As a seemingly endless stream of reports continues to pour in surrounding the coronavirus, many are becoming increasingly concerned over the effect this global pandemic could have on the global financial system in the future.

The outbreak is shaping up to potentially cause one of the worst financial crashes of all time. The current pandemic is as bad as the Wall Street Crash of 1929, the Dotcom bubble of the early 2000s, and the Global Financial Crash of 2008.

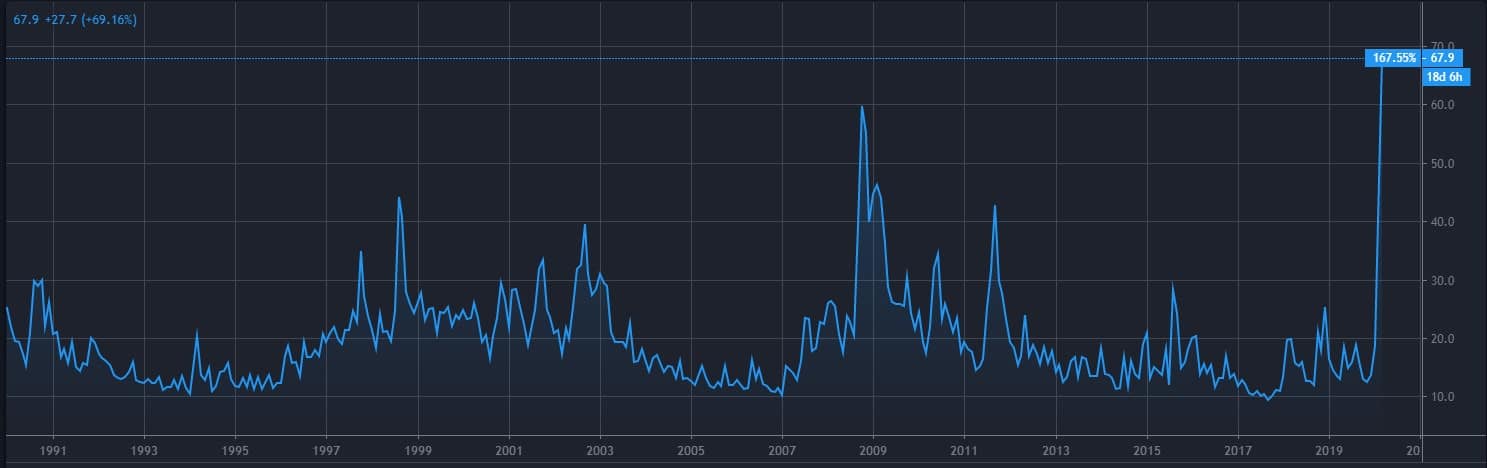

VIX Soars

As of yesterday, March 12, 2020, the VIX, or the fear index, has been trading at its highest levels since the 2008 financial crisis.

In fact, virtually all financial assets were down yesterday, March 12, which has since become the Black Thursday. This includes commodities, equities, corporate debt, cryptocurrencies, and even Gold – all have taken a hit.

Just as a side note, during the recent global financial crisis of 2008, Gold was declining at the first of crisis, but quickly gained momentum as the crisis deepened.

Bear Market, Officially

During yesterday, Dow Jones recorded its worst day since the Black Monday of the 1929 financial crisis. The S&P 500 recorded 9.5% losses yesterday, and down 26.7% from the February 19 all-time high.

All Wall Street major indexes had crossed the 20% drop from their records, which changes the market status to ‘bear market,’ for the first time since 2009.

Italy First

In Italy, the country is now on high-alert, and citizens fear a recession in the near future. In fact, the country has recently announced a suspension on mortgages to help counteract the effects of the economic blow and prevent a financial crisis.

The tourism-based country is entitled to the worst situation of the coronavirus, and the end doesn’t seem to be near.

Besides Italy, other leading EU economies are starting to feel the hit of the virus, including Germany, France, Switzerland, and Spain. As it stands, unemployment is also rampant in the European nation, at only 28.9% for people under the age of 25.

Solving The Problem Will Take Expensive Time

To date, there is currently a total of 140K reported cases of the coronavirus worldwide.

While exactly half of the cases have been confirmed as cured, there have been over 5,000 deaths related to the virus. And as reports continue to emerge from new regions all around the globe, these numbers are only expected to rise.

A cure is a matter of time, everyone knows, but until scientists will develop one, test it, deliver it – it’s likely to take months, even over a year. The hope is that the summer will kill the virus, but no one can promise it won’t return.

Regarding economic effects, the world doesn’t know how to deal with such global virus properly. Unlike in 2008, where it was apparent what needed to be fixed, this new situation has health matters. As long as people will be afraid and worried about their health, no one can force them to travel abroad, sleep in hotels, eat in restaurants, watch live shows and; you got the idea.

Fed Panics? Takes Actions Very Early

Following the recent markets collapse, the Fed already used its first life-save, by cutting the interest rate by 0.5%. Yesterday came the second one: a $1.5 trillion liquidity injection to the markets. Even this didn’t save Wall Street from its fatal double-digit daily crash. Now, Trump demands even more actions from the Fed.

2008: Were the lessons learned?

Since the Financial Crisis of 2008, the mainstay of global financial risk has been shifted from the national banks to the asset management industry. Therefore, they don’t believe that another crisis is likely.

But, while there’s no doubt that a viral outbreak of this magnitude is going to have deep, far-reaching effects on global economic systems, many point to the underlying fragility of the system as the main culprit surrounding the recent upsets.

In fact, the main reasons for the recent volatility are low-interest rates and increased leverage on the buyer’s side of the trade.

In other words, the system is already off-kilter, and this pandemic could be the “straw that breaks the camel’s back,” overwhelming global systems and potentially causing another global financial crisis.

The post 6 Reasons Why Coronavirus Will Carry The World Into Next Global Financial Crisis After 2008 appeared first on CryptoPotato.

The post appeared first on CryptoPotato