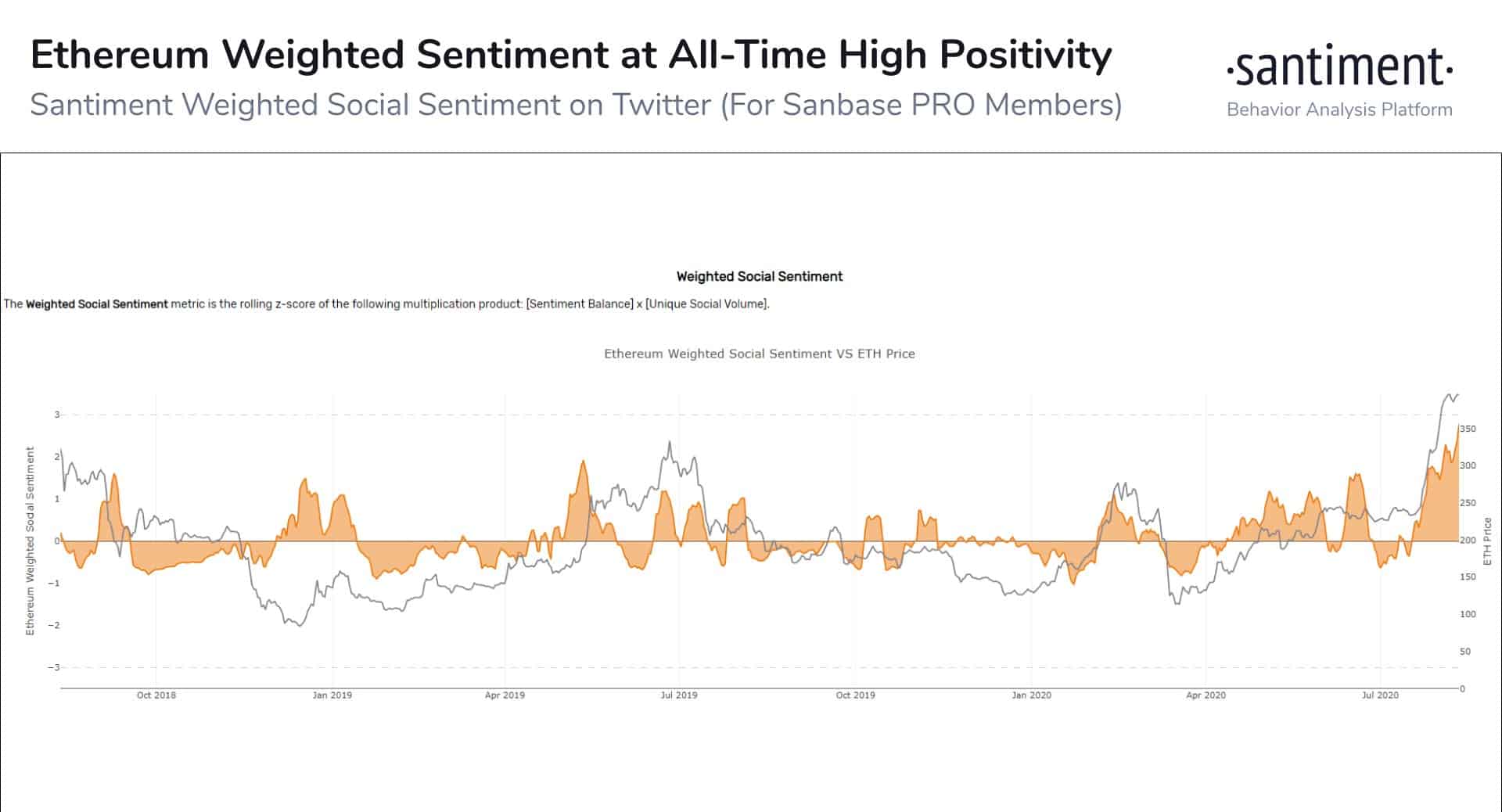

According to data from the popular analytics company Santiment, Ethereum’s so-called weighted social sentiment has been increasing in positivity lately.

Essentially, this metric takes into consideration the positive and the negative comments about each token and provides a score in either direction. In a recent tweet, Santiment brought out Ethereum’s ongoing improvements of positive interactions on the giant social media platform – Twitter.

The company concluded that “Ethereum is at +2.78 deviations above its neutral resting position when it comes to weighted social sentiment, which is easily an all-time high.”

However, it’s worth noting that Santiment tracks this specific metric from early 2018. Meaning, that there’s no data from the parabolic price increase in late 2017 when ETH surged to its all-time high of $1,400. Instead, this metric became available when the asset began tanking and bottomed below $100 a year later.

Plausible Reasons?

Ethereum’s network has a significant role in the ongoing DeFi boom. DeFi has attracted numerous investors and proponents in the past several months, which could have also resulted in a popularity boost for the underlying technology behind most projects in the field.

Additionally, the community anticipates the release of the ETH 2.0 network update, which will signify the transition from the current proof-of-work consensus algorithm to proof-of-stake. Although the launch has been delayed several times and it’s still not confirmed when it will occur, the first major step was taken recently with the release of the Medalla testnet.

Whether to keep up with the mentioned above developments or for other reasons, ETH’s price has also pumped hard recently. While it recovered rather quickly from the mid-March sell-offs when it dipped to $95, Ether was in a range from $200 to $250 for a few consecutive months.

However, all of that changed in mid-July with the start of the current bull run. The asset marked a new yearly high of over $400 after a 70% increase in a few weeks.

In any case, the growing positive feedback for Ethereum on social media platforms could indicate that investors are becoming more interested in the asset. As such, it’s not surprising that the leading digital asset management company Grayscale recently filed a Form 10 with the SEC on behalf of its Ethereum Trust to become the second company product reporting directly to the Commission.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato