In a sudden move, Solana (SOL), one of the most talked-about altcoins currently in the market, has encountered a significant resistance that has halted its upward journey. Interestingly, the current bearish rally is echoing the turbulence of March 2022 as this week saw the largest inflow for Solana since 2022. This was mainly due to declining buying pressure near resistance levels, triggering a surge in exchange reserves.

Solana Added $24 Million In Inflow

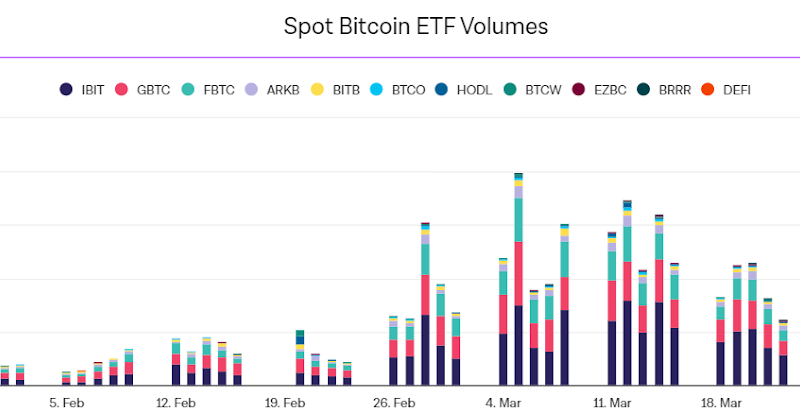

Investment products managed by prominent asset managers, including CoinShares, Grayscale, 21Shares, Bitwise, and ProShares, have witnessed a surge in inflows for the second successive week, marking the most significant influx since July, with an addition of $78 million. This influx has been spearheaded by funds focused on Solana and Bitcoin.

Notably, Solana investment products have seen a remarkable uptick, registering their highest inflows since March 2022 by accumulating an additional $24 million, as per the most recent report from CoinShares.

James Butterfill, the Head of Research, penned that Solana is “persistently establishing itself as the preferred altcoin,” especially in light of the recent debut of Ether futures ETF products. Remarkably, Solana funds have noted inflows in 28 weeks of this year, countered by a mere four weeks of outflows in 2023. Notably, SOL price witnessed its solid decline in March of 2022, dropping from $140 to just $25.

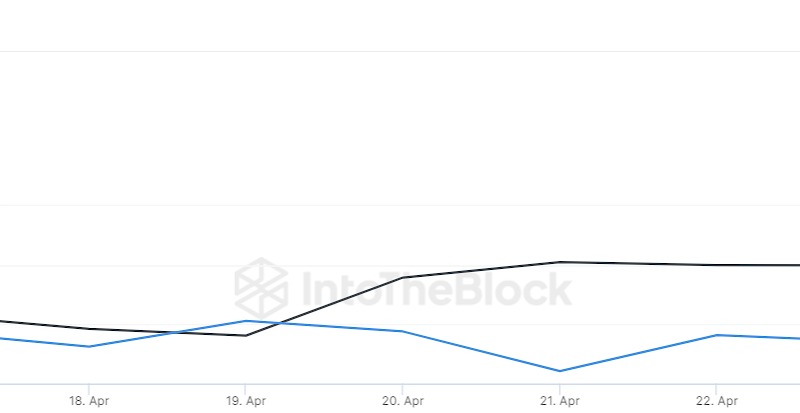

The uptick in inflows implies that holders were actively transferring SOL to exchanges last week after the altcoin reached a high. This movement suggests an intent to secure their profits, subsequently exerting a downward pressure on the altcoin.

Last week’s debut of six ether futures ETFs in the U.S. attracted just under $10 million, showcasing a “tepid appetite,” according to James Butterfill. This pales in comparison to the $1 billion seen by bitcoin futures ETFs in their initial 2021 week, albeit in a distinct market environment.

What’s Next For SOL Price?

Solana has been navigating through a bearish range after declining steeply from $23.5. Recent price actions have brought concerns of a massive drop in the coming hours. As of writing, SOL price is trading at $22.2, declining over 5% from yesterday’s rate.

As bulls are attempting to prevent a decline below $21, the price might see a minor rebound. Should the price ascend and escape its bearish territory, the SOL price might seek to rally to $25, and potentially aim for a target at $32.

On the flip side, the declining 20-day EMA at $23 and the falling RSI line toward the oversold region, indicate a rising bearish sentiment. A slide below the support of $21 could indicate a surrender by the bulls, potentially paving the way for a bearish consolidation with $17-$18.

The post appeared first on Coinpedia