It’s been quite a year for Ethereum as on-chain activity on the network continues to spike, comparable to what it was during the bull run of 2017.

Tx Fee Surged 688%

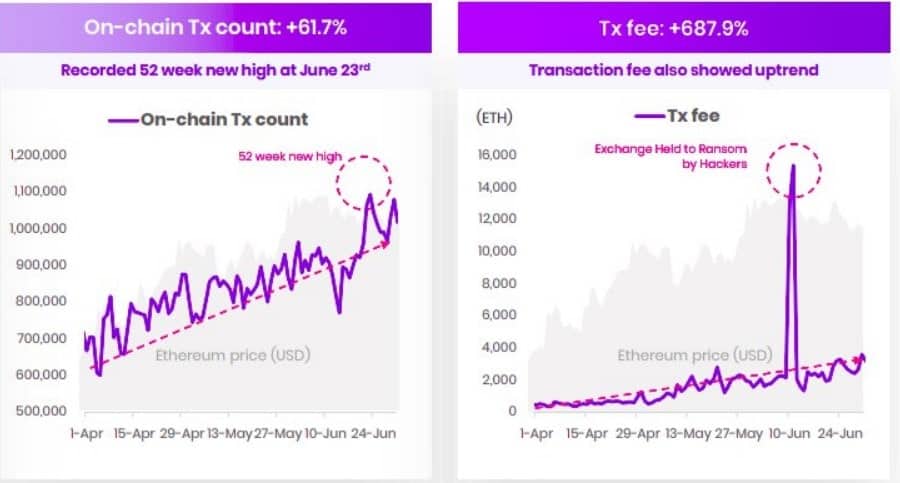

According to new research on Decentralized Finance (DeFi) by Xangle, a global crypto-asset disclosure platform, the transaction volume and fees on the Ethereum network recorded tremendous growth in the second quarter of 2020.

Daily ETH transfer volume surged 61.7% as transactions surpassed 1,000,000, reaching 52 weeks high on June 23. This figure is a few thousand less than the ATH of 1,349,890. The transfer fee, on the other hand, skyrocketed 687.9%. Xangle said the movements “partially resembles” spike recorded during the bull run of late 2017 and early 2018.

A DeFi Boom

DeFi has been the hottest niche in the cryptocurrency industry since the start of Q2, tripling the total value locked (TVL) in DeFi protocols to over $3.5 billion in the last few months. Interestingly, the TVL has increased by 2,524% since January 2018, the report said.

The booming DeFi sector is mainly responsible for the increased on-chain activity on Ethereum in the past quarter of 2020.

As noted in the report by Xangle research Analyst, Jehn Kim, “Defi in 2Q20, (is a) deja vu of 2017 ICO market boom.”

Aside from DeFi projects, most stablecoins issuers prefer to house their coins on the Ethereum blockchain.

And just like DeFi, the stablecoin market has also experienced massive growth since the start of the year, especially after the March crash. This has also contributed to the increase in on-chain activity in terms of transaction fees.

ETH Still Undervalued

However, despite the similar performance in on-chain activity, ETH ended Q2 with a price of $230, which is 83.5% down from its peak of $1,396 in 2017-2018 with Kim stating that “Ethereum’s on-chain indicator activity needs to be reconsidered.”

Previous reports suggest that Ethereum is undervalued but is steadily heading towards market cap parity with Bitcoin. Analysts believe the leading altcoin might be bullish in the long-run regardless of its current valuation.

With Q320 already in motion, ETH’s price has started gaining upward momentum, perhaps getting ready for a rally as the launch of Etheruem 2.0 draws closer. The altcoin grew over 35% over the last week and is currently trading at $321.

Binance Futures 50 USDT FREE Voucher: Use this link to register & get 10% off fees and 50 USDT when trading 500 USDT (limited – first 200 sign-ups & exclusive to CryptoPotato).

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato