In a statement released an hour ago, the Chairman of the US Federal Reserve, Jerome Powell, revealed a serious policy shift aimed at average inflation targeting.

As a result, the prices for gold, silver, and Bitcoin pumped collectively immediately after the announcement. However, all three assets have also decreased in a similar manner minutes after that.

US Federal Reserve Taps the Standard 2% Inflation Target

In his latest statement, the Chairman of the Federal Reserve of the United States, Jerome Powell, revealed that the institution will be changing its approach to inflation with an intention to keep lower rates for longer.

“Many find it counterintuitive that the Fed would want to push up inflation. However, inflation that is persistently too low can pose serious risks to the economy.” – Powell said.

Contrasting the economic situation now to what it was years ago, he remarked that under the new policy, the Fed would target inflation that averages 2% over time. As a result, if the inflation rate is below the Fed’s target, which was the case for most of the past decade, the Fed would allow it to run “moderately above 2% for some time,” he said.

Moreover, the central bank is also expected to follow this announcement with a vow to continue keeping interest rates at near-zero until the economy can recover and return to full employment, while inflation reaches 2% over the long term.

Speaking on the matter was the popular cryptocurrency commentator Alex Saunders, who outlined:

“Inflation will now target an AVERAGE of 2%. Meaning, following periods of sub 2% inflation such as now, we will endeavour to get inflation HIGHER than 2%! New target range will use NO FORMULA”

We continue to move goal posts & are flying blind…

🏦🖨️💵 #FED #JacksonHole #Brrrr pic.twitter.com/VNHzCKzJT5

— Alex Saunders 🇦🇺👨🔬 (@AlexSaundersAU) August 27, 2020

Bitcoin, Gold, and Silver Prices React to the News

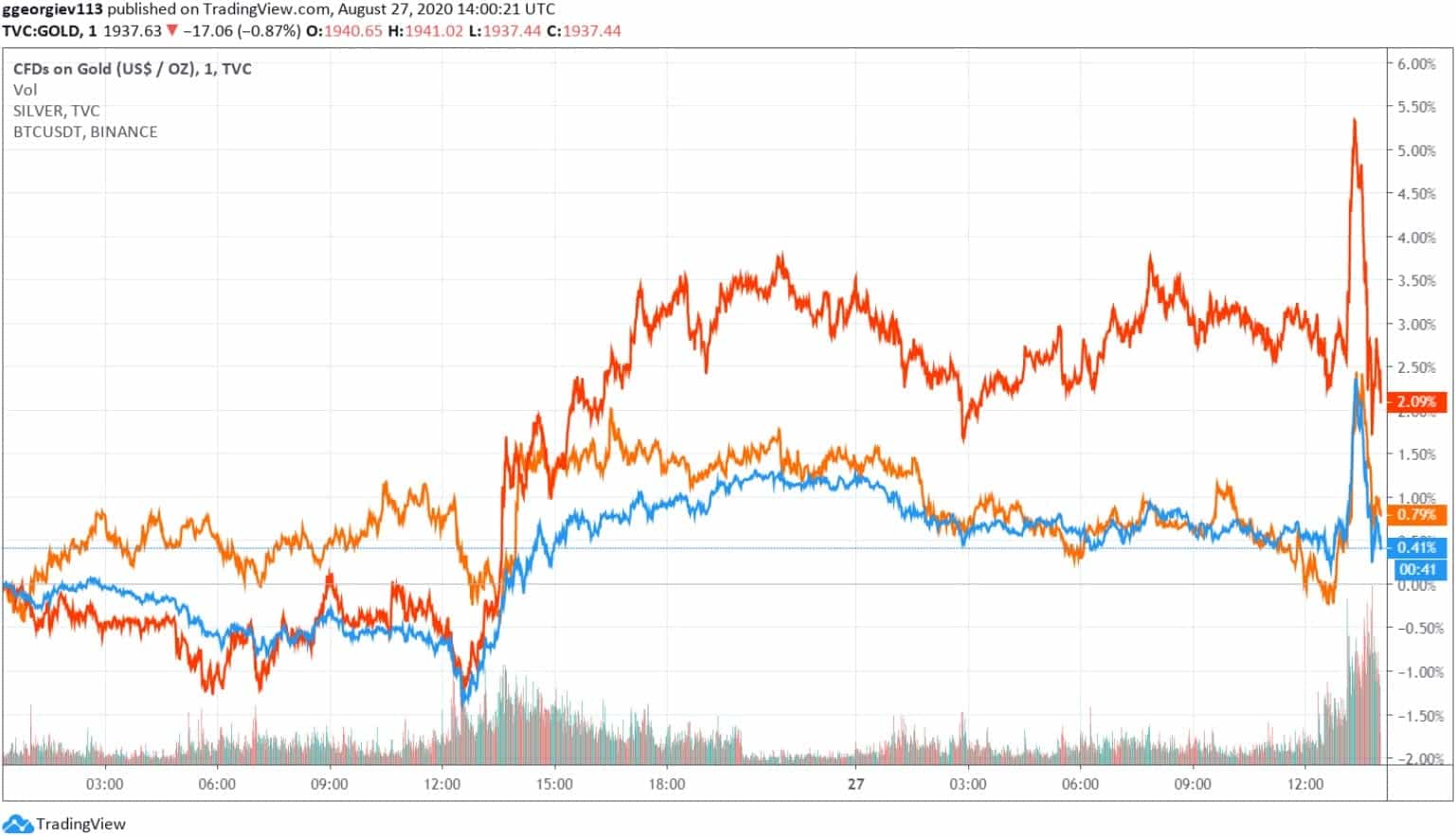

Somewhat expectedly, global markets reacted to the news. The prices gold, silver, and Bitcoin, largely known for their inflation-hedging characteristics pumped in response. So did Bitcoin.

As seen on the chart above, the behavior of the three assets was absolutely identical. All of them pumped following the news and retraced immediately after.

Bitcoin reached a price of about $11,592 on Binance before retracing down to $11,300 where it’s currently trading. Gold and silver underwent a similar pattern.

Interestingly enough, the same happened to stock markets, as the S&P 500, Nasdaq 100, and the Dow Jones Industrial Average all pumped after the announcement only to retrace shortly after.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato