Abstract: According to new findings from @mononautical, Bitcoin mining is dangerously centralised, with one entity controlling the coinbase outputs for around 47% of the network hashrate. Bitcoin analyst Alex Bergeron claims the reason for this centralisation is that miners want to eliminate all the variance in their revenue and that entities with large balance sheets therefore take this variance risk for them. In this piece we attempt to calculate how large these balance sheets need to be. We conclude that perhaps only around $20m of capital is required, which is a relatively small amount. Therefore, although the problem is currently manifesting itself on the network to an extreme extent, this variance smoothing issue does not appear to be as much of a long term fundamental incentive problem as some may think.

Source: Thermal image of a Bitcoin mine

Overview

Recently, Bitcoin analyst and commentator Alex Bergeron wrote an excellent piece on Bitcoin Magazine, entitled “SHADOW BOXING: COMMENTS ON PROOF-OF-WORK CENTRALIZATION HYSTERIA”. The gist of Alex’s article is that block construction has become highly centralised, which the below Tweet illustrates.

Alex explains the cause of the centralisation as mining pools offering to “adjust [their] payout scheme and completely remove variance from the equation”. Pools offering this smoothing out service are therefore more attractive and they gain market share. The purpose of this article is not to evaluate the extent of the problem or discuss any real solutions. Instead we are focusing on one part of Alex’s essay:

If that sounds expensive to you that’s because it is. The pool effectively has to front every payment out of pocket and hope they can pay themselves back with the blocks they eventually mine. If you hit a bad streak and your balance sheet isn’t strong enough to absorb the lack of revenue, you’re Sam Bankman fried. Enter Foundry. Through a combination of uncanny timing, business savvy, and a DCG-sized war chest, they’ve created a financial moat around their pool operations that makes it very hard for smaller players to come in and compete.

Alex mentions a “DCG-sized war chest”. The question we want to focus on in this report is simple: how large of a war chest is necessary to provide this revenue smoothing?

Value of the Reduced Variance

In finance, risk has a cost. What would you rather, $100 or a 50% chance of $200 and a 50% chance of $0? The correct rational financial response is of course $100, because this has lower risk, even though the expected value of each choice is the same. This is also why miners want lower variance in their revenues. Computing the value of the benefit of this lower risk is extremely difficult. How much more is $100 worth than that 50% chance of $200? It is challenging to calculate that and perhaps involves all kinds of issues, such as the preferences and financial circumstances of the entity in question and the risk premium in the wider economy. There are financial theories that attempt to tackle this problem, such as the Capital Asset Pricing Model, but applying this type of theory to Bitcoin mining would be challenging. Therefore, while we know that miners benefit from lower variance, computing the value of this benefit with a robust statistical model is not something we are going to attempt in this article.

However, although it’s difficult to prove, in our view it is safe to assume the maximum value of the benefit to miners from totally removing variance is pretty small relative to the size of total mining revenue. Once you hit 5% of the total network hashrate, the impact of this variance is somewhat limited, in our view.

Mining Pools

We of course have mining pools, specifically created for the purpose of reducing this variance and benefiting miners. However, no mining pool has a 100% market share and therefore even large mining pools still have this variance problem. In Alex’s essay, his point is that in spite of pools being reasonably large, some of the pools apparently fully mitigate the remaining variance risk as a service for the miners, by using their own balance sheets. In order to do this the balance sheets need to be large, but how large?

How Large of a War Chest Does One Need?

On reading Alex’s excellent piece, one of my first thoughts was that he is correct about the overall issue, but in theory the actual size of the “war chest” one would require is relatively small and therefore not the fundamental driver of this monopolistic behaviour to the extent one might think. Our initial guess while reading his piece was that the size of the war chest needed would perhaps be less than $10m. This is not much money when compared to the size of the mining industry or the size of the net cash and Bitcoin balances of many of the listed Bitcoin miners, which tend to raise large amounts of capital fairly easily. Therefore, we assumed that perhaps this variance issue is not a fundamental long term economic problem in Bitcoin mining and instead the problem is manifesting due to other factors. As we explained above, we will not calculate the value of benefit to miners of the lower variance, but we can perhaps calculate the cost to Bitcoin pools of providing this smoothing service.

Model Assumptions

Let us run through a basic scenario below. Let’s say we are launching a new Bitcoin mining pool startup and we offer to completely remove variance, by using a “reserve fund”, funded from our initial capital. Let us make the following assumptions:

- As soon as we launch the pool our share of the global hashrate immediately reaches a certain percentage and remains at this level (We use 5% and 50% in our calculations)

- As soon as the reserve fund is depleted, the hashrate of the mining pool falls to zero and remains at zero indefinitely

- The pool charges a 1% fee, which is shared 50:50 between the reserve fund and pool operating costs

- The pools pays out the miners daily

- Transaction fees are zero

- Nobody attacks the pool

- No issues with accurately estimating the network hashrate or the pool hashrate

Then let’s ask the question, how large does the initial capital in the reserve fund need to be?

We then ran some pretty simple mathematical models, trying to determine the probability that the reserve fund depletes to zero, in certain scenarios. In our model, we used a random number generator to determine if our pool mined each block in a hypothetical period of one year. If the pool had a 5% hashrate, the probability of finding the next block is 5%. If the pool had 50% of the hashrate, the probability of finding the next block is 50%. The random number generator determines if the pool mined the next block or not, a binary output, 1 or 0. After each day (a 144 block period), we then looked at the accumulated value of the reserve fund. If the fund ever reached a value of zero or less, the model ended and the mining pool business failed. This is not exactly a Sam Bankman-Fried scenario, nobody loses money and the pool doesn’t go bankrupt, the pool just gracefully shuts down.

This model is an oversimplification and should be considered as a basic back of the envelope type calculation. We would welcome any feedback on why our model could result in wrong estimates and incorrect conclusions.

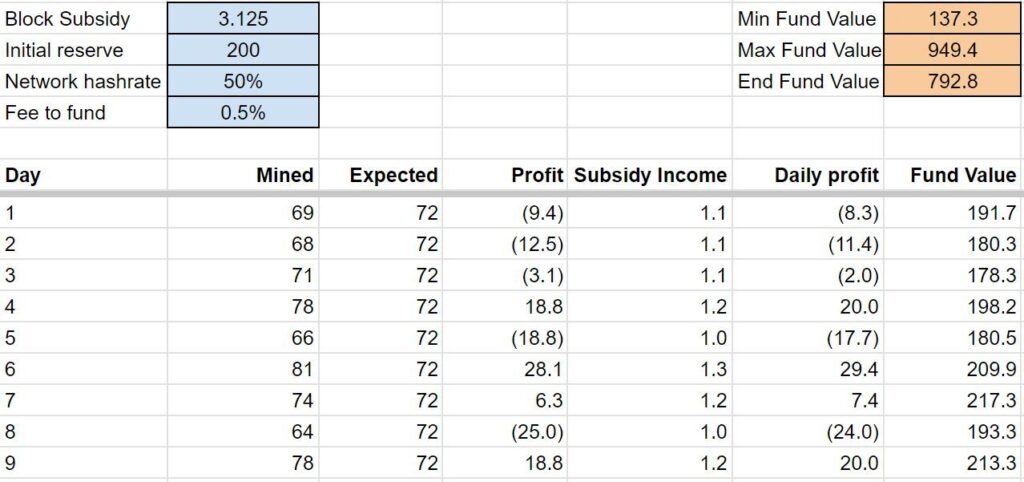

The below table illustrates how our basic model works on a daily basis, assuming our pool has 50% of the global hashrate. We expect to mine 72 blocks per day and we expect to pay out our miners based on this 72 block average. The random number generator determines how many blocks we “actually find”, which results in a profit or loss for our fund each day. We then repeat this for 365 days, to model the outcome over a one year period. We then conducted 400 of these trials, to obtain the expected results. The outputs from the first 10 days of one of the trials, with 200 Bitcoin of initial capital, is shown below.

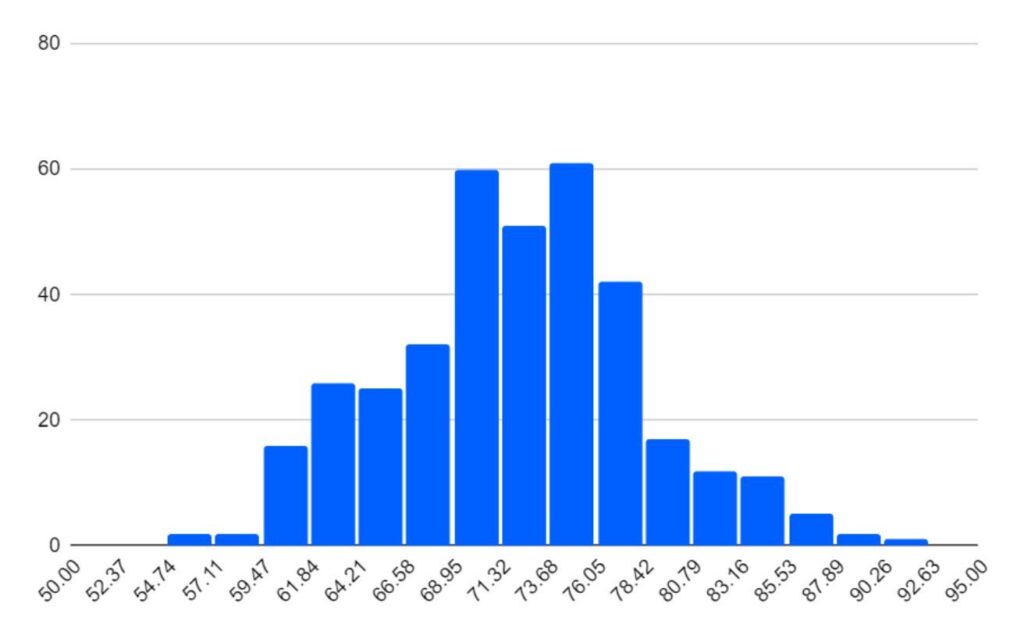

The histogram below shows the results for one of the trials. As expected, the distribution of the number of blocks found per day is approximately normally distributed.

Histogram – Number of blocks produced each day over one year (50% hashrate)

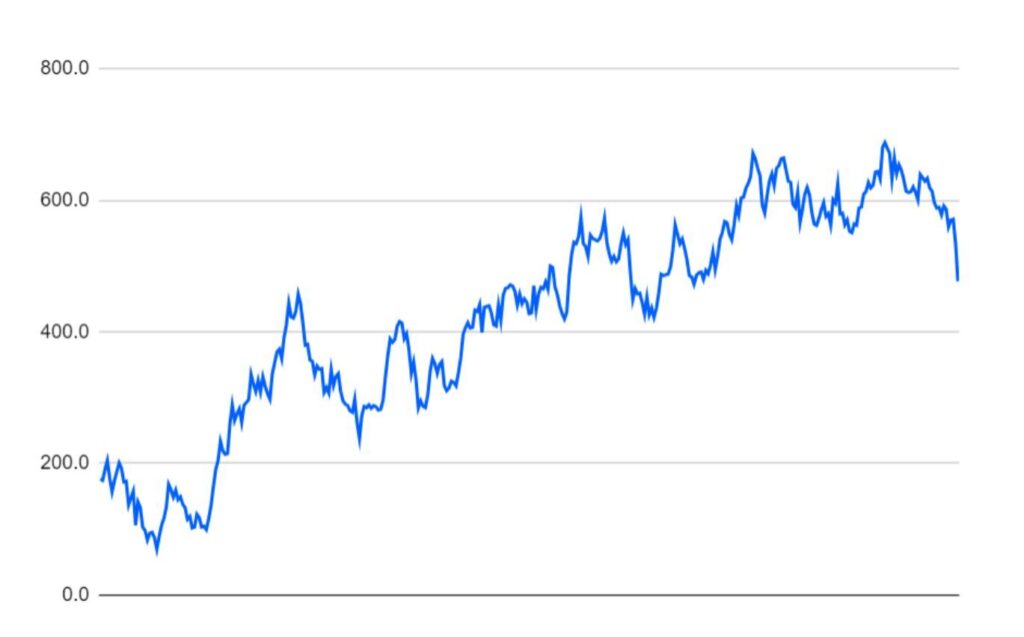

The below chart shows the reserve fund assets each day over the year, for one of the trials. The fund has 200 Bitcoin of initial capital. Based on our assumptions, with 50% of the network hashrate, the fund is likely to accumulate capital, due to the fees the pool charges, however depletion to zero is still a possibility.

Reserve Fund size over 1 year period (50% hashrate)

Model Results

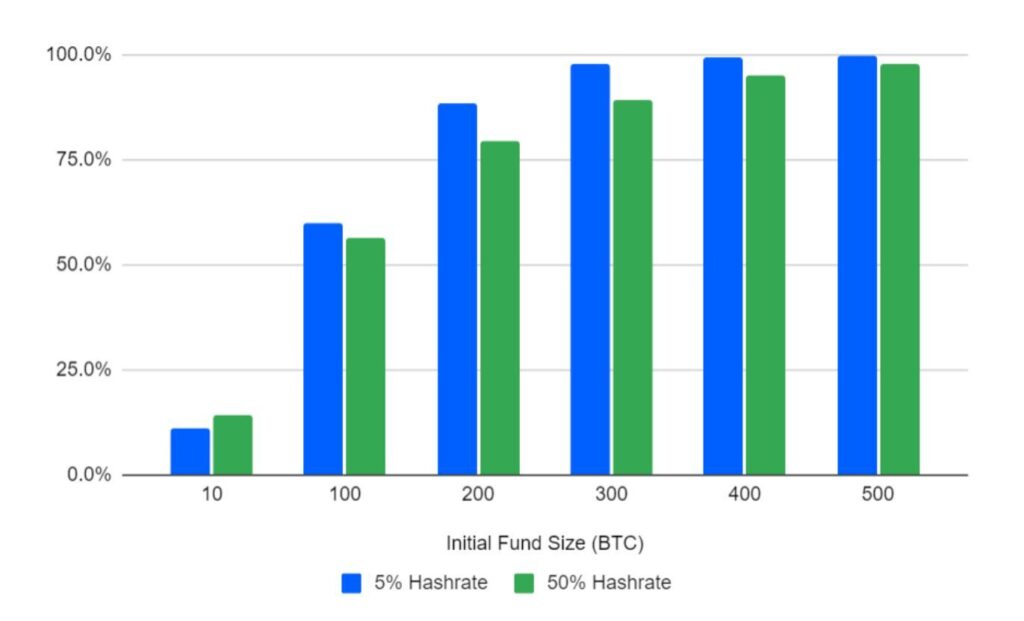

The results of the 400 trials are displayed in the table below, for two hashrates, 5% and 50%. Based on our model, if our pool obtains 5% of the network hashrate, an initial reserve fund of 300 BTC will give us a 97.8% chance of surviving for a year. On the other hand, if our pool obtains 50% of the network hashrate, an initial reserve fund of 400 BTC will give us a 95.0% chance of surviving for a year. Therefore, based on a Bitcoin price of $63,000 our initial guess of $10 million was a bit low, but $20m seems potentially sufficient. Although, maybe one would like a large buffer and therefore $40m could be a nice starting value for the fund. One could also repeat this exercise for more hashrate levels and then draw a line chart based on the 95% survivorship threshold. An exercise we may do another day.

| Initial Fund Size (BTC) | 5% Hashrate | 50% Hashrate |

| 10 | 11.0% | 14.3% |

| 100 | 59.8% | 56.5% |

| 200 | 88.5% | 79.5% |

| 300 | 97.8% | 89.3% |

| 400 | 99.5% | 95.0% |

| 500 | 100.0% | 98.0% |

Probability of reserve fund remaining solvent over a 1 year period

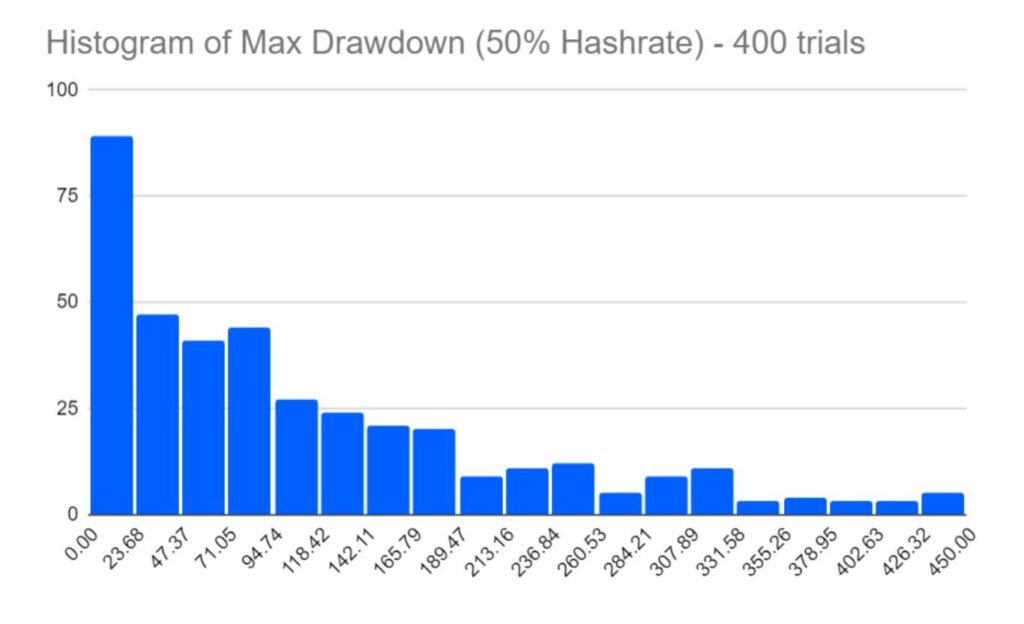

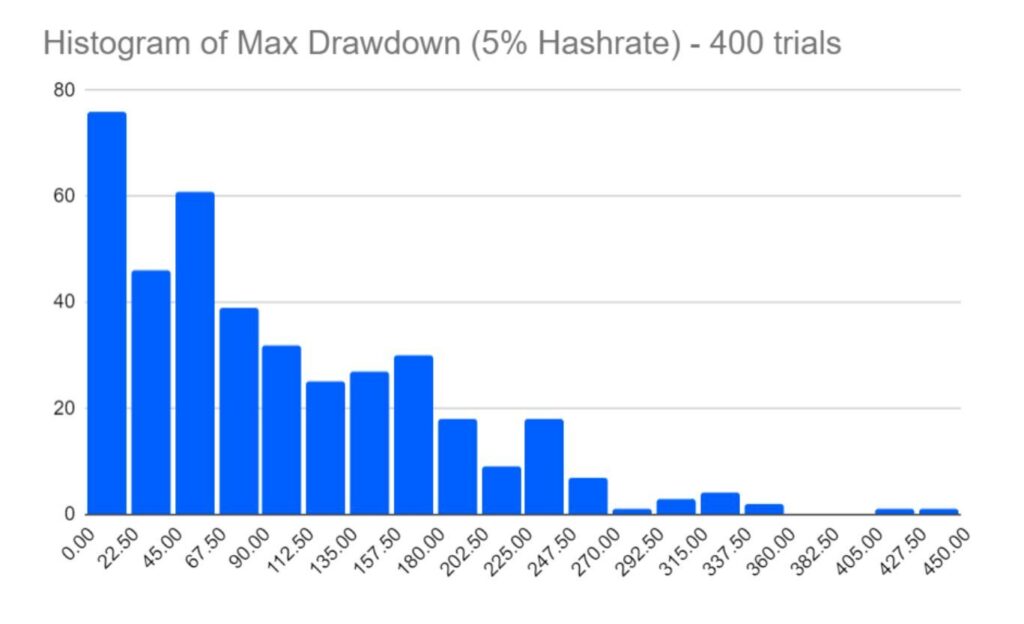

We have also constructed histograms, which show the maximum cumulative loses for the reserve fund, in each of the 400 trials. The y-axis counts the number of times the result fell into each bucket, while the x-axis contains buckets for the maximum cumulative losses in Bitcoin.

New Mining Pool Proposal

One could even adopt the above model as a business model. A new mining pool startup, could raise $2m to fund technical development and another $20m for the initial capital for the smoothing reserve fund. Therefore total funding of $22m would be required. While this is not a trivial amount of money, given the size of the mining industry, perhaps it is much less than a typical crypto industry “war chest”. For example, listed miners like Marathon, Cleanspark, Riot, Cipher Mining, Hut 8 and Hive, all have over $100m of Bitcoin on their balance sheets, far more than the $20m required for this revenue smoothing.

One could even split the reserve fund out as a separate investable financial product. Investors could purchase shares in the fund, as if it was an open ended investment fund. The shareholders would benefit from the 50% of the fee income from the pool, while also experiencing volatility (and full depletion risk) related to the luck of the mining pool. The fact we are talking about a financial product is not a good sign. As we discuss a lot in our analysis of Ethereum’s PoS system, the PoS system has many characteristics like financial services and they often tend to centralise. This revenue smoothing serices also has financial service like characteristics.

Block Withholding Attack

The transparent open ended fund structure outlined above may not work. Any mining pool can be attacked with something called the “block withholding attack”. Miners could attack the pool by only sending partial proofs and if the miner does actually find a block with the required difficulty, they can keep this secret. A rival pool could conduct this attack on a pool with a transparent “reserve fund” in place and they would know exactly when to attack and exactly when the target pool would shut down. Therefore, in the above model, the total assets in the reserve fund would need to be kept confidential.

Conclusion

The Bitcoin mining network appears to be in a pretty poor and centralised shape, with a single entity custodying the coinbase output funds for almost 50% of the global hashrate. Alex Bergeron may be correct in asserting that the proximate cause of this problem may be the desire for the miners to reduce variance in their revenue. It is clear that this is a real problem. Although the size of the fund you need does increase as the pool gets larger, there are clearly significant economies of scale here. In our example of a 5% pool and a 50% pool, the 50% pool is 10x larger, while only around 2x the funds are needed for the larger pool to have the same fund depletion to zero risk.

It is important to note that the factor discussed in this article only really directly centralises the ownership of the coinbase output. It is still possible for the mining farms to be decentralised and for transaction selection to be decentralised via Stratum V2. However, centralised custody of the coinbase outputs is still pretty bad news.

The positive news is that the level of capital a pool operator needs to smooth out the impact of luck is not as large as some people might think, perhaps around $20 million to $40 million. Therefore while the issue is a problem, it may not be critical. It does not feel that this luck issue is therefore the only fundamental long term cause of this apparent monopolistic structure. Perhaps another reason for this alarming degree of centralisation right now is that many in the mining industry simply don’t care enough.

Related

The post appeared first on Blog BitMex