Stablecoins, which make up a huge chunk of those steep fees, could all switch to Layer 2 for some relief, according to one industry expert.

Yearn Finance founder, Andre Cronje, has suggested that USDC and USDT will soon be available on Layer 2 as stablecoins make the transition away from Ethereum.

USDC and USDT will soon both be available on L2.

This will allows non-congested transfers of USDC and USDT.

This is great if you do payments in USDC and USDT.

From my experience USDT and USDC are trade instruments. Not currency. How much will really move to L2?

— Andre Cronje (@AndreCronjeTech) September 7, 2020

The comment comes in the wake of a massive month for Ethereum transactions, which saw them surge to record levels in terms of amount and average cost. Cronje added that he considers stablecoins as trade instruments and not currencies.

DeFi analyst Chris Blec replied that L2 solutions could give Tether and Centre an easier way to force regulatory compliance through KYC, should they require whitelisting.

Layer 2 is essentially a blockchain scaling solution that implements technology such as side chains and zk-rollups to enable faster transactions by taking data off the root chain. A zk-rollup is a ‘zero-knowledge proof,’ which cryptographically secures some of the data off the chain, easing the load on it.

Tether Already on OMG Network

Tether has already integrated into the Layer 2 OMG Network, formerly called Omise GO, which operates on Plasma. USDT holders will be able to transact over this network to save in fees and decrease the time take for it to be verified.

Tether has also moved a chunk of its supply to other networks, including Tron, EOS, and Algorand, but the ultimate solution could be a full switch to Layer 2. According to the Tether Transparency Report, around 62%, or $8.9 billion USDT, is still on the Ethereum network.

ETH Gas Station reports that in terms of fees, Tether generated over $10.5 million in the past 30 days, second only to Uniswap, which has generated 20% more. USD Coin, the dollar-pegged stablecoin launched by Circle, is also gaining traction in the DeFi sector as an alternative to Tether.

Ethereum Fees Take a Breather

With Ethereum 2.0 Phase 1 still a long way away, scaling solutions for the world’s most popular smart chain network will not be here any time soon.

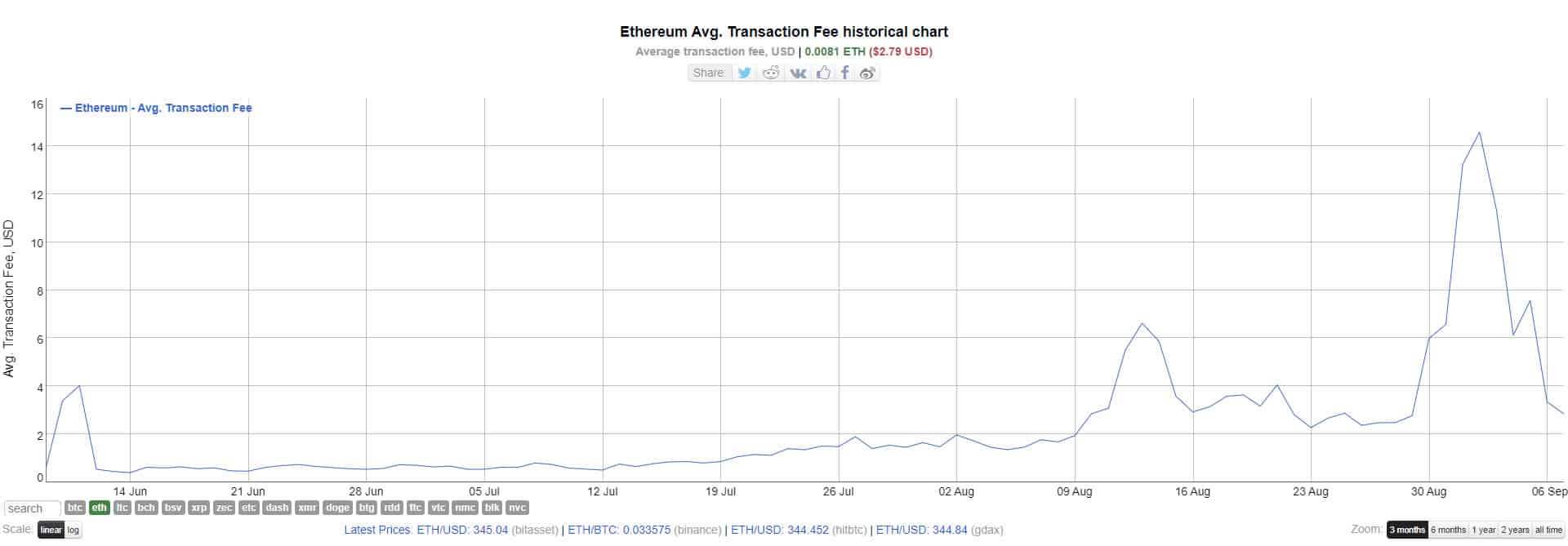

It has come as some relief, however, that the average transaction fee on Ethereum has fallen 80% so far this month from a peak of $14.58 on the second to $2.84 today.

The spikes tend to be correlated with new offerings in the DeFi food farming frenzy, so gas fees are unlikely to remain low for long.

Click here to start trading on BitMEX and receive 10% discount on fees for 6 months.

The post appeared first on CryptoPotato