In the last few years, the blockchain industry has shifted from being a rather niche market mostly comprised of experimental technologies and fledging protocols, to a multi-billion dollar industry full of fintech unicorns and novel platforms that promise to disrupt traditional finance and practically every other industry.

Although many countries have been racing to position themselves as a global hub for blockchain, it is becoming increasingly apparent that Asia is forming the epicenter of this growth.

Crypto Projects Choose Asia

As it stands, South Korea, Hong Kong, Japan, Singapore, and China are responsible for many of the blockchain developments that come out of Asia—thanks to their progressive stance on cryptocurrency and blockchain regulations, and willingness to give developing platforms the breathing room they need to thrive.

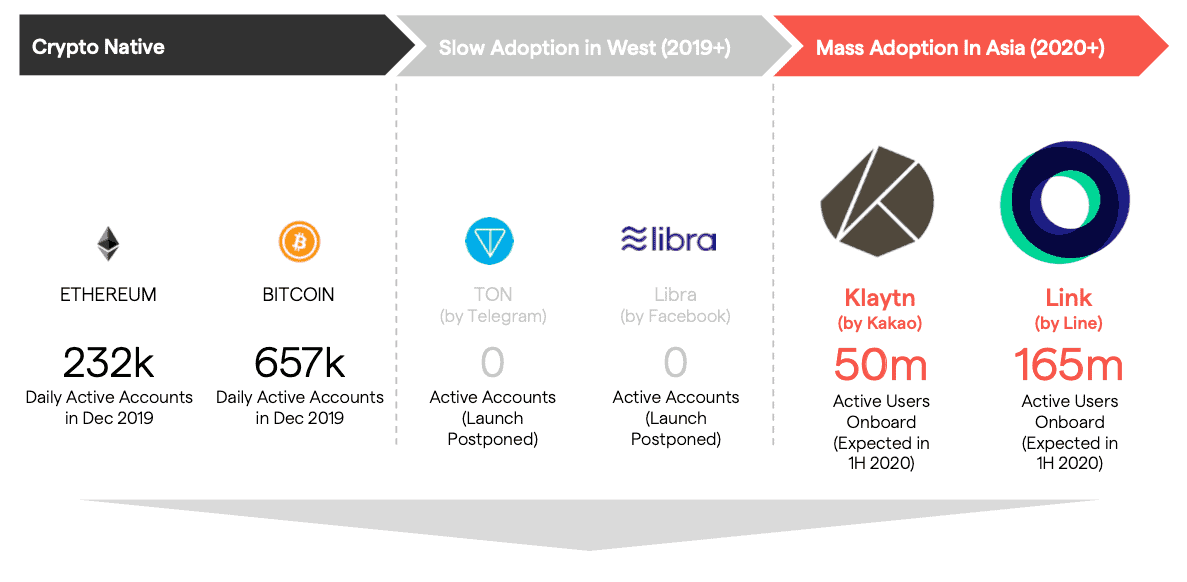

Among these, Sound Korea is arguably leading the charge. For one, the country was the first in the world to announce a fully comprehensive regulatory framework for cryptocurrencies, giving blockchain companies the clarification needed to operate without worries for the first time. Likewise, South Korea also gave rise to two of the world’s most successful blockchain-powered solutions—Line’s LINK platform for blockchain services and products, and Kakao’s Klaytn platform for blockchain applications. These projects alone are on track to onboarding well over 100 million users alone in 2020.

The potential of Klaytn, LINK, and more than a dozen other early-stage blockchain projects in Asia has already been recognized by South Korea’s biggest crypto fund, Hashed. The crypto fund made early strategic investments in both projects, as well as ICON, Ontology, and numerous other platforms it believes will help build out the blockchain ecosystem and drive mass adoption.

Simon Kim, Hashed’s founder and CEO, noted in a Yahoo Finance interview:

“We see many western projects with a heavy focus on research and ideology on issues such as mechanism design. At the same time, they often fail to take into account the dynamics of a real-world consumer setting. Projects such as Klaytn and Chai take a different approach, focusing on improving the UX layer which is the key to overcoming challenges with mass adoption.”

Although LINK and Klaytn are on track to bring the benefits of blockchain to the masses, Asia already has its fair share of blockchain heavyweights—some of which already have millions of users and turn over more than $100 million in yearly profits. Overall, as of January 2020 more than half of the top 10 cryptocurrency exchanges by trading volume were based on Asia, as well as around a third of the top 30 cryptocurrency projects.

Half of the Biggest Blockchain Companies are in Asia

Since blockchain and cryptocurrency technology first emerged in 2009, Asia has gradually established itself as a hotbed for cryptocurrency talent and as a result, also calls itself home to almost half of the top 10 blockchain companies.

A large part of Asia’s current dominance in the blockchain industry comes as a result of its early foray into the Bitcoin mining industry. Two of the earliest Bitcoin mining companies set up operations in China—Bitmain and Canaan Creative, giving it a headstart on developing public awareness about cryptocurrencies and blockchain.

Both Bitmain and Canaan Creative were among the first companies to begin mass manufacturing of application-specific integrated circuit (ASIC) miners—a type of cryptocurrency mining hardware that offers massive yield improvements over standard CPU or GPU mining. Not only this, but four of the top five largest Bitcoin mining pools have their base in Asia and currently hash out close to half of all newly minted Bitcoin.

But Asia’s blockchain industry dominance goes far beyond simple Bitcoin mining. The region has also positioned itself as a leader in the blockchain development and infrastructure industry, including Block.one—the company that developed the massively popular EOS.IO blockchain.

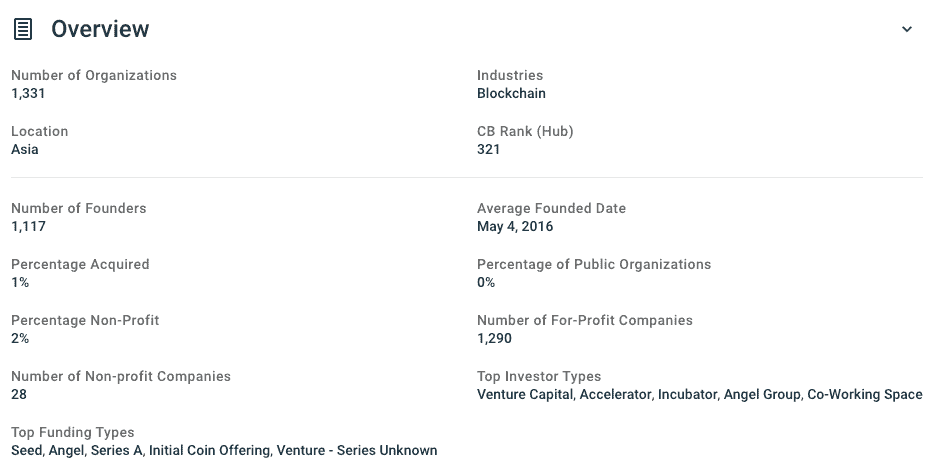

According to data from Crunchbase, there are now well over 1,300 different blockchain companies operating in Asia, which on average, were founded in May 2016 and have raised a combined total of $4.6 billion in capital. With China recently announcing plans to double-down on blockchain development efforts and the Asian-Pacific blockchain technology market poised to achieve a compound annual growth rate (CAGR) of 66.2% until 2027, it appears likely that Asia will continue to lead the stride for years to come.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato