Banca Generali, Italy’s largest insurance group, is to provide bitcoin custody services to its customers beginning next year. This follows a partnership with the Italian Crypto Custody firm Conio. This partnership will allow the bank to acquire a stake of $14 million in the crypto-focused fintech.

Financial Institutions that once criticized cryptocurrency are now embracing the new revolution. Banca Generali’s move to joining the cryptocurrency world should serve as a wakeup call to other banks in the world.

Rather than asking a question such as; ‘will cryptocurrency be widely accepted across the globe?’ we need to ask questions like; ‘what will investments and payments look like in the coming future?’

Banks that will embrace Cryptocurrencies will find prosperity in the coming future while banks that will be unfamiliar in this new age currency will be lost forever. In this article, we will explore some of the different banks in Europe that offer bitcoin and cryptocurrency services to their consumers.

Let’s dive in.

Why Should Banks Adopt to Crypto Custody Solutions?

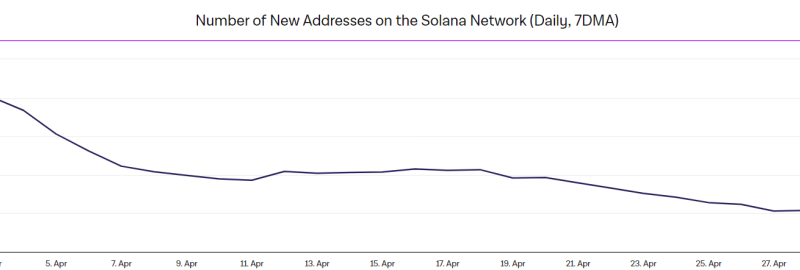

In the last six months, we have seen significant growth in the number of banks that have launched crypto custody solutions. As we had seen earlier with Banca Generali, different banks are now filing patents to provide bitcoin services in their organizations. In the current age, most products are being developed around Bitcoin, and therefore banks need to provide regulations to help secure the financial aspect of these products.

Crypto Custody solutions act as a vault system where you can store digital assets effectively and safely. In the crypto world, custody services will enable banks to provide a platform to clients in the finance industry that have purchased large amounts of bitcoin.

Using custody services banks can assign large amounts of cryptocurrency without any issues concerning regulations and security. The primary purpose of a crypto vault is to enable financial institutions to store volumes of crypto while still being in a position to transact the crypto regularly.

Which Banks in Europe Offer Crypto and Bitcoin Accounts?

I believe by now, you have understood what Crypto custody solutions are and why banks need them in the current time we are living. Now let’s have a look at some of the banks in Europe that offer these services.

Revolut

Revolut is a Fintech company that is located in London, United Kingdom. Nikolay Storonsky and Vlad Yatsenko founded it in July 2015. To buy Bitcoin with Revolut is entirely possible. This fintech company can be compared to Bunq, a Dutch fintech bank. Bunq is better than Revolut in the sense that it offers cheaper services due to its partnership with Transferwise. Revolut uses a smartphone application that makes you bank for free. In the app, you have normal bank accounts that are in various foreign currencies.

Skrill

Skrill is a platform that many online users use to make and receive payments online. Skrill is considered to be PayPal’s main competitor by the fact that it is much cheaper and more innovative. Skrill which is a UK based company was founded by Daniel Klein and Benjamin Kullmann in 2001 and has grown to be a global company that many nations use to send and receive money around the world. Among its many advantages offer other online sending platforms, Skrill supports Bitcoin. The downside of Skrill’s support to Bitcoin is that it does not offer real wallet functionality.

Solaris Bank

Solaris is a fintech Bitcoin Bank that is based in Germany, Europe. The company has a German banking license. Founded in 2016 by Sun Microsystems, the bank rose to become one of German’s best fintech companies that offer other banks crypto custody solutions. The bank offers other financial technology companies a banking-as-a-service platform.

This bank provides white label solutions for European banks for them to be able to provide cryptocurrency services to their consumers. The first German bitcoin bank was Bitwala, the bitcoin services capabilities of this bank were all thanks to Solaris, which provided the services.

Vontobel

Vontobel is a bank that has been in operation in Zurich since 1924. The bank boasts of being the third-largest asset manager in Switzerland with around 1,700 employees and over € 100 billion. Vontobel was the first bank to develop participation certificates on Bitcoin cash and Bitcoin in the German-speaking world. In collaboration with the Taurus Group, a Swiss fintech company, Vontobel can now offer its customers bitcoin bank accounts.

Banca Sella

The 2020 pandemic has made many banks to recline on introducing bitcoin services. Banca Sella an Italian bank with over 1.2 million consumers in Italy plans on launching a new platform that will embrace Crypto custody solutions. At the moment, the bank offers Bitcoin accounts using the Hype app.

Banca Generali

We started this article talking about Banca Generali the big Italian bank that serves the “who-is-who” public figures. As stated earlier, Banca Generali will start offering Bitcoin to its customers come 2021.

Incore Bank

Incore Bank is one of the big banks in operation in Switzerland. Founded in 2006, the bank has now received permission the Swiss regulator (FINMA) to provide cryptocurrency services. Unlike other Swiss banks, Incore can help a financial organization or individual to buy, sell, store and also insure bitcoin. Incore embraces blockchain technology.

Bunq

We had mentioned Bunq fintech company earlier in the article when talking about the similarities it has with London based company Revolut. Bunq is a young company that was founded by Ali Niknam in 2012 in the Netherlands. Bunq has helped notably established banks such as Rabobank to start offering crypto custody solutions to their consumers.

Conclusion

Well, as you can see the future of payments and investments will be crypto-based. Banks around the world need to take this matter seriously and jump into the crypto train. Ignorance of bitcoin and cryptocurrency may make notable big banks in the world to be lost forever in the wilderness.

The post appeared first on Coinpedia