Every industry that got into crypto the last around, and we mean both before the huge Bitcoin and Altcoin bull runs and during the 2017 rise, those industries will begin to experience yet another boom. Crypto investors are on top of the world at the moment while swing traders and day traders are making more trades than ever before.

Sports bettors and casino players on cryptocurrency iGaming sites are betting more than ever, while those not involved are snapping their pencils thinking ‘what if’.

We saw a similar rise in 2017 beginning with a late bull run for mainstream cryptos before early 2018 when cryptos took a huge hit and continued to die down.

Take Bitcoin for example which rose to over $19,500 in Q4 2017 and then crashed to as low as $3,400 by Q4 of 2018. It could be the same scenario happening all over again right now while those that currently own crypto are willing to hold on.

For now, what will presumably happen as cryptos hit new highs, is the crypto industry will boom once again, and it is those already involved in crypto services, tech, and apps that are benefiting.

Crypto Trading Apps

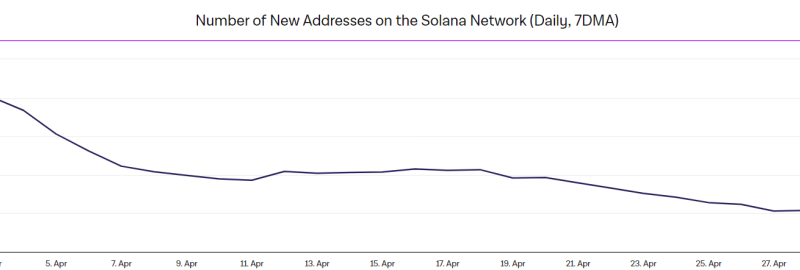

Of course, the main apps benefiting from the resurgence of cryptos is the trading apps themselves. As cryptos become a trending subject, much like 2017 which saw more new crypto adoptions than ever before, an increasing number of people are looking at how they can get involved. A fair argument to make right now is that we will probably see more people adopt cryptos compared to 2917.

The line of thought behind this prediction is that people are now a little more aware of what cryptos are and there are far less horror stories than before. Cryptos are now more heavily regulated and Ponzi schemes are almost a thing of the past creating more trust in a market that let’s face it, pre-2017, no one really knew much about.

As a result of this market hype, more people are seeing the chance to learn how to trade crypto, why they should trade crypto, and signing up for courses because they can see that the digital financial era is quite possibly just around the corner.

Crypto Sports Betting and iGaming Apps

Over in the iGaming industry and sports betting app sphere there are websites that still pushed forward focusing on cryptos as their main option or as a convenient way to place bets. In the Guardian online publication, cryptos are one technology powering the online gambling industry.

And, it has to be said, the crypto versions of these iGaming sites are now rising back into popularity as players see their chance to get more value out of their bets while outside of their betting account, cryptos are on the rise anyway.

Even the software providers that offer mobile game are making sure all their slots and betting platforms are crypto ready, accepting the major virtual currencies such as BTC, ETH, and LTC. On top of this, crypto games have their very own absolutely risk free provably fair algorithm.

This is a highly encrypted system that gives random results on games such as virtual racing, virtual football, and other virtual spots available and sports bet sites as well as slots and table games like poker, blackjack, and roulette.

Crypto Exchange Apps and Wallets

Exchange apps are also going crazy as more people look to diversify their crypto portfolios as they look for multiple opportunities to make money off the current upswing which seems to not only be affecting Bitcoin and Ethereum but many of the alt coins too.

Also, for many of the reasons stated above in the ‘Crypto Trading Apps’ section, people will want to invest in cryptos and need an exchange to purchase BTC or ETH so they can then go out there and diversify.

Naturally, the golden rule is always ‘never keep your crypto on an exchange’. As such, crypto wallets are also going to see a huge increase in signups as people look to take advantage of the current crypto bull run, we are seeing!

The post appeared first on Coinpedia